- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Those with an 850 score, please provide DPs!

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Those with an 850 score, please provide DPs!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

I think people have reached 800 with an AAoA of 2-3 years and an AoOA of not much more than that.

I mean, people are able to debut with a FICO score in the 730-750 range and can be at 740-760 in under a year. That's with just a couple of accounts. Take that to 3 revolvers, employ AZEO and the SSL technique and you're going to be darn close to 800 already. Go a year without apping (AoYA > 1 year & no scoreable inquiries) and you can scrape 800 with 2-3 years of credit history.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

ABCD, keep in mind the person you were describing last with an AAoA of 6 years may be leaving points on the table verses 7 years or 7.8 years. I know you said they were maxed out in categories, but it's feasible that 6 years AAoA is not maxed out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

@Anonymous wrote:I think people have reached 800 with an AAoA of 2-3 years and an AoOA of not much more than that.

I mean, people are able to debut with a FICO score in the 730-750 range and can be at 740-760 in under a year. That's with just a couple of accounts. Take that to 3 revolvers, employ AZEO and the SSL technique and you're going to be darn close to 800 already. Go a year without apping (AoYA > 1 year & no scoreable inquiries) and you can scrape 800 with 2-3 years of credit history.

^ Agreed - a Fico 8 score of 800 is achievable with only 3 years of credit history and an AAoA of two years or more. Three open credit cards with only one reporting at a low utilization and an installment loan paid down to under 9% can do it. That's a self made 800. One can certainly get to 800 with only two credit cards + a paid down loan or with cards only if credit age is sufficiently high.

As a short cut to the self made approach, one can game the system by adding an aged AU account (or two) to inflate credit history age.

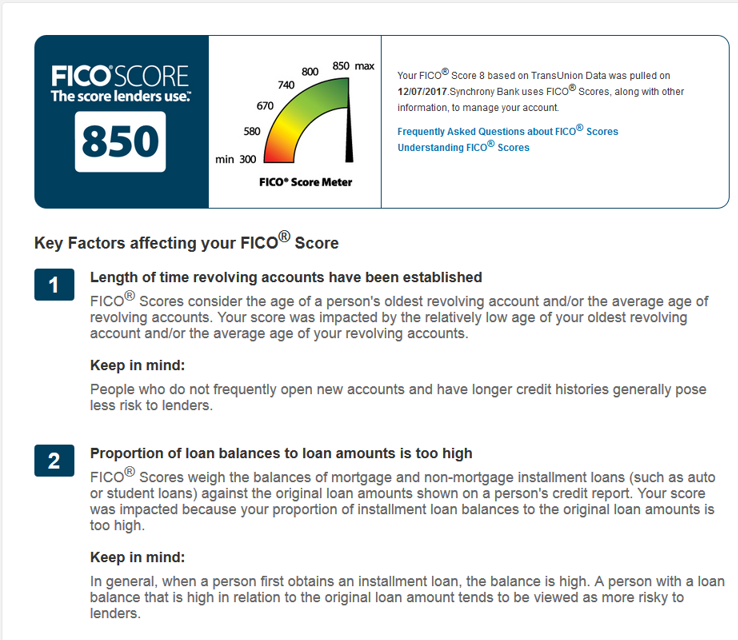

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

I got updated copies of my CR. 1 INQ on TU and EX, none on EQ. 1 New account which is a year old and 1 CC reporting 1% on TU, 2 CCs reporting 1% on EQ, EX, AAoA is 8.5 to 13 depending on the CR and oldest account is over 30 years old. No CFLs, PIF mortage and other PIF autoloans reporting and current autoloan is around %57. No derog.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

@marty56 wrote:I got updated copies of my CR. 1 INQ on TU and EX, none on EQ. 1 New account which is a year old and 1 CC reporting 1% on TU, 2 CCs reporting 1% on EQ, EX, AAoA is 8.5 to 13 depending on the CR and oldest account is over 30 years old. No CFLs, PIF mortage and other PIF autoloans reporting and current autoloan is around %57. No derog.

So technically the only "derogatory" is installment balances too high, keeping you from 850s?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

When you say 1 new account "which is a year old" can you be more specific? If it is > 1 year old, your AoYA is > 1 year which can impact score. If it's < 1 year old, that "new account" can be holding back your score some. Also if the account is < 1 year old, the inquiry is also scoreable.

How many total revolvers do you have? If you have 2 reporting on TU but only have 4 total, you could see a ding for 50% or more accounts with balances reported, for example.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

Good question on # of CC accounts. Perhaps the poster only has three total and perhaps one of those is an AU card.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

I have 10 CC accounts that are open. Several more that are on my report that are old and closed. The newest account was Best Buy Visa opened Dec last year.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

A couple posters, "IV" and My-Own-Fico had 850 scores. They each opened a new installment loan (IV may have opened a couple CCs as well). Both saw their scores drop from 850. [point drop in the 20 to 30 range] My recollection is it took two full years to return on or more CRA scores to 850. Both had an AoOA well over 20 years, possibly +30 years, and a lengthy AAoA.

How old is your Auto loan?

I suspect recency of open installment loan comes into play - particularly if the loan is under two years age. Paying down the installment loan(s) to under 9% B/L may circumvent the payment history piece which otherwise may come into play. Inverse had two open mortgages and two car leases - aggregate B/L% for mortgages in the upper 60s, aggregate B/L% for the leases in the upper 60s as well. Equated to mid 60s overall. His mortgages had significant age but, my recollection was one of the leases may have been 1 - 2 years age.

Given open mortgages with a few years payment history don't inhibit one from reaching 850 with B/L in the upper 60% (perhaps higher); I suspect age of open loan is important. Age of youngest open is important as with revolving credit but, perhaps age of oldest open adds a buffer if it is sufficiently aged. Thus, the dampening affect of a seasoned mortgage with solid payment history.

Fico does list the factors:

"Length of time installment loans have been established" and "You have not established a long installment credit history" I believe this refers to active accounts only. Mortgages appear to be evaluated differently. I don't have a non mortgage open or closed installment loan on file. Just have an open mortgage with 12 years payment history.

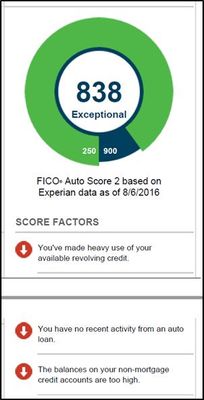

- I receive the "not established a long" message when my Fico 04/Fico98 Industry scores drops below 850. Also received a "no recent Auto loan activity" on EX Auto Score 2.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Those with an 850 score, please provide DPs!

@Anonymous wrote:I know that it's possible to achieve an 850 FICO 08 score with a less than "perfect" profile due to a top end buffer. My question for those of you that do have an 850 score, what area(s) of your profile are less than perfect? For example, you may have more than 0-1 inquiries. Your AAoA may be less than 7.8-8.0 years, your utilization may not be between 1%-8.99%, you may not have an open installment loan that's almost completely paid off, etc. There are more examples, as we all know.

I'd like to hear which factors can be less than perfect but still enable someone to achieve an 850 score.

I just got my first ever 850. I just got a PL with amex in November, too. Aggregate utility just over 4%. Have two other installment loans. One student loan, and one a auto lease. My sl was at 58%, my mortgage is at 85%, and the auto loan is at 13%. Oh, and pl is at 100%, but not sure it had reported yet, since we know amex is so slow to report new accounts. (Glad for this!)

EQ 817, EX 815, TU 813 (Updated 1/5/18: TU 843

EQ 817, EX 815, TU 813 (Updated 1/5/18: TU 843