- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- This is rich, opening a new account helped EX FICO...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

This is rich, opening a new account helped EX FICO 2 (mortgage score)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is rich, opening a new account helped EX FICO 2 (mortgage score)

@Thomas_Thumb wrote:

@Revelate wrote:So it appears that AOYA is something that may bucket you in EX FICO 2 and associated industry options.

I got 40+ points across the board and a non-trivial shift in reason codes. This is from my US Bank auto loan reporting, doesn't quite look fully populated but that was the only change on my report: no balances of any sort updated and no inquiries fell off.

Score 12/7/18 12/8/18 FICO 8 750 750 FICO 2 688 730 FICO 8 AU 755 752 FICO 2 AU 677 718 FICO 8 BC 782 766 FICO 3 682 687 FICO 2 BC 688 732

The reason codes changed substantially:

12/7/18:

- Heavy Revolving

- Missed Payments

- Recent Missed Payments

- Balances on non-mortgage too high

12/8/18

- Short Account History

- Heavy Revolving

- Recent Missed Payments

- Number of accounts with Balances

That certainly looks like a different scorecard: some minor points lost on FICO 8 industry options but I don't care, at all, about those.

So you broke down and purchased a Tesla model S - Yes?

The bump in Fico 98 score is suggestive of a charge card with a B/HB ratio being paid off. I have seen a drop and subsequent boost in score (Fico 98 model only) when AMEX reports a high B/HB that I then pay off. In those high B/HB situations I also get the "balances on non mortgage too high".

The drop off of the "missed payments" reason code is suggestive of an older (greater than 30) late no longer counting against you. I say this because the "missed payments" ranked higher than the "recent missed payments" which suggests you have (or had) an older missed payment that was a greater duration (say 60 or 90 days) holding down your Fico 98 score. Given lack of score change on Fico 8 would suggest the older "missed payment" had minimal impact on Fico 8.

As you suggest, it is possible you were assigned to a different (non derog) scorecard. Derog scorecards may not consider certain types of installment loan account histories as an attribute.

Heh actually it was a Model 3.

We can't really pull much on the relative weights of reason codes if there was a scorecard shift: also no balances changed between the two days, my only charge card is a Zync at $0.

That large of movement, on basically a known negative (opening an account other than credit mix potential which should not be a factor for me) I can't see how it is anything but a scorecard change.

Could be deliquent + new account is separate than deliquent + no new account for some age: I'm not sure there's really another explanation and I can't really get any better data than this, nothing else reported in that time and it was just the auto loan getting tacked onto the report.

It's just plain weird... and the fact FICO 8 stayed absolutely flat, suggests a non-trivial difference somewhere in there: I think new accounts might still be a scorecard assignment factor in FICO 04 or at least it doesn't show up in the derogatory scorecards at all, but perhaps not in FICO 8?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is rich, opening a new account helped EX FICO 2 (mortgage score)

@Thomas_Thumb wrote:

The drop off of the "missed payments" reason code is suggestive of an older (greater than 30) late no longer counting against you. I say this because the "missed payments" ranked higher than the "recent missed payments" which suggests you have (or had) an older missed payment that was a greater duration (say 60 or 90 days) holding down your Fico 98 score. Given lack of score change on Fico 8 would suggest the older "missed payment" had minimal impact on Fico 8.

As you suggest, it is possible you were assigned to a different (non derog) scorecard. Derog scorecards may not consider certain types of installment loan account histories as an attribute.

Ugh, missed a part of your message my apologies TT.

Late aging generally happens as the beginning of the month, this change did not.

I think for the missed payment reason code, it just got pushed off the table by the rest of them. The only deliquency on EX is a 30D late from April.

The minimal change just suggests either the new account bit is 2 years or greater (in which case I didn't reset at 23 months), or a recent 30D late scorecard is simliar to the tax lien and similar derogatory scorecards in that new accounts may not matter under FICO 8. Don't know and unfortunately the reason codes suck in FICO 8 other than the myFICO TU monitoring service so I don't know that we can really state for certain.

