- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Utilization Percentage on one card, vs. Overal...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Utilization Percentage on one card, vs. Overall ?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization Percentage on one card, vs. Overall ?

A methodical test is needed on utilization by a qualified poster as part of controlled study. Is there a poster who has:

1) Clean files

2) An aggregate utilization over 100k

3) A small limit credit card of $300, $500 or $100 that can be used as a test card

4) Say 8 to 15 credit cards.

5) A file that is not overly active and is reasonably well aged (Say AAoA > 5 years and AoOA > 10 years.

6) AoYA . 12 months with no need to open a new account during testing

7) Can monitor spending closely, has access to daily Fico 8 score(s) and has the ability to get their CC company to send balance updates to the CRA(s) on an as requested basis.

8) Able to keep # cards reporting a balance at 1 or2 with test card always having the highest UT%.

If so, it would be helpful to get solid data points on individual utilization while maintaining aggregate utilization below 5% for all test data points. Desired test points for individual card having highest UT% balance are.

a) UT in the 5% to 8% range

b) UT in the 15% to 18% range

c) UT in the 25% to 28% range

d) UT in the 35% to 38% range

e) UT in the 45% to 48% range

f) UT in the 55% to 58% range

g) UT in the 65% to 68% range

h) UT in the 75% to 78% trange

i) UT in the 85% to 88% range

j) UT above 90%

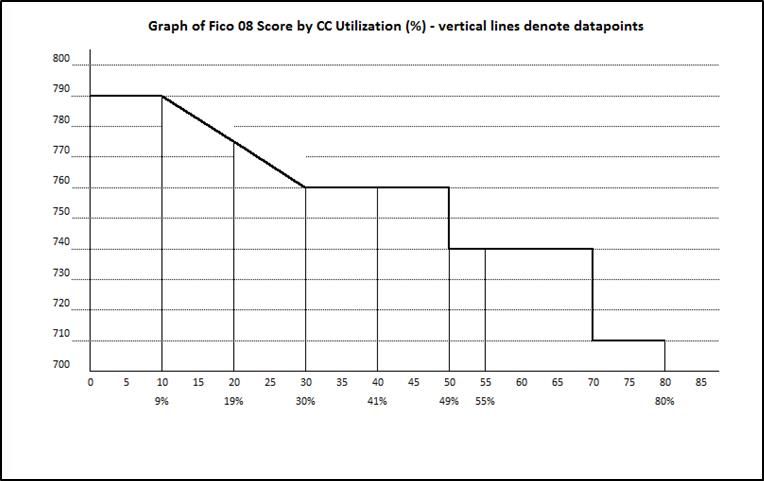

At one point in the past a poster provided the below data points from a secondary source. It appears this data was for a single card profile where AG UT = single card UT. Note the region between 10% and 30%. (continuous decrease or more likely step changes at 9% and 19%).

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization Percentage on one card, vs. Overall ?

Experiment design makes great sense.

Would love to help. Here's where I'm at:

1) Clean files - completely

2) An aggregate utilization over 100k - more like 5-10K

3) A small limit credit card of $300, $500 or $100 that can be used as a test card - nope

4) Say 8 to 15 credit cards - yep

5) A file that is not overly active and is reasonably well aged (Say AAoA > 5 years and AoOA > 10 years) - yep

6) AoYA . 12 months with no need to open a new account during testing - coming up on it, but will be apping 2 in next 3 mo

7) Can monitor spending closely, has access to daily Fico 8 score(s) and has the ability to get their CC company to send balance updates to the CRA(s) on an as requested basis - yep, we do that

8) Able to keep # cards reporting a balance at 1 or2 with test card always having the highest UT% - lowest CL is 5K, 3-4 cards in use. Have 1 card with higher utilization, but changing how we spend AND getting CLIs to change that; all other individual cards are <9% and aggregate usually <5%.

If that profile can help in any way, let me know.

Question I have for you and other experienced folks like you and BBS:

1Y after applying and getting new? card, is score increase due to aging of inquiry OR aging of new account? Usually, they are the same date, but not always. So the question: what drives the FICO score increase, the aging of inquiry (at 6m, 1Y or 2Y), or aging of the account (at 6m, 1Y or 2Y). It's not the most consequential of questions, but could change how and when I apply for new cards. Thanks all

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization Percentage on one card, vs. Overall ?

