- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Something Remarkable Happened With My FICO Score

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Something Remarkable Happened With My FICO Score

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Something Remarkable Happened With My FICO Score

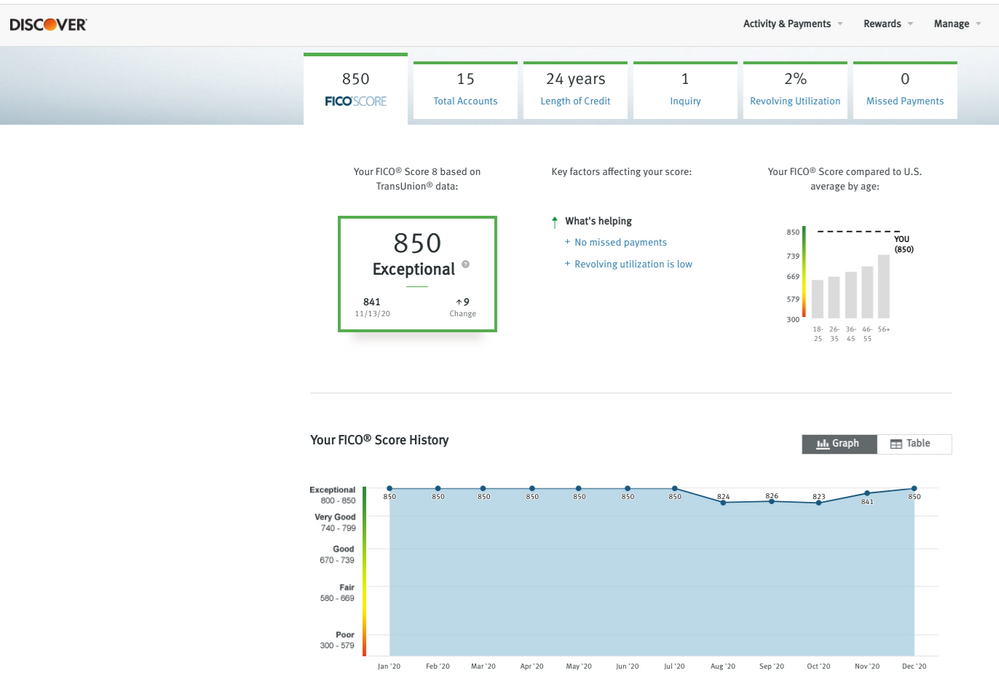

Back in June, while I was riding the trifecta of 850 FICO-8's across the board for 24 straight months, I took out a mortgage. I knew it would negatively impact my scores, but that's what we achieve high scores for anyway. I figured I'd pay it off in 5-6 years and be back in the 850 club around that time. I posted about it here:

Today, I logged into my Discover account and was pleasantly surprised to see this. I'm shocked (in a good way) at how quickly my score recovered. Has anyone seen this happen so quickly? BBS, maybe you can shed some light with the data points you've collected.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something Remarkable Happened With My FICO Score

What was your AAoA prior to the new account and what is it now? What was your installment loan utilization prior to the new mortgage and what is it now with it in place? Based on your 850 scores prior to the new mortgage, my assumption is that you hadn't opened a new revolver within the last 12 months... really 24+ months since you stated your score was pinned there for roughly that length of time. Is that an accurate assumption? If so, your scorecard did not change at all in the last 5-6 months.

Were you able to grab a score pull between your 850 and 824 score when the inquiry/inquiries were at play prior to the new account landing on your report? Also the up and down 824 --> 826 --> 823 is indicative of other things going on, my guess being reported balance changes.

Do you have any idea how much buffer was built into your 850 starting score? Just for the sake of numbers, let's say your 850 was capable of being buffered to 860 if you were optimized at AZEO. If you weren't optimized and were leaving 10 points on the table (maybe number of accounts with balances related or something) and you were still starting with an 850 score and then did optimize following the loan, you could pick up 10 points without really knowing it because of the whole buffer thing on Score 8.

Also probably a dumb question, but just to verify, you didn't significantly pay down the mortgage in the last few months since opening it up right?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something Remarkable Happened With My FICO Score

BBS, thanks for taking the time to read and respond to my post.

What was your AAoA prior to the new account and what is it now? Around 13 years 2 months prior, 13 years 8 months now.

What was your installment loan utilization prior to the new mortgage and what is it now with it in place? 8-9% (Alliant SSL Loan)

Based on your 850 scores prior to the new mortgage, my assumption is that you hadn't opened a new revolver within the last 12 months... really 24+ months since you stated your score was pinned there for roughly that length of time. Is that an accurate assumption? Yes, that is 100% accurate. The last revolver I opened was probably close to a decade ago. I also had not opened any installment loans within the last 24 months.

If so, your scorecard did not change at all in the last 5-6 months. I'm not familiar with scorecard, can you explain : )

Were you able to grab a score pull between your 850 and 824 score when the inquiry/inquiries were at play prior to the new account landing on your report? Yes, my scores were unchanged at 850 when the inquiry hit, and remained there until the new account landed on my report.

