- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- What AAoA would be considered "Fair" versus "Poor"

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What AAoA would be considered "Fair" versus "Poor"

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What AAoA would be considered "Fair" versus "Poor"

@Anonymous wrote:Try to find an older person (Mom, Dad, Uncle, Aunt, Cousin.... 70 year old neighbor lady down the street) and ask them to add you to their oldest credit card as an authorized user. Explain to them that you don't even want the physical card. They can hold on to it and sock drawer it. Therefore, you won't be able to "rack up" their bill spontaneously. I made this same deal with my Mom on a 18 year old Citi card she had and it boosted my AAoA considerably. It also lowered my utilization because it has a 10k limit and she keeps a really low, or zero balance on it.

Is this still accurate information? I don't believe that Fico 8 lends that much weight to AU accounts. I know for sure your old next door neighbors aged account would NOT be factored into your score. I could be mistaken, but I think Fico is trying to minimize the effect of AU accounts because people were abusing this provision and as a result accurate default probabilities were not being scored accordingly.

Current Scores 3/2016 Equifax 676 Transunion 697 Experian 648 Goal Scores: 720's accross the board. Gardening Goal: 3/2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What AAoA would be considered "Fair" versus "Poor"

An article I randomly found:

Authorized users are typically spouses, children and other relatives or even people close to the primary cardholder. The most current FICO score model is FICO® Score 8. Under FICO 8, the benefits of authorized user credit are substantially reduced if it appears that a primary cardholder has “rented” their good credit to a stranger. The scoring system recognizes a spouse, child or other family member as opposed to a complete stranger that may live in a different state but yet has been added as an authorized user.

Source: http://rebuildcreditscores.com/authorized-user-credit-to-boost-credit-scores/

So... "70 year old neghbor lady down the street" might not help, but Mom, Dad, Brother, Sister would.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What AAoA would be considered "Fair" versus "Poor"

@Revelate wrote:

@Anonymous wrote:

@Anonymous wrote:Currently rebuilding my credit. I've gotten my scores up to the 700 range, however my AAoA is currently sitting at 8 months.

I know 8 months is considered "Poor" according to CK. But what would I need my AAoA to be to be considered "Fair" or even "Good"?

And I just got approved for the Amex Delta Gold card, so I imagine that my AAoA will drop down to 4 months once that card shows up on my report :/

The first bump in AAoA for fico appears to be at 1 year (From other threads posted here). So until you hit the 1 year mark I would say you should consider it poor status, maybe even until after 2 years. All you can do to build AAoA is wait. Remember age is only 15% of your overall score.

Where have you seen that?

Historically it's been stated as 2 years and rounded down to the lowest year with a minimum value of 1 year effectively. This is somewhat illustration as it's hard to tease out AAOA changes without careful testing: didn't see a change at 1 on my profile, did get a change on 2 (worth 4 points on my file EQ 8) and saw nothing at 3 on any score version..

Sort of for illustration;

>2 years = fair

>~5 years = good

Maybe greater than 8 years = excellent, hard to say but you can hit an 850 with that, not sure you can at 5 years.

Mine is 10 years and it still says "fair". Ha

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What AAoA would be considered "Fair" versus "Poor"

This is a true statement about authorized users with Fico8 and most likely FICO9 as well. However, on previous model scores the AUs count. At least from what I have been inform.

My take is if you can find an old card with low balance, in good standing, from family member willing to add you, then go for it.

I had my mom add me on a 32 year old store card. It reported on two of the three CRAs. However when pulling FICO scoring reports I can't tell any effect because FICO discounts the AU accounts as stated on there disclaimer. My mother is remarried with different last name and lives in different stated, so I'm not sure if it is having any effect at all as far as FICO8 is conserned.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What AAoA would be considered "Fair" versus "Poor"

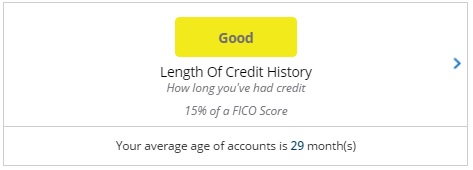

Looks like it also varies by CRA...

EX 33 months = Fair

TU 29 Months = Good

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What AAoA would be considered "Fair" versus "Poor"

Elim -

This question is off topic. I believe you, like me, CGID and SJ, lost a majority of minutes on-line. I see your rank recently re-gained established contributor.

What are your current minutes on-line?

I'm about 1200 minutes at the moment (up from 160 minutes post glitch) and was curious where the next break might be.

| Total Page Views | 50,502 |

| Total Messages Read | 114,618 |

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What AAoA would be considered "Fair" versus "Poor"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What AAoA would be considered "Fair" versus "Poor"

@Thomas_Thumb wrote:Elim -

This question is off topic. I believe you, like me, CGID and SJ, lost a majority of minutes on-line. I see your rank recently re-gained established contributor.

What are your current minutes on-line?

I'm about 1200 minutes at the moment (up from 160 minutes post glitch) and was curious where the next break might be.

Total Page Views 50,502 Total Messages Read 114,618

I can also answer this. My status was somehow bumped down to Member a few days ago. I PMed a moderator who changed it to Established Member. I think that's what it was before. Total minutes online is currently at 260. That's just over the last few days. Does anyone know what happened?

Current Scores - EQ - 687 / TU - 663/ EX - 677

TD Bank - $5000 / Mercury - $5000 / Capital One Savor One- $5000 / SDFCU Secured - $4990 / Capital One QuickSiver - $4500 / Ally Master Card - $2800/ Walmart Mastercard - $2250

Andrews FCU SSL $1500