- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- What kind of increase can I expect?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

What kind of increase can I expect?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What kind of increase can I expect?

@FireMedic1 wrote:Paying off a charged off account does not remove it immediately from your credit report. Instead, the creditor will update the account payment status to reflect "paid charge-off." The status will be updated to reflect that it is paid, but the account will remain on the report for seven years from the original delinquency date, or initial missed payment that led up to the account being charged off.

https://www.experian.com/blogs/ask-experian/can-paid-charged-off-account-be-removed-from-report/

Yes, it continues to be denoted a "chargeoff".

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What kind of increase can I expect?

@GZG wrote:

@SouthJamaica wrote:

@FireMedic1 wrote:

@kcos194 wrote:

@FireMedic1 wrote:Best part it will quit updating monthly as a CO. That helps some. But with lates and balances on other cards not knowing the %'s. Hard to tell. Though it will reflect you paid your debt settled/PIF for the fututre.

It stops updating as a CO immediately upon payoff? I thought it would still update as a CO until it fell off the report. Going to be mortgage shopping in late 2023/early 2024 so that's good to know.

No more CO status. If you pay off the account either in full or for less than the full amount owed. The balance on the account will