- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- TU FICO®8 has jumped +29 FICO's to "831"😎

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

TU FICO®8 has jumped +29 FICO's to "831"😎

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TU FICO®8 has jumped +29 FICO's to "831"😎

IN CREDIT NEWS:

BOA reporting TU FICO8 has jumped +29 FICO's

FICO® Score. The score lenders use.

So I had to go searching for what caused the jump?

So it is all just a guess at this point, I am AZE5 (revolvers) (AZE6 with open Installment)

(2) AoYRA's hit 1mo, (4) CC's hit 5yrs & (1) (closed) installment hit 10yrs. ALL at the same time.

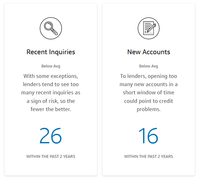

ETA: (2) Inquiries under 12 months were somehow deleted from my TU report.

So it is hard to pinpoint TU FICO8 gains by just an individual event.![]()

(Age metrics pulled fron EQ)

AZE5 (AZE6 with Installment)

ACCOUNTS WITH A BALANCE BALANCE AVAILABLE BALANCE CREDIT LIMIT

REVOLVING ACCOUNTS 88

ACCOUNTS WITH A BALANCE 5

INSTALLMENT 1 1 $20 $24,980 $25,000

TOTAL 89 6 $28,720 $1,877,180 $1,905,900

Further DP's;

88 open Revolving TL's reporting / 1 open Installment loan reporting

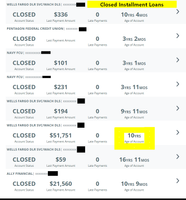

43 Closed Accts. reporting / 8 closed installment loans reporting.

AZE5 (AZE6 with one open Installment)

AoYRA(s) 1mo.

AAoA 4yrs

AoORA 39+ AMERICAN EXPRESS (Will be 40yrs. in June 2023)

No Mortgage reporting (PIF 2005)

No open auto loans reporting (5 PIF closed reporting)

Some Inqs are Business PG related.

10/12 scoreable Inqs.

Inqs/24 New Accts./24

Disclosure:

I do not claim to Understand FICO® Scoring ![]()

ETA: (2) Inquiries under 12 months were somehow deleted from my TU report.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TU FICO®8 has jumped +29 FICO's to "831"😎

@M_Smart007 wrote:IN CREDIT NEWS:

BOA reporting TU FICO8 has jumped +29 FICO's

FICO® Score. The score lenders use.

Information about your credit scoreCredit rating is EXCEPTIONALCredit score 831+29Changein Fico ScoreFico Score As of 5/27/2023 Updated monthly by

So I had to go searching for what caused the jump?

So it is all just a guess at this point, I am AZE5 (revolvers) (AZE6 with open Installment)

(2) AoYRA's hit 1mo, (4) CC's hit 5yrs & (1) (closed) installment hit 10yrs. ALL at the same time.

ETA: (2) Inquiries under 12 months were somehow deleted from my TU report.

So it is hard to pinpoint TU FICO8 gains by just an individual event.

(Age metrics pulled fron EQ)

(Click image to enlarge)

(Click image to enlarge)

(Click image to enlarge)

(Click image to enlarge)

AZE5 (AZE6 with Installment)

ACCOUNTS WITH A BALANCE BALANCE AVAILABLE BALANCE CREDIT LIMIT

REVOLVING ACCOUNTS 88

ACCOUNTS WITH A BALANCE 5INSTALLMENT 1 1 $20 $24,980 $25,000

TOTAL 89 6 $28,720 $1,877,180 $1,905,900

Further DP's;

88 open Revolving TL's reporting / 1 open Installment loan reporting

43 Closed Accts. reporting / 8 closed installment loans reporting.

AZE5 (AZE6 with one open Installment)

AoYRA(s) 1mo.

AAoA 4yrs

AoORA 39+ AMERICAN EXPRESS (Will be 40yrs. in June 2023)

No Mortgage reporting (PIF 2005)

No open auto loans reporting (5 PIF closed reporting)

Some Inqs are Business PG related.

10/12 scoreable Inqs.

Inqs/24 New Accts./24

(Click image to enlarge)

Disclosure:

I do not claim to Understand FICO® Scoring

ETA: (2) Inquiries under 12 months were somehow deleted from my TU report.

Congratulations on the uptick.

That's a pretty big one, though, and your failure to isolate the reason(s) for it is quite disappointing in view of your investigatory credentials working for CONTROL.

Have you looked at your TU report carefully?

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TU FICO®8 has jumped +29 FICO's to "831"😎

My AoOA is an AMEX at 39 years as well. Beyond that our profiles have very little in common. I have 6 open credit cards and 1 closed loan.

You have far to many accounts to pinpoint cause(s) for such a score change.

