- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Vantage 3.0 vs Fico Inquiry point differences

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Vantage 3.0 vs Fico Inquiry point differences

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage 3.0 vs Fico Inquiry point differences (Update)

My profile is totally different than yours (and you should be grateful! ![]() ) but I noticed a score drop after I added new cards/inquiries, but that impact faded quickly. After some faithful gardening, the scores kept on going up and up and up. (Now the scores are going to take a dip because I apped for a new card and got it!) But I tell myself, that is the price for a much-wanted card and in truth, that card is going to be worth the temporary dip in credit score.

) but I noticed a score drop after I added new cards/inquiries, but that impact faded quickly. After some faithful gardening, the scores kept on going up and up and up. (Now the scores are going to take a dip because I apped for a new card and got it!) But I tell myself, that is the price for a much-wanted card and in truth, that card is going to be worth the temporary dip in credit score.

Time always helps. In a few months, all your accounts will be a few months older. It's just a necessary process, and time corrects and "heals" it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage 3.0 vs Fico Inquiry point differences (Update)

@Anonymous wrote:

@Anonymous wrote:So you had a year on 1 card only and you had that drop vs my credit history which is 4.5 yrs old based on a pretty much prefect report but only with 1 card also. I know others say dont worry, but my fico will be dopping again once my 2 accounts hit my credit profile, I still have 4 more cards to apply for too. That sounds bad but once Im done, each will only have 2 inquires per EX EQ TU and Ill be done and in the garden. Ill be keeping track of my fico movenment along the way

I had a year on a 'credit builder' / Share Secured Loan (SSL). There were no revolving accounts on my file at the time I apped with Citi.

I'm sure Citi probably SP'd TU too. Even though I was approved for my very first card ever from my credit union just a few days prior, to Citi it looked like theirs would be my first card.

Maybe the high inquiry penalty is all about the number of cards. 1 in your case, 0 in mine.

I can see 10 pts but 17pts? I still got 1 more pull with Ex but that will be done in July and yes I understand they will go back up. I guess I shouldnt care since my scores dont matter anyways since im gettig high APRs, they will matter once I garden and start getting more history

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage 3.0 vs Fico Inquiry point differences (Update)

@tenaya

Yes I understand that, im tracking what my ficos will be with every inquiry I get and by how much. While I am grateful for my scores, they mean nothing to the creditors as they are basing it on history of a mix of credit. When Im done with my spree Ill garden and have to wait, like you said "time" is needed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage 3.0 vs Fico Inquiry point differences (Update)

Well, again, I can't say I'm an expert or that I know how the story ends, but to me, FICO scores only matter in terms of qualifying for stuff. If I had high scores but couldn't qualify for stuff due to thin profile, I would sacrifice points without thinking twice, to address the issue (in this case, thicken the profile). I approached my build with a very different philosophy, consciously frontloading pain for longterm gain. Good luck!

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage 3.0 vs Fico Inquiry point differences (Update)

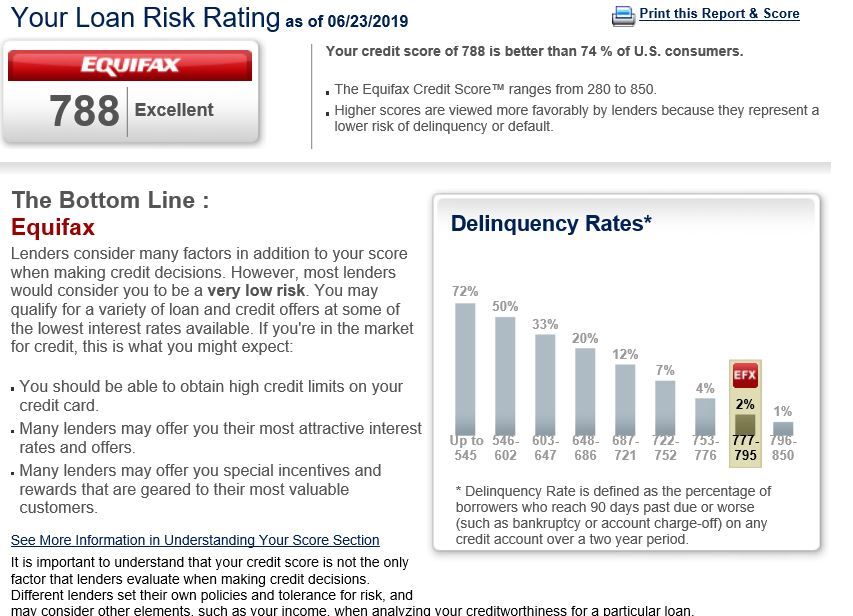

Vantage score risk indictor which maybe true to some but very wrong for me

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage 3.0 vs Fico Inquiry point differences (Update)

The score you posted in the image above is not from the VS 3.0 model. It's from EQ's own scoring model.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage 3.0 vs Fico Inquiry point differences (Update)

@Anonymous wrote:The score you posted in the image above is not from the VS 3.0 model. It's from EQ's own scoring model.

The point I was making is this scoring model is wrong in my case....

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage 3.0 vs Fico Inquiry point differences (Update)

@Anonymous wrote:The point I was making is this scoring model is wrong in my case....

I'm not following you. No scoring model is "wrong." A scoring model can be "different" than another one, but they aren't "wrong." Maybe you can clarify what you mean.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage 3.0 vs Fico Inquiry point differences (Update)

@KJinNC wrote:Bear in mind that scores aren't the point. The point is qualifying for what you want to qualify for.

If, as your sig implies, you have great scores but in effect are treated like you are merely in the "good credit" range due to a thin file, the way to solve that isn't by preserving your scores, it's by rounding out your credit profile.

You're so right. You'll notice that by some coincidence, we have identical FICO8 scores. But I can't qualify for any of the cards you have. My good cards are based on Canadian credit history. On my American, despite the 691 (704 last month), I've only been able to get the Capital One Platinum.

It's more than scores. They look at my file and they see someone who seemingly didn't exist a year ago, with no employment history. It's going to take more than 8 months of responsible use of a few cards to make lenders trust someone with no history of existing.

(Of course in conversation I'm not puzzling at all, but the simple story that I'm a Canadian who finds it financially advantageous to use US cards will never show up in a credit report)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Vantage 3.0 vs Fico Inquiry point differences (Update)

Well, you probably could qualify for all my stuff except maybe the Coastal Credit Union stuff, as it's mostly secured cards and other starter stuff aside from that. I just sort of "appeared" in March, in a way, also, though for different reasons. However you slice it, it takes time.

FICO Resilience Index: 64. Cards: 5/24, 2/12, 2/6. Accounts including loans: 8/24, 4/12, 3/6. Card CLs total $213,900, or $240,400 including the AU card. Cards (oldest to newest)

Authorized user / Corporate / Auto loans / Personal loan