Really this goes to not having enough data around scorecard segmentation I suspect.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is rich, opening a new account helped EX FICO 2 (mortgage score)

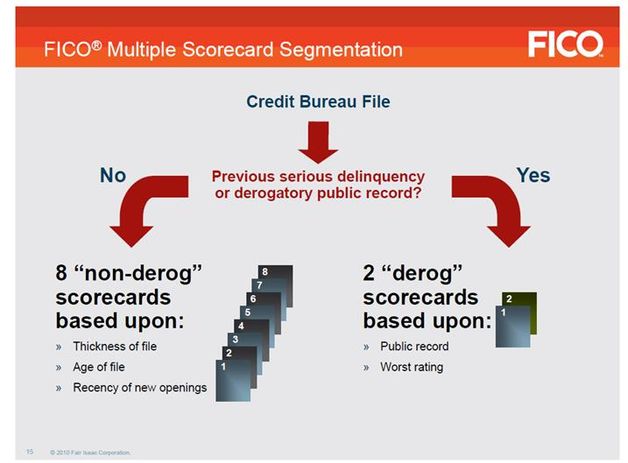

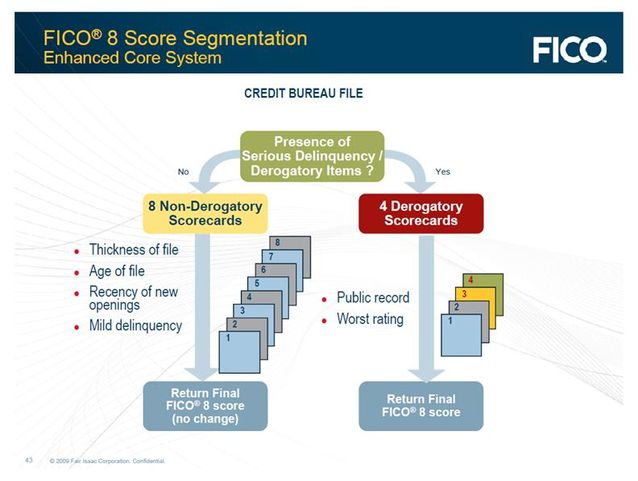

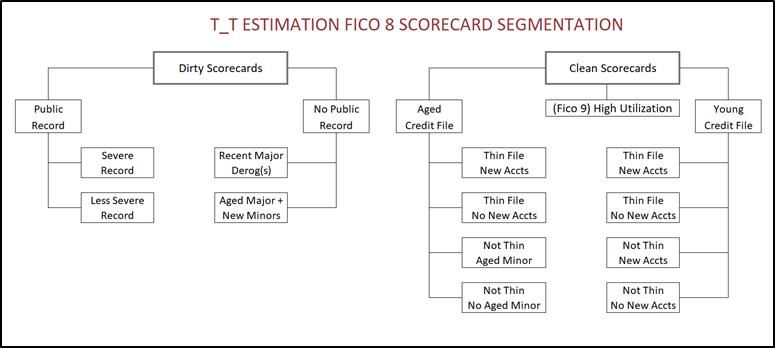

Scorecard segmentation for clean files includes new account, file age and file thickness. Those criteria do not exist for dirty scorecards (per the below - top is Fico 98/04, bottom is Fico 8). The primary difference in segmentation between Fico 8 and the older Fico 04/Fico 98 models is the addition of two derog scorecards with Fico 8.

There is no change in clean scorecards between Fico 8 and Fico 04/Fico 98 per the below. So, if you changed clean scorecards on Fico 98, you should have on Fico 8 as well. In contrast, if your file is classified as dirty, you could change scorecards on one Fico version but not the other - However, recency of new openings is not a scorecard consideration on dirty scorecards.

.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is rich, opening a new account helped EX FICO 2 (mortgage score)

TT, off topic question based on the graphic above with the 4 derog scorecards for FICO 8... do you have an opinion (or even know for sure perhaps) what would land someone in each of the 4 different derog scorecards? Basically, an example of what would take you from one to the next?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is rich, opening a new account helped EX FICO 2 (mortgage score)

I'm not certain that marketing powerpoints the algorithm make TT, but your point is well taken. My old data basically demonstrated the derogatory scorecards aren't affected by new accounts, also my TU data suggests a 30D late is a pretty scorecard, whereas a 60D is not certainly for FICO 04/8.

The interesting thing then is that the calculation appears to be flatly different:

FICO 98/04 <=23 months for new account calculation

FICO 8 classic > 23 months for new account calculation

FICO 3 is also complaining about the new account in the reason codes, with a similar re-shuffling of the rest of them too. Should note these are from Experian, might not quite hold similarly on EQ/TU as there are unknown tweaks between the bureaus.

