- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Turned 20 and over 800 credit score without AU...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Turned 20 and over 800 credit score without AU !!!!

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Turned 20 and over 800 credit score without AU !!!!

Thanks for pulling a 3B report and listing your scores.

As expected, the older mortgage models appear to require more credit history to reach 800. That might to the case with Vantagescore as well although VS3 also appears to require more accounts than does Fico for "optimizing" credit mix points.

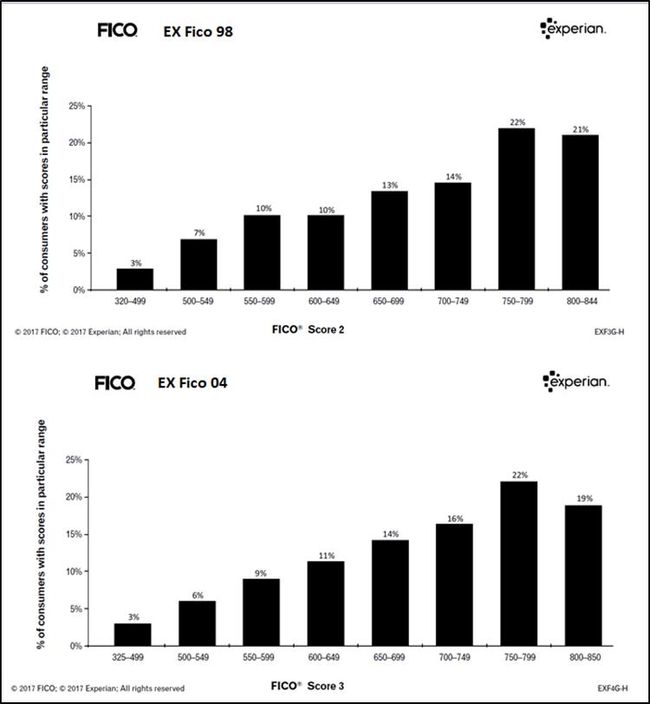

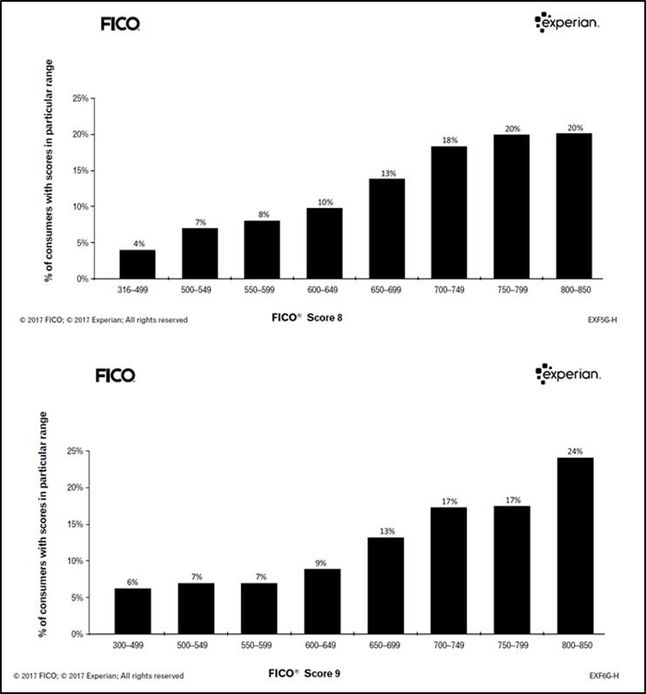

Pasted below are some distribution graphs fot the various Experian Classic Fico models

...

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Turned 20 and over 800 credit score without AU !!!!

Can I ask whats the sixth card.. only see five in the siggy...

Assuming the alliant is not a card though... but an SSL...

Congrats on breaking 800...

-J

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Turned 20 and over 800 credit score without AU !!!!

@joltdude wrote:Can I ask whats the sixth card.. only see five in the siggy...

Assuming the alliant is not a card though... but an SSL...

Congrats on breaking 800...

-J

I have a $500 LOC with SECU with is considered revolving credit like a credit card, but I don't list it in my siggy.

Also thanks!!

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Turned 20 and over 800 credit score without AU !!!!

@Thomas_Thumb wrote:Thanks for pulling a 3B report and listing your scores.