A few things that tend to shift score around 25 points are a lone car or SSL loan dropping below 9% B/L, a lone 30 day late dropping off a report with no other derogs on file, reducing one or more highly utilized/maxed out credit cards to a point where highest card UT is under 29% or a scorecard reassignment.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TU FICO®8 has jumped +29 FICO's to "831"😎

Congrats 😊😊😊😊 I was excited when my TU went to 805 , I would be over the moon with that one ❤️

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TU FICO®8 has jumped +29 FICO's to "831"😎

@Jnbmom wrote:

Congrats 😊😊😊😊 I was excited when my TU went to 805 , I would be over the moon with that one ❤️

@Jnbmom, Thank You![]()

I almost fell over,

I still have not figured it out yet, and I might not ever![]()

It is not a mistake, as I did a 3B pull to verify, and also pulled TU from https://www.annualcreditreport.com/index.action

Everything looks the same?, just a few aging metrics.

Maybe like @Thomas_Thumb pointed out, ->" or a scorecard reassignment."??

Aggregate utilization is a little higher and a couple more cards reporting balances ...so ¯\_(ツ)_/¯

I know my TU has a couple of accounts NOT being reported "HSBC Premier" and "HSBC Cash Rewards",

also one older $50K PLOC with zero bal. is reporting.

So AAoA is a little more lengthy than EX or EQ.

I have not had any, BK's, CO's, Lates, Repo's or Medical Collections ...or any other type of derogs on my report.

I have only had (1) open installment reporting a $20 bal. out of $25K for the last 3 years.

But never the less, i'll take it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TU FICO®8 has jumped +29 FICO's to "831"😎

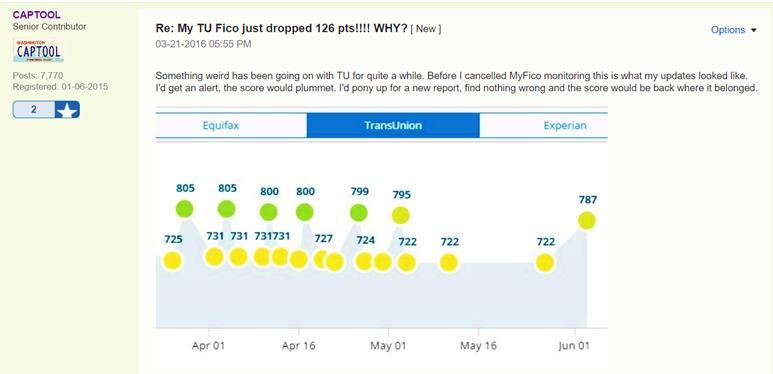

Years ago CAPTOOL experienced a bouncing ball score effect on his Fico 8 TU. Score was shifting over 70 points. Fico 8 EX and EQ were essentially stable during these times. Don't think cause was ever figured out. His TU score had been depressed due to a derog on that CB only. His score spiked when it was removed from his TU report. We speculated he had something like a split file on TU that was cycling between clean/dirty as if the derog was being factored in one credit pull but not the next.

It will be interesting to see how your EQ/EX scores behave. Are those being tracked as well? Are you able to compare all accounts on each CB? Are you AU on any accounts?

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TU FICO®8 has jumped +29 FICO's to "831"😎

@Thomas_Thumb wrote:Years ago CAPTOOL experienced a bouncing ball score effect on his Fico 8 TU. Score was shifting over 70 points. Fico 8 EX and EQ were essentially stable during these times. Don't think cause was ever figured out. His TU score had been depressed due to a derog on that CB only. His score spiked when it was removed from his TU report. We speculated he had something like a split file on TU that was cycling between clean/dirty as if the derog was being factored in one credit pull but not the next.

It will be interesting to see how your EQ/EX scores behave. Are those being tracked as well? Are you able to compare all accounts on each CB? Are you AU on any accounts?

So far I have not seen a spike in EX or EQ .. I will be watching to see and report back.

All accounts are exactly the same across all three CB's with the exception of TU not having the (2) HSBC MC's and very old PLOC.

No, I have never been an AU on any accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TU FICO®8 has jumped +29 FICO's to "831"😎

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TU FICO®8 has jumped +29 FICO's to "831"😎

@M_Smart007 woohoo! Congratulations and thanks for the detailed DPs.

(+102) |

(+102) |  (+106) |

(+106) |  (+151)

(+151)| TU Fico 9: ? | Exp Fico 9: ? | EQ Fico 9: ?| EQ Fico 8 Bankcard: TBA

Initial Goal: Min. 740 w/all CRAs - Met

Interim Goal: 780 w/all CRAs - Met

Current Goal(s): Min. 800 w/all CRAs

Gardening Until: ??/??/202?| Last App: 10/20/2023

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: TU FICO®8 has jumped +29 FICO's to "831"😎

@M_Smart007 nice job on the score and the clean profile.