- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: ‘ Short Revolving History ‘ / ‘ Long Credit Hi...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

‘ Short Revolving History ‘ / ‘ Long Credit History ‘

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous wait a minute, you've got to forgive me. I believe I'm thinking of TU8 on the AWB & balance thresholds.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous wrote:

When you went from $7,879 to $4,864, was that balance on only a single card or was it across multiple cards? Just checking to see if it was also a drop in AWB. If it was on a single card, what was the limit on that card? Checking to see if maybe there was an indiv recolver util threshold(s) in addition to aggregate % revolver util.

The big paydown was on a card with a $24k CL. It went from 14% to zero, but I simultaneously let another card report a balance to keep AWB steady, at 6. Agg Util went from 3% to 2% the way 5/4/2 calculates it (gotta love the ol' Amex!). My highest Ind Util went from 21% to 16%, so there might be something there, but that's not a well known threshold.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

Understood. It's a tangled web.

At the end of the day, paying my $11,400 down to say $4,500 would cross the revolver $ util, revolver individual util and revolver aggregate util. That should definitely get me there, but that's 7 grand. Gulp. Or maybe try to time a balance transfer and eat the 3-4% fee. That also kills my 0% interest. I can probably get a balance transfer offer on my existing citi or chase with no HP or upgrade with no HP and get a 0% grace preriod. If so, it would just be a matter of timing.

That's the thing with AZEO. Would love to low ball it and get below 30% aggregate util. % and see how far I have left to go. That's maybe 5-7 and still leaves 7-9 more to go. You get to strike your best pose once every 30 days and see what the judge says. Then you have to wait another 30 days.

I think I just talked myself into a solution with an existing card's balance transfer offer. Let that card's statement cut on the 14th, balance transfer to it the next day, the card that has a balance now (Wells Fargo) has a statement cut date of the 28th. Get the BT to process by the 28th and look pretty from the time the time the Wells Fargo card reports at the end of the month until the balance transfer offer card reports mid June.

I'll get pre-approved now at 720 middle mortgage but wait to lock my rate on a mortgage offer until I can pose for the camera all pretty in early June. Hmmmm.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

Wow. We are really in the same ballpark here. My current AZEO card has a $24,400 CL. This is nearly apples-to-apples.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous Yeah I don't know what I was thinking. The lowest balance thresholds will definitely be lower for version 4. But yes, it looks like you have an Individual and an Aggregate Threshold you can cross and potentially Balance Thresholds.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous: I think there should be a note in the mortgage section of the Primer about EX2 losing a lot of points at AoOA 2yr0mo, even when balances report exactly the same as the previous month.

Probably a pretty small number of people going for a mortgage right at 2yr0mo after starting their credit file, but it might help someone.

I still had 'High Revolving Balances' on EX2 then at $816 aggregate balance on 2-of-2 cards (100%) reporting a balance.

(This is my full myFICO 3B report on all 28 scores with reason statements on each one.)

TU4 actually went up +11 on the same report. Again, I intentionally kept number of cards reporting and the balances exactly the same from AoYA 11mo to AoYA 1yr0mo (AoOA 1yr11mo to AoOA 2yr0mo), so I could isolate aging changes.

(See the report link above for the full report metadata, like util percentages and aging values.)

FICO 5 | EQ | 724 |

| 724 |

[Change] | Short credit history, High revolving balances, Short revolving history, Seeking credit | |||

| Short credit history, Too many accounts with balances, Seeking credit, Short revolving credit history | |||

FICO 4 | TU | 717 | +11 | 728 |

[Change] | Short credit history, No recent loan activity, Recently opened new credit account, High revolving balances | |||

| Short credit history, Seeking credit, Short revolving credit history, Recently opened new credit account | |||

FICO 2 | EX | 733 | -22 | 711 |

[Change] | Short credit history, Short revolving credit history, Seeking credit, High revolving balances | |||

| Short credit history, Too many accounts with balances, Seeking credit, Recently opened too many new credit accounts |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous wrote:@Anonymous: I think there should be a note in the mortgage section of the Primer about EX2 losing a lot of points at AoOA 2yr0mo, even when balances report exactly the same as the previous month.

Probably a pretty small number of people going for a mortgage right at 2yr0mo after starting their credit file, but it might help someone.

I still had 'High Revolving Balances' on EX2 then at $816 aggregate balance on 2-of-2 cards (100%) reporting a balance.

(This is my full myFICO 3B report on all 28 scores with reason statements on each one.)

TU4 actually went up +11 on the same report. Again, I intentionally kept number of cards reporting and the balances exactly the same from AoYA 11mo to AoYA 1yr0mo (AoOA 1yr11mo to AoOA 2yr0mo), so I could isolate aging changes.