As expected, the older mortgage models appear to require more credit history to reach 800. That might to the case with Vantagescore as well although VS3 also appears to require more accounts than does Fico for "optimizing" credit mix points.

...

What age combinations of AoOA,AoYA, and AoAA would most likely put at least 2 out of the 3 Mortgage models above 760? I heard you want your middle score above 760 to get the best rates. I was hoping to get a mortgage right out of college at a good rate. It's also probable that I will be applying for new credit cards next month.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Turned 20 and over 800 credit score without AU !!!!

@Thomas_Thumb wrote:Thanks for pulling a 3B report and listing your scores.

As expected, the older mortgage models appear to require more credit history to reach 800. That might to the case with Vantagescore as well although VS3 also appears to require more accounts than does Fico for "optimizing" credit mix points.

What age combinations of AoOA,AoYA, and AoAA would most likely put at least 2 out of the 3 Mortgage models above 760? I heard you want your middle score above 760 to get the best rates. I was hoping to get a mortgage right out of college at a good rate. It's also probable that I will be applying for new credit cards next month.

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Turned 20 and over 800 credit score without AU !!!!

@SubexistenceWhat age combinations of AoOA,AoYA, and AoAA would most likely put at least 2 out of the 3 Mortgage models above 760?

My shooting from the hip response here assuming a thick/clean file and ideal utilization would be an AoOA of 9+ years, AoYA of > 12 months, AAoA of 4+ years. I'm sure it could be accomplished with at least one of those factors being significantly less, maybe even several, but those values above would put someone in a really solid place.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Turned 20 and over 800 credit score without AU !!!!

@Subexistence wrote:

@Thomas_Thumb wrote:Thanks for pulling a 3B report and listing your scores.

As expected, the older mortgage models appear to require more credit history to reach 800. That might to the case with Vantagescore as well although VS3 also appears to require more accounts than does Fico for "optimizing" credit mix points.

...

What age combinations of AoOA,AoYA, and AoAA would most likely put at least 2 out of the 3 Mortgage models above 760? I heard you want your middle score above 760 to get the best rates. I was hoping to get a mortgage right out of college at a good rate. It's also probable that I will be applying for new credit cards next month.

Mortgage scores of 760 would not require much additional aging over what you have. I'd guestimate the following for mortgage scores:

760 score - AoYA > 12 months, AAoA > 2 years, AoOA > 3 years

800 score - AoYA > 12 months, AAoA > 3 years (possibly 5 but, 3 likely enough), AoOA > 5 years (possibly 8 but, 5 likely enough)

Of course, the 12 months AoYA is not required for 760 or 800 scores if other factors are strong enough.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Turned 20 and over 800 credit score without AU !!!!

Has anyone ever tested the impact of moving from 11 months AoYA to 12 months AoYA on their mortgage scores? It's fairly well documented at this point that on FICO 8 scores most seem to receive around 20 points. I'm curious if this value is relatively the same when it comes to mortgage scores, or if it's more/less?

My gut tells me it may be a little less for mortgage scores, which sort of goes against what my brain would tell me. What I mean is that we always talk about how it's highly recommended to open no new accounts for a year or so leading up to a mortgage. We speak of how upon a manual review, seeing an account or accounts opened in the previous 12 months is a bad "look" when applying for a mortgage. Based on that rationale, I always sort of assumed that AoYA was more impactful when it comes to mortgage scores. Maybe that thought process is wrong on my part.

My only mortgage score source is my TU FICO 4 score thought my mortgage company. Unfortunately they only provide me with a monthly score without any historical data... no graph or anything to show the progression of the score over time and no archived history. I've been really bad as far as jotting that score down every month, so on a month to month basis I have no history for the score. Currently, my TU FICO 4 score sits at 808, the highest I can ever recall it being. The lowest I can recall it being in the last year or so was in the upper 780's, so probably a 20 point variance. I've always chalked the score changes up to number of accounts with balances (like when I did my AZEO to 100% of accounts with balances test) since the rest of my profile is very stable.

That being said, earlier this year when I saw about a 20 point gain from my AoYA crossing the 12 month mark, I don't recall experiencing a significant score gain on TU FICO 4; I definitely feel I would have noticed a significant gain such as the one I saw on my FICO 8 scores.