The not quite sure is I took a dip in the FICO 8 industry options, but I didn't in FICO 8 classic. No change in the reason codes, appears the overlay scorecards have a new account factor different from the classic scorecards?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is rich, opening a new account helped EX FICO 2 (mortgage score)

@Revelate wrote:

@SouthJamaica wrote:

@Revelate wrote:So it appears that AOYA is something that may bucket you in EX FICO 2 and associated industry options.

I got 40+ points across the board and a non-trivial shift in reason codes. This is from my US Bank auto loan reporting, doesn't quite look fully populated but that was the only change on my report: no balances of any sort updated and no inquiries fell off.

Score 12/7/18 12/8/18 FICO 8 750 750 FICO 2 688 730 FICO 8 AU 755 752 FICO 2 AU 677 718 FICO 8 BC 782 766 FICO 3 682 687 FICO 2 BC 688 732

The reason codes changed substantially:

12/7/18:

- Heavy Revolving

- Missed Payments

- Recent Missed Payments

- Balances on non-mortgage too high

12/8/18

- Short Account History

- Heavy Revolving

- Recent Missed Payments

- Number of accounts with Balances

That certainly looks like a different scorecard: some minor points lost on FICO 8 industry options but I don't care, at all, about those.

That would be bizarre, if it works out that way. Will be curious to see how it plays out as the dust settles. Wouldn't that be crazy if we could advise people applying for a mortgage "oh first get yourself a new auto loan, that will give you a 40 point pop on your mortgage scores".

BTW how are you monitoring the scores and reports so closely?

Experian's $10/month monitoring service gives me daily Experian sores + reason codes for everything other than FICO 9.

I was expecting some fun later in the month so figured I'd give it a try, but I absolutely did not expect this but it's a highly interesting find. I don't know that we can really give that advice because we know so little about scorecards other than they exist, but 30D late + new account and I probably dropped a scorecard or three down the ladder, but I score better in that one in comparison with non-trivial history I suppose.

As you suggest will be interesting to see what happens when the dust settles.

How are you only paying $10/month for that when I'm paying $25/month for the same thing?? Are you able to pull all 3 bureaus once a month?

![Comenity – Express Next Store Card : $5,000 [AU]](https://i.imgur.com/Pmmb7kq.jpg)

Officially collection free as of 3/19/19!!

STARTING SCORES: 377 (11/2013) & 580 (3/2018)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is rich, opening a new account helped EX FICO 2 (mortgage score)

@Queen_Etherea wrote:

@Revelate wrote:

@SouthJamaica wrote:

@Revelate wrote:So it appears that AOYA is something that may bucket you in EX FICO 2 and associated industry options.

I got 40+ points across the board and a non-trivial shift in reason codes. This is from my US Bank auto loan reporting, doesn't quite look fully populated but that was the only change on my report: no balances of any sort updated and no inquiries fell off.

Score 12/7/18 12/8/18 FICO 8 750 750 FICO 2 688 730 FICO 8 AU 755 752 FICO 2 AU 677 718 FICO 8 BC 782 766 FICO 3 682 687 FICO 2 BC 688 732

The reason codes changed substantially:

12/7/18:

- Heavy Revolving

- Missed Payments

- Recent Missed Payments

- Balances on non-mortgage too high

12/8/18

- Short Account History

- Heavy Revolving

- Recent Missed Payments

- Number of accounts with Balances

That certainly looks like a different scorecard: some minor points lost on FICO 8 industry options but I don't care, at all, about those.

That would be bizarre, if it works out that way. Will be curious to see how it plays out as the dust settles. Wouldn't that be crazy if we could advise people applying for a mortgage "oh first get yourself a new auto loan, that will give you a 40 point pop on your mortgage scores".

BTW how are you monitoring the scores and reports so closely?

Experian's $10/month monitoring service gives me daily Experian sores + reason codes for everything other than FICO 9.

I was expecting some fun later in the month so figured I'd give it a try, but I absolutely did not expect this but it's a highly interesting find. I don't know that we can really give that advice because we know so little about scorecards other than they exist, but 30D late + new account and I probably dropped a scorecard or three down the ladder, but I score better in that one in comparison with non-trivial history I suppose.

As you suggest will be interesting to see what happens when the dust settles.

How are you only paying $10/month for that when I'm paying $25/month for the same thing?? Are you able to pull all 3 bureaus once a month?

No, I don't get the EQ/TU monitoring at all, just the Experian.