Also the up and down 824 --> 826 --> 823 is indicative of other things going on, my guess being reported balance changes. That is very possible. I don't always practice AZEO, even during the 24+ month 850 run.

Do you have any idea how much buffer was built into your 850 starting score? Just for the sake of numbers, let's say your 850 was capable of being buffered to 860 if you were optimized at AZEO. If you weren't optimized and were leaving 10 points on the table (maybe number of accounts with balances related or something) and you were still starting with an 850 score and then did optimize following the loan, you could pick up 10 points without really knowing it because of the whole buffer thing on Score 8. I'm not really sure regarding the scoring buffer. I do know that single inquiries never impacted my 850 score throughout the 24+ month run. From what I understand, a single inquiry costs 4-5 points. However I've never had more than 1 inquiry in a 12 month period while at 850.

Also probably a dumb question, but just to verify, you didn't significantly pay down the mortgage in the last few months since opening it up right? Not a dumb question at all! I'm glad you brought it up. I paid down about 10% of the loan, so the right now the balance stands at around 87%. I didn't think I'd have a chance to get back to 850 until I was under 30% at the very least.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something Remarkable Happened With My FICO Score

Well, I'm more or less stumped ![]()

Your installment loan utilization going up from 8%-9% from the SSL to 87% or so now with the new mortgage would certainly explain the score drop. When looking at your Amounts Owed (percentage) on installment loans you would have moved from getting the boost associated with having an almost-paid-off installment loan to losing that boost with the loan utilization increase of the mortgage. That score loss of around 20 points would definitely make sense. What doesn't make sense to me is how those points had returned so quickly.

Some have theorized that the threshold of a mortgage in order for it to be "considerably paid down" is much greater than other loan types, typically because the dollar values associated with mortgages are significantly greater than many other loans. I have never seen anyone put a "guess" on this value being greater than 70%-80% though, so I wouldn't think paying down to 87% would cut it. But, if there's no other logical explanation, perhaps that's something to consider. When exactly did you pay down to 87%? Was it right after opening the loan, or was it several months in? Are you able to correlate the score increase as coming directly after that paydown?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something Remarkable Happened With My FICO Score

@Anonymous wrote:Well, I'm more or less stumped

Your installment loan utilization going up from 8%-9% from the SSL to 87% or so now with the new mortgage would certainly explain the score drop. When looking at your Amounts Owed (percentage) on installment loans you would have moved from getting the boost associated with having an almost-paid-off installment loan to losing that boost with the loan utilization increase of the mortgage. That score loss of around 20 points would definitely make sense. What doesn't make sense to me is how those points had returned so quickly.

Some have theorized that the threshold of a mortgage in order for it to be "considerably paid down" is much greater than other loan types, typically because the dollar values associated with mortgages are significantly greater than many other loans. I have never seen anyone put a "guess" on this value being greater than 70%-80% though, so I wouldn't think paying down to 87% would cut it. But, if there's no other logical explanation, perhaps that's something to consider. When exactly did you pay down to 87%? Was it right after opening the loan, or was it several months in? Are you able to correlate the score increase as coming directly after that paydown?

As @Thomas_Thumb has often pointed out, mortgages have their own special place in FICO land.

It seems to me that being head over heels in debt on a mortgage is considered a good thing in the FICO algorithms.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something Remarkable Happened With My FICO Score

@SouthJamaica wrote:As @Thomas_Thumb has often pointed out, mortgages have their own special place in FICO land.

Yes, they definitely do, it's just trying to quantify that. I believe that TTs last best guess landed somewhere in that 70%-80% range that I referenced earlier as being a significant break point in terms of "significantly paid down" on a mortgage. Perhaps he can give us an update if he's made any further progress at identifying such a point. I've been ticking down from ~75% on my mortgage to ~70% or so for the last few years and didn't notice any significant gain at any point on any of my scores (that aren't maxed obviously).

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something Remarkable Happened With My FICO Score

So without an exhaustive examination of all the metrics in a particular profile, it’s hard to come to a conclusion that it’s due to utilization, irrespective of age.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something Remarkable Happened With My FICO Score

I feel like age would be an easier metric to nail down than utilization percentage.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something Remarkable Happened With My FICO Score

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Something Remarkable Happened With My FICO Score

When exactly did you pay down to 87%? Was it right after opening the loan, or was it several months in? Are you able to correlate the score increase as coming directly after that paydown?

The mortgage was taken out in mid June, it didn't hit my reports until almost a full month later. I paid down to 89% in mid November (it's at 87% today after paying down another 2% since), so about 4 months after the loan reported. Until then as you can see from the graph, my scores were in the 820's then a big jump to 841.

If you look at the date on the Discover 841 score, it shows the score was pulled 11/13. I paid down to 89% a few days after 11/13 so the pay down would not have been the cause for it to jump from 823 to 841. But perhaps the pay down was the reason for the jump from 841 to 850, as I can't think of any other events that would have triggered it. One thing I can note is that when it jumped from 823 to 841, it went from 96% to 94%. So maybe there's some importance to paying down the first 5% of a mortgage?