- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: ‘ Short Revolving History ‘ / ‘ Long Credit Hi...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

‘ Short Revolving History ‘ / ‘ Long Credit History ‘

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous wrote:So freaking helpful @Anonymous . I've had my mind stuck at 50% awb as one of the few awb thresholds. That made me think that it shouldn't be picking up closed accts in denominator to make it 9 of 22. that I think about it, I remember 40% and 60% being a thing in some models. 9 of 22 is 41%. Maybe it's barking at me to hit the 40% awb. Hmmmmm.

@Anonymous funny I have found evidence of 40% and possibly 60% as well on some models, so you may be correct. Additionally, I just had a card switch networks, so it added an account sporadically and at different dates on each bureau. Talk about thrown a monkey wrench into things. Lol.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

I know the nearly the entire tax code backwards and forwards and it's nothing compared to this FICO stuff.

The difference: the IRS publishes the score card. Fair Isaac is more like the "Pick a Number" game from the Native American casino in Lampoon's Vegas Vacation.

"Ah, just pay you bills on time"

(score drops - no recent use of revolving blah blah blah)

"You paid too many bills too on time."

(score drops more - AZ penalty)

"You paid the wrong bills too on-time"

(score drops more - single card utilization threshold penalty)

"You don't have enough lines of credit and payment history"

(score drops more - inquiries)

The you just throw hands up in disgust, neglect your bills, and abandon the effort altogether.

(score goes up - unknown, average age of something, age of youngest child, age of oldest nephew, or something along those lines)

You take the bait continue to neglect bills for more than 30 days.

(Credit is ruined for 7 years - derogatories)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous wrote:I know the nearly the entire tax code backwards and forwards and it's nothing compared to this FICO stuff.

The difference: the IRS publishes the score card. Fair Isaac is more like the "Pick a Number" game from the Native American casino in Lampoon's Vegas Vacation.

"Ah, just pay you bills on time"

(score drops - no recent use of revolving blah blah blah)

"You paid too many bills too on time."

(score drops more - AZ penalty)

"You paid the wrong bills too on-time"

(score drops more - single card utilization threshold penalty)

"You don't have enough lines of credit and payment history"

(score drops more - inquiries)

The you just throw hands up in disgust, neglect your bills, and abandon the effort altogether.

(score goes up - unknown, average age of something, age of youngest child, age of oldest nephew, or something along those lines)

You take the bait continue to neglect bills for more than 30 days.

(Credit is ruined for 7 years - derogatories)

![]()

![]()

![]() @Anonymous you made me laugh so hard. Yeah I studied the tax code once and I hated it every bit of it. However I must say, I definitely enjoy this much more! Lol. But you are right at least they publish all the scorecards, but my goodness every single time you think there is a loop there is a catch for it!

@Anonymous you made me laugh so hard. Yeah I studied the tax code once and I hated it every bit of it. However I must say, I definitely enjoy this much more! Lol. But you are right at least they publish all the scorecards, but my goodness every single time you think there is a loop there is a catch for it!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

If you haven't seen Lampoon's Vegas Vacation, you'll really appreciate the reference when you watch it.

"Pick a number"

"5"

"Nope, 8"

"Pick a number"

"7"

"Nope, 2"

"Pick a number"

"2"

"Nope, 3"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous wrote:If you haven't seen Lampoon's Vegas Vacation, you'll really appreciate the reference when you watch it.

"Pick a number"

"5"

"Nope, 8"

"Pick a number"

"7"

"Nope, 2"

"Pick a number"

"2"

"Nope, 3"

@Anonymous have not saw that, I should watch it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

Can't do another 1B for another hour or so because 24 hours has to pass.

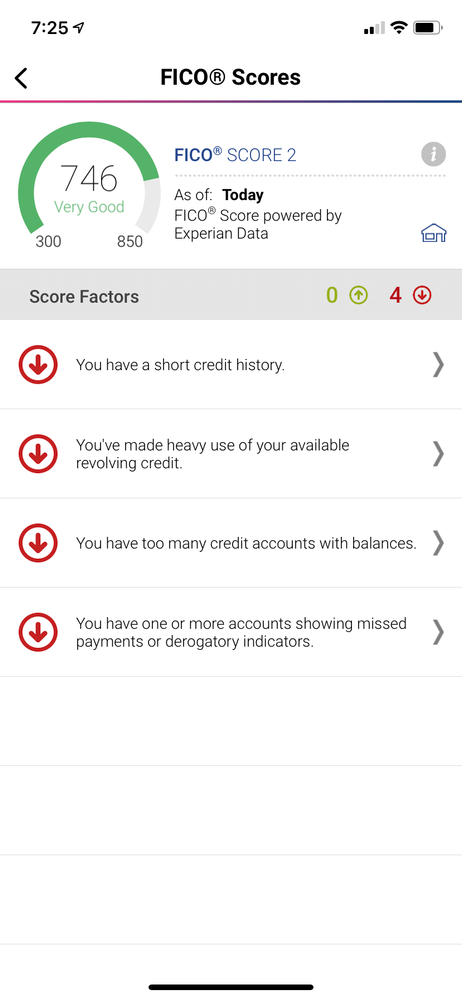

For what it's worth, EX2 was +6 on exact anniversary date of most recent inquiry on clean/thick/mature/yes new acct scorecard.