Honestly I don't find the 25/month service all that appealing: the scores track closely enough for everything but a mortgage (in which case I'm spending the additional money here at myFICO) and EQ/TU have a fantastic free report option in Credit Karma anyway.

I'm in the middle tier, above free, but below your service.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is rich, opening a new account helped EX FICO 2 (mortgage score)

@Revelate wrote:

@Queen_Etherea wrote:

@Revelate wrote:

@SouthJamaica wrote:

@Revelate wrote:So it appears that AOYA is something that may bucket you in EX FICO 2 and associated industry options.

I got 40+ points across the board and a non-trivial shift in reason codes. This is from my US Bank auto loan reporting, doesn't quite look fully populated but that was the only change on my report: no balances of any sort updated and no inquiries fell off.

Score 12/7/18 12/8/18 FICO 8 750 750 FICO 2 688 730 FICO 8 AU 755 752 FICO 2 AU 677 718 FICO 8 BC 782 766 FICO 3 682 687 FICO 2 BC 688 732

The reason codes changed substantially:

12/7/18:

- Heavy Revolving

- Missed Payments

- Recent Missed Payments

- Balances on non-mortgage too high

12/8/18

- Short Account History

- Heavy Revolving

- Recent Missed Payments

- Number of accounts with Balances

That certainly looks like a different scorecard: some minor points lost on FICO 8 industry options but I don't care, at all, about those.

That would be bizarre, if it works out that way. Will be curious to see how it plays out as the dust settles. Wouldn't that be crazy if we could advise people applying for a mortgage "oh first get yourself a new auto loan, that will give you a 40 point pop on your mortgage scores".

BTW how are you monitoring the scores and reports so closely?

Experian's $10/month monitoring service gives me daily Experian sores + reason codes for everything other than FICO 9.

I was expecting some fun later in the month so figured I'd give it a try, but I absolutely did not expect this but it's a highly interesting find. I don't know that we can really give that advice because we know so little about scorecards other than they exist, but 30D late + new account and I probably dropped a scorecard or three down the ladder, but I score better in that one in comparison with non-trivial history I suppose.

As you suggest will be interesting to see what happens when the dust settles.

How are you only paying $10/month for that when I'm paying $25/month for the same thing?? Are you able to pull all 3 bureaus once a month?

No, I don't get the EQ/TU monitoring at all, just the Experian.

Honestly I don't find the 25/month service all that appealing: the scores track closely enough for everything but a mortgage (in which case I'm spending the additional money here at myFICO) and EQ/TU have a fantastic free report option in Credit Karma anyway.

I'm in the middle tier, above free, but below your service.

Ok I'm going to sign up for that one instead. I don't need all 3 scores every month because I can just get them from CCT for $1 each month. I do like having the daily EX scores, though.

![Comenity – Express Next Store Card : $5,000 [AU]](https://i.imgur.com/Pmmb7kq.jpg)

Officially collection free as of 3/19/19!!

STARTING SCORES: 377 (11/2013) & 580 (3/2018)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is rich, opening a new account helped EX FICO 2 (mortgage score)

@Thomas_Thumb

very interesting, thank you for sharing. Where did you find this information? I've been trying to find information on scorecards but keep getting crap articles that say scorecards exist. I realize there's a lot of proprietary information that we will never find out but figured there's gotta be SOME type of information we can get eyes on......any other scorecard info you can share either in the thread or PM?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: This is rich, opening a new account helped EX FICO 2 (mortgage score)

@slowbut850sure

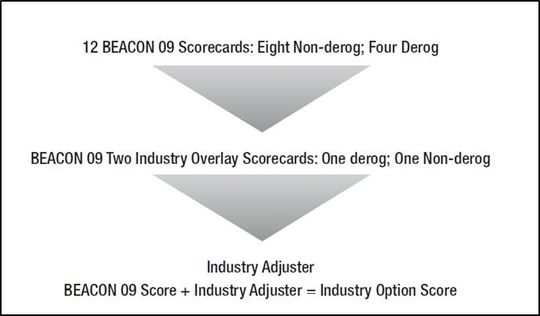

Fico 9 has 13 scorecards with the 13th added to segment files with high revolving utilization. Industry specific Fico versions have overlay scorecards ontop of there representative classic versions. The failed Fico 8 mortgage had 17 scorecards.

VantageScore also uses scorecards. Provided below are some additional pastes. Note, You may also want to do a search on MyFico as all this has been discussed in prior threads. [Beacon 09 = EQ Fico 8]

...

...

...

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950