- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: What is impacting my score the most?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What is impacting my score the most?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What is impacting my score the most?

I've managed to get rid of multiple collections on my credit report. Now, I'm down to the big ones. I'm trying to understand how I could be potentially at 700+ with minimal credit.

TU=652

EQ=651

Each credit report is posting almost completely different information. For instance, EQ is showing an old CC account which is in collections for (LVNV) $2,156. They're also showing Midland (Citibank) and the Citibank Charge-off as Credit Accounts, not collections. They are NOT shown on EQ as collection accounts. TU is not showing the Citibank charge-off but is showing a credit card in good order which was closed in 2004. TU is showing bad accounts as collection accounts.

I want to keep the charge-off on because it's aging my credit history 9+ years and I think by removing it, my EQ score would drop substantially because it would drop my credit history to less than 4 years.

In common, there is Pinnacle (Verizon Wireless) for $637 and Midland (Citibank) for $1,730.

If I can get those 2 out of the way, how much is this going to impact my score? Based on the simulator, I could hit near 700 just by paying my CC balance down. This is my only credit line, a CC for $300.

I'm looking to buy a house and obviously want to clear this up the right way. I'm just unsure how I can get to that level with minimal credit.

TRANSUNION

EQUIFAX

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is impacting my score the most?

To buy a home you would more then likely have to either PIF or pay by settlement all owed debt. Most underwriters will require this. So holding onto a charge-off with-out paying could be grounds for a denial on mortgage application.

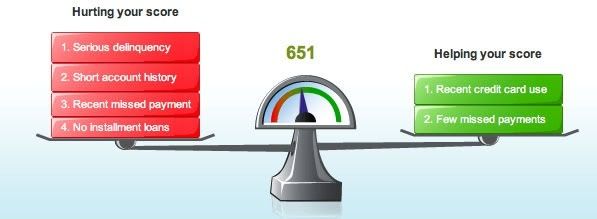

As far as your direct question for this post the COLLECTION on TU and or SERIOUS DELINQUENCY on EQ is impacting your score the most. The list on the left hurting your scores is listed with the most impact on top.

Good Luck

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is impacting my score the most?

Charge-offs and collections are major derogs, and are probably having the greatest negative impact.

A charge-off should not be shown as a collection. Charge-offs are payment history and account status codes reported by the OC.

Collections are reported by debt collector, not OCs. An OC can post a status code of referred for collection, but it does become an actual CA in your CR until it is reported by a debt collector. . Both could post simultaneously on the same CR.

You can get a CO deleted without losing its account history. Dont request account deletion, but only request the deletion of the CO itself.

Discrepancies in reporting done to the three CRAs is not under the control of the CRA. Each creditor can choose to report an item of information to n0ne, one, two, or all three CRAs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is impacting my score the most?

Thanks. I'm just having difficulty understanding how my score is where it's at and potentially where it can go. I only have one positive account and a bunch of negatives. The collections from Midland has a payment history of "OK" but was 120 days late in July. I'm assuming Equifax is scoring that also. Each of the collections on Equifax are read as Credit Accounts. I feel like if you go PFD my scores might actually drop because of how they're being accounted for. Obviously any lender would look at these and if I pay it off it would still report as "OK" for a while.

Am I overanalyzing this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is impacting my score the most?

I'll try to explain the way I understand it,but with my southern accent you may have problems.LOL. So if you dont understand it let us know

FICO scoring sees a collection anywhere on your CR, is what dings your CS.By collections, I mean LVNV or Midland which are CA's.

Where the CA's are located on your CR is insignificant, the account section or under the collections part of your CR.

FICO sees a CA's as a major derogs. Also a Paid CA is the same as a unpaid CA, should not see a score change.

Now if the CA's is deleted,your CS should improve but that depends on how old the debt is.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is impacting my score the most?

Where did you get these credit reports from ?

JC Penney 10/2008 4,700 US Bank Cash 08/2010 12,000 Citibank Custom Cash 5/2015 14,100, State Dept. FCU 06/2023 25,000 02/2024 Redstone FCU Signature VISA 10,000 08/23/2024 Commonwealth Credit Union 15000 07/25

Banking: Lafayette FCU Fortera FCU State Department FCU Redstone FCU Hughes FCU Commonwealth FCU

My personal blacklist Axos Bank, Bank of America, Synchrony Bank Capital One TD Bank Comerica Bank BMO US Bank Wells Fargo

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is impacting my score the most?

@AndySoCal wrote:Where did you get these credit reports from ?

Well, if you're asking OP, those sure look like myFICO reports to me...

OP, it would be a good idea if you checked your full reports directly from each bureau. Third-party monitoring services, including myFICO, occasionally show reports in odd ways, because the info doesn't transmit over smoothly from the underlying reports.

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is impacting my score the most?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is impacting my score the most?

The no installment loan reason from Equifax caused my question. That reason does not sound like FICO score reason.

JC Penney 10/2008 4,700 US Bank Cash 08/2010 12,000 Citibank Custom Cash 5/2015 14,100, State Dept. FCU 06/2023 25,000 02/2024 Redstone FCU Signature VISA 10,000 08/23/2024 Commonwealth Credit Union 15000 07/25

Banking: Lafayette FCU Fortera FCU State Department FCU Redstone FCU Hughes FCU Commonwealth FCU

My personal blacklist Axos Bank, Bank of America, Synchrony Bank Capital One TD Bank Comerica Bank BMO US Bank Wells Fargo

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What is impacting my score the most?

@AndySoCal wrote:The no installment loan reason from Equifax caused my question. That reason does not sound like FICO score reason.

Good point. It looks like reason code #32: FICO Scoring Reason Codes (click on the link on the linked thread)

FICO's: EQ 781 - TU 793 - EX 779 (from PSECU) - Done credit hunting; having fun with credit gardening. - EQ 590 on 5/14/2007