Inquiry date was 4/4/20 (screenshot a few posts above). Today is 4/4/21 and I checked EX2 around 7:00 am central time and it was +6. Went from 740 to 746.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous thanks for providing all of the data points! As far as your mortgage is concerned, are you and your wife both going to be on the loan? My wife and I were in a situation where I couldn't be on the loan (moving several states over for her career when I had no job lined up) and we were able to do several balance transfers to shift her debt to my profile and boost her scores in time for the mortgage. Just something to ponder. Even if your wife is on the mortgage, maybe it would be possible to shift some debt to her profile without affecting any of her thresholds but helping you cross some positive ones.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

UPDATE AND DATA POINTS:

Did the TU 1B again today to see the impact of the anniversary date of my sole inquiry becoming unscorable. Trying to get my TU4 mortgage score from 724 to 740.

The inquiry becoming unscorable on the anniversary date was a +2 points on TU4, taking it from 724 yesterday, then +2 today to 726.

EX2 was a bigger impact at +6 taking me from 740 yesterday, then +6 today to 746.

Full DPs for TU and EX are below. The TU DPs are clean, no other changes or threshholds crossed. The EX data points also had a +1 revolver with balance due to a $50 annual fee (and TU hasn't updated that account yet).

-Clean/thick/mature/YES new account (3@12 mos.) scorecard.

-Has 2 30-day lates on 12/2015 & 01/2016

-Aggregate Revolving Util ($): $11,409

-Aggregate Revolving Util (%): $11,409/$92,950 = 12.3% with AU and $11,409/$41,850 without AU = 27.3%

-AZEO w/ Single Revolver Util (%) $11,409/$24,400 = 46.8%

-Scorable Inquiries drop from 1 to 0

-AoYRA and AoYA: 12 months (1 installment, 1 AU and 1 revolver non-AU all opened May of 2020)

-AAoA: 5 years & 3 months with AU and 4 yrs & 11 months without AU

-AAoRA: 5 years & 4 months with AU and 4 yrs & 3 months without AU

-AoOA: 16 years & 11 months with AU and 13 yrs & 4 months without AU

-AoORA: 16 years & 11 months with AU and 6 yrs & 2 months without AU

-# accts. w/ balances: 9 of 22 = 40.9% with AU and 9 of 17 = 52.9% without AU

Inquiry Date (only inquiry on entire profile): 5/4/2020

Today's Date: 5/4/2021

No changes to any of the reason codes for any of the TU scores. Not a single change

Transunion

As of 5/3/21 -----> as of 5/4/21 ------------ Reason Codes (1, 2, 3, 4)

TU8: ----------------- 729 -------------------> 730 (+1) ------------- Derogs, installment balance,

TU4 Mortgage: -- 724 -----------------> 726 (+2) ------------- New credit acct., no long revolver hist, revolver balance ($, not %), #acct. w/balances

TU8 Auto: -----------737 -----------------> 739 (+2) ------------- Derogs, installment balance, short credit history, revolver util. (%)

TU4 Auto: ---------- 699 -----------------> 701 (+2) ------------- revolver balance ($, not %), short credit history, installment balance, New credit acct.

TU8 Bankcard: ---731 -----------------> 732 (+1) ------------- Derogs, installment balance, revolver util. (%), short credit history

TU4 Bankcard: ---732 -----------------> 734 (+2) ------------- revolver balance ($, not %), revolver util. (%), New credit acct., no long revolver hist

TU9: ------------------ 731 -----------------> 731 (No Change) --- Derogs, no long revolver hist, installment balance, revolver util. (%)

TU9 Auto: ---------- 738 ----------------> 742 (+4) ------------- Derogs, no long revolver hist, installment balance, revolver util. (%)

TU9 Bankcard: ---733 ----------------> 733 (No Change) --- Derogs, revolver util. (%), no long revolver hist, installment balance

Experian

As of 5/3/21 -----> as of 5/4/21

EX8: ----------------- 725 -------------------> 725 (No Change)

EX2 Mortgage: -- 740 -----------------> 746 (+6)

EX8 Auto: -----------730 -----------------> 730 (No Change)

EX2 Auto: ---------- 741 -----------------> 746 (+5)

EX8 Bankcard: ---721 -----------------> 721 (No Change)

EX3 Bankcard: ---757 -----------------> 770 (+13)

EX2 Bankcard: ---749 -----------------> 756 (+7)

EX9: ------------------ N/A -----------------> N/A

EX9 Auto: ---------- N/A -----------------> N/A

EX9 Bankcard: ---N/A -----------------> N/A

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous wrote:UPDATE AND DATA POINTS:

Did the TU 1B again today to see the impact of the anniversary date of my sole inquiry becoming unscorable. Trying to get my TU4 mortgage score from 724 to 740.

The inquiry becoming unscorable on the anniversary date was a +2 points on TU4, taking it from 724 yesterday, then +2 today to 726.