@AnonymousQuestion I have for you and other experienced folks like you and BBS:

1Y after applying and getting new? card, is score increase due to aging of inquiry OR aging of new account? Usually, they are the same date, but not always. So the question: what drives the FICO score increase, the aging of inquiry (at 6m, 1Y or 2Y), or aging of the account (at 6m, 1Y or 2Y). It's not the most consequential of questions, but could change how and when I apply for new cards. Thanks all

The score increase is due to both. The scoring impact of the inquiry goes away after 365 days. The scoring increase realized from your AoYA reaching 12 months usually comes first, though, as that happens the following year on the 1st of the month in which you took that inquiry... assuming the date of the account being opened is in that month. For example, if your account opened date is April 15th and that's when you took the inquiry, that account will actually reach 12 months of age the following year on April 1st. The only time it would be really difficult to isolate the scoring impact of each individual event would be if you opened the account on the 1st of any given month, or maybe the 2nd or 3rd as well just to give yourself a little wiggle room for report/score pulls.

Remember that AoYA refers only to your youngest account and that opening any other account during the next 12 months will reset the clock to 0 months again. What I mean is that if you have Account X at 11 months of age and it's your youngest account, ready to give you a score boost on the 1st of the following month and you open Account Y and it reports before then, your AoYA drops to 0 months. The following month when Account Y (your new AoYA account) reaches 1 month of age, you will not then see any score improvement at all when Account X becomes 12 months old.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization Percentage on one card, vs. Overall ?

We also paid one of my First Premier cards down to $98 balance.

These are the next two accounts that will report, around the 7th of October. It feels GREAT to make these payments. I cant wait to see what may happen. Thanks to all for the great advice.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization Percentage on one card, vs. Overall ?

@Anonymous wrote:Experiment design makes great sense.

Would love to help. Here's where I'm at:

1) Clean files - completely

2) An aggregate utilization over 100k - more like 5-10K

3) A small limit credit card of $300, $500 or $100 that can be used as a test card - nope

4) Say 8 to 15 credit cards - yep

5) A file that is not overly active and is reasonably well aged (Say AAoA > 5 years and AoOA > 10 years) - yep

6) AoYA . 12 months with no need to open a new account during testing - coming up on it, but will be apping 2 in next 3 mo

7) Can monitor spending closely, has access to daily Fico 8 score(s) and has the ability to get their CC company to send balance updates to the CRA(s) on an as requested basis - yep, we do that

8) Able to keep # cards reporting a balance at 1 or2 with test card always having the highest UT% - lowest CL is 5K, 3-4 cards in use. Have 1 card with higher utilization, but changing how we spend AND getting CLIs to change that; all other individual cards are <9% and aggregate usually <5%.

If that profile can help in any way, let me know.

Question I have for you and other experienced folks like you and BBS:

1Y after applying and getting new? card, is score increase due to aging of inquiry OR aging of new account? Usually, they are the same date, but not always. So the question: what drives the FICO score increase, the aging of inquiry (at 6m, 1Y or 2Y), or aging of the account (at 6m, 1Y or 2Y). It's not the most consequential of questions, but could change how and when I apply for new cards. Thanks all

@Anonymous

Key points for the test are maintaining a low aggregate utilization while testing, avoiding crossing aging attributes during the test time such as AoYA crossing over 12 months, avoiding new accounts or inquiries that can skew score and ideally amintaining # cards with balances at a constant # thru out. Three cards reporting would be ok if you stay at three reporting. The primary concern with three, particularly if not low limit cards is potential affect on aggregate UT%.

If you are up for the challenge, go for it. If you stumble at some point but let us know what data points are confounded, they can be excluded.

Regarding inquiries and AoYA, they are separate factors. If you have multiple accounts under 12 months the score boost only comes when the last one reaches 12 months. Likewise, if you have an account under 12 months and add another one, your score won't take a 2nd hit for AoYA. In contrast, HPs are looked at individually apart from a potential binning into groups. Each HP added or subtracted can impact score if it pushes # HPs under 12 months into a different bin.

As BBS mentioned inquiry aging is based on exactly 1 year from the date received - I've experienced that myself. Most other aging related metrics are based on calendar month.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization Percentage on one card, vs. Overall ?

Folks, a data point that appears to confirm earlier comments about AAOA time sensitivity.

Just gained 8 points on EXP FICO. Uplift suggests due to AAOA passing the 6Y 6M mark, as no other changes evident.

4% util on 200K CL. Dropped 4 INQs last 60 days, and awaiting 2 more INQs to drop off within next 2 weeks, bringing me to 0. I'll post the effects (if any, expecting +10 points) for what it's worth.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization Percentage on one card, vs. Overall ?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Utilization Percentage on one card, vs. Overall ?

EX FICO now reflects 0 INQs; final 2 just clicked past 1Y. Score went up a modest 5 points. 4% utilization on 190K. AAoA 78 mo.

TU FICO now reflects 2 INQs. Score up 10. Same utilization and AAoA.

EQ FICO still at 2 INQs which drop in next 60 days.

Will report any further changes, as CLIs on several cards will bring total CL to over 200K. May app for 1-2 more cards.