(See the report link above for the full report metadata, like util percentages and aging values.)

FICO 5

EQ

724

724

[Change]

Short credit history, High revolving balances, Short revolving history, Seeking credit

Short credit history, Too many accounts with balances, Seeking credit, Short revolving credit history

FICO 4

TU

717

+11

728

[Change]

Short credit history, No recent loan activity, Recently opened new credit account, High revolving balances

Short credit history, Seeking credit, Short revolving credit history, Recently opened new credit account

FICO 2

EX

733

-22

711

[Change]

Short credit history, Short revolving credit history, Seeking credit, High revolving balances

Short credit history, Too many accounts with balances, Seeking credit, Recently opened too many new credit accounts

@Anonymous I think the segmentation threshold is mentioned, but you're right, I should elaborate on the consequences. I will do that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Anonymous Done!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

@Curious_George2 and @Anonymous , I though you guys would find this AWB DP update interesting.

As anticipated, TU finally updated ant the card that assessed the annual fee reported as another account with a balance. That dropped my TU4 from 726 to 719 (which is a dip right out of a mortgage tier, but I digress.) I increased from 9/22 (40.91%) AWB to 10/22 (45.45%) AWB and saw a 7 point TU4 drop. AWB reason code moved from #4 to #2. No other code changes except for #4 leapfrogs to #2. With it only being $50, I don't think revolving utilizaiton was affected (from 12.27% to 12.33%).

If I remove closed installments (but keep closed revolvers) from AWB, it's 9/17 (52.9%) to 10/17 (58.8%).

If I removed closed revolvers (but keep closed installments) from AWB, it's 9/20 (45.0%) to 10/20 (50.0%).

Also, one of the revolvers is a store card. Maybe it is treated differently for AWB. I'm going to hone in on those dang TU4 AWB threshholds one way or another.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: ‘ Short Revolving History ‘ / ‘ Long Credit History ‘

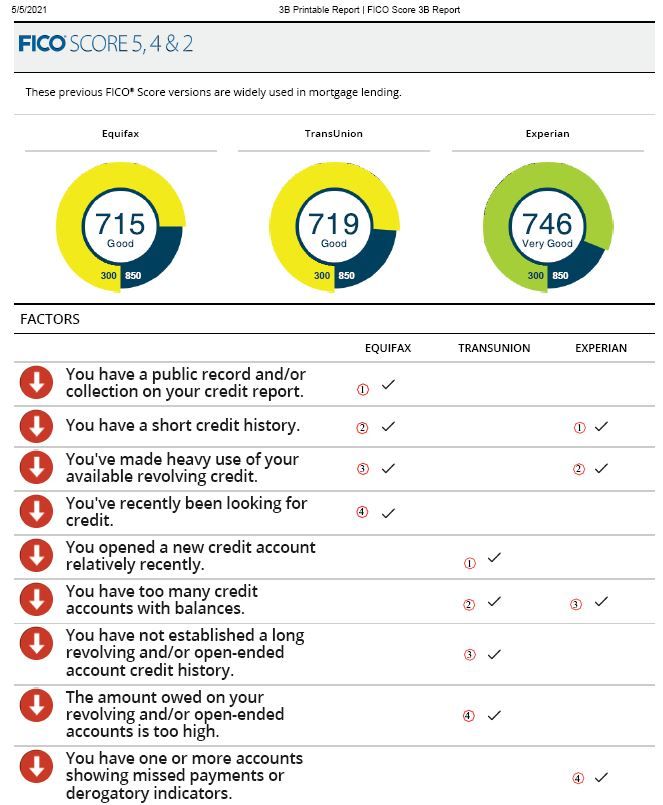

Also, I had given up on EQ5 because it has historically been awful due to a $66 collection (6/15/16 DoFD, so will be 5 years next month) only reported on EQ (and only EQ5 versions specifically due to being under $100). Due to the collection, I've always ignored it for mortgage purposes because it's usually in the low to mid 600s.

I ran a 3B today just for good measure and it's at 715. Can you believe that EQ5 with a collection (collection as reason code #1) is only 4 points lower than my TU4 with no collection?

In the primer, you all felt that EQ5 is very sensitive to AWB and TU4 is most sensitive to total number of accounts. That could be relative to the scorecard because my EQ5 gives no AWB codes and TU4 has AWB as code #2.

Regardless, for EQ 5 I have Revol. Util % at #3and inquiries at #4. Anyone have a feel for:

- points when the final EQ5 inquiry becomes unscorable on 5/22? (headed over to master inquiry thread now)

- Aggregate Revolver Util % threhold(s) for EQ5?