EX2 was a bigger impact at +6 taking me from 740 yesterday, then +6 today to 746.

Full DPs for TU and EX are below. The TU DPs are clean, no other changes or threshholds crossed. The EX data points also had a +1 revolver with balance due to a $50 annual fee (and TU hasn't updated that account yet).

-Clean/thick/mature/YES new account (3@12 mos.) scorecard.

-Has 2 30-day lates on 12/2015 & 01/2016

-Aggregate Revolving Util ($): $11,409

-Aggregate Revolving Util (%): $11,409/$92,950 = 12.3% with AU and $11,409/$41,850 without AU = 27.3%

-AZEO w/ Single Revolver Util (%) $11,409/$24,400 = 46.8%

-Scorable Inquiries drop from 1 to 0

-AoYRA and AoYA: 12 months (1 installment, 1 AU and 1 revolver non-AU all opened May of 2020)

-AAoA: 5 years & 3 months with AU and 4 yrs & 11 months without AU

-AAoRA: 5 years & 4 months with AU and 4 yrs & 3 months without AU

-AoOA: 16 years & 11 months with AU and 13 yrs & 4 months without AU

-AoORA: 16 years & 11 months with AU and 6 yrs & 2 months without AU

-# accts. w/ balances: 9 of 22 = 40.9% with AU and 9 of 17 = 52.9% without AU

Inquiry Date (only inquiry on entire profile): 5/4/2020

Today's Date: 5/4/2021

No changes to any of the reason codes for any of the TU scores. Not a single change

Transunion

As of 5/3/21 -----> as of 5/4/21 ------------ Reason Codes (1, 2, 3, 4)

TU8: ----------------- 729 -------------------> 730 (+1) ------------- Derogs, installment balance,

TU4 Mortgage: -- 724 -----------------> 726 (+2) ------------- New credit acct., no long revolver hist, revolver balance ($, not %), #acct. w/balances

TU8 Auto: -----------737 -----------------> 739 (+2) ------------- Derogs, installment balance, short credit history, revolver util. (%)

TU4 Auto: ---------- 699 -----------------> 701 (+2) ------------- revolver balance ($, not %), short credit history, installment balance, New credit acct.

TU8 Bankcard: ---731 -----------------> 732 (+1) ------------- Derogs, installment balance, revolver util. (%), short credit history

TU4 Bankcard: ---732 -----------------> 734 (+2) ------------- revolver balance ($, not %), revolver util. (%), New credit acct., no long revolver hist

TU9: ------------------ 731 -----------------> 731 (No Change) --- Derogs, no long revolver hist, installment balance, revolver util. (%)

TU9 Auto: ---------- 738 ----------------> 742 (+4) ------------- Derogs, no long revolver hist, installment balance, revolver util. (%)

TU9 Bankcard: ---733 ----------------> 733 (No Change) --- Derogs, revolver util. (%), no long revolver hist, installment balance

Experian

As of 5/3/21 -----> as of 5/4/21

EX8: ----------------- 725 -------------------> 725 (No Change)

EX2 Mortgage: -- 740 -----------------> 746 (+6)

EX8 Auto: -----------730 -----------------> 730 (No Change)

EX2 Auto: ---------- 741 -----------------> 746 (+5)

EX8 Bankcard: ---721 -----------------> 721 (No Change)

EX3 Bankcard: ---757 -----------------> 770 (+13)

EX2 Bankcard: ---749 -----------------> 756 (+7)

EX9: ------------------ N/A -----------------> N/A

EX9 Auto: ---------- N/A -----------------> N/A

EX9 Bankcard: ---N/A -----------------> N/A

@Anonymous well that really sucks. Any other time, the last inquiry would be worth more than that, that's unbelievable. I am disgusted with that.

anyway now that you have laid out more information, I see more points! first off as I told you, I think there's a 6 point Balance a Threshold and I think there's a 6 point AWB Threshold, but now you've got the 30% individual & the 10% Aggregate Revolving! I see enough points if you get your balance and Utilization in check, I think. You may not have to lower AWB.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

You are correct. I saw some additional thresholds unfold as I laid out the full details.

The AWB issue isn't going to resolve itself. I had a card throw a $50 annual fee on at midnight and is now reporting a $50 balance on EX (TU should catch up in a day or 2). That will take me the wrong direction in terms of AWB.

Also, getting the aggregate util down to the sub $5k range will be roughly $6,500 (and the threshold is fuzzy). That $6,500 is a heavier blow than paying off my smallest revolver, which is $4,132. Indiv. util at 30% is also about $4,200 away.

With aggregate revolving balance and AWB being reason codes 3 & 4, general wisdom says that they should yield more points than either of the utilization metrics, but I'm quite confident that isn't a definitive statement. I think I'm going to have my lender go ahead and do the HP at 726 middle mortgage today before TU reports another AWB and potentially takes me below 720. Then try to make some moves to hit 740 before that new inquiry catches up with me (I think it's like 45 days or so, but I'll have to go back through the threads and/or the primer).

With my AAoRA being 5 yrs. & 4 months, I wonder if 5.5 yrs. will be a thing given that no long revolver history is reason code #2? Hmmmm. I need to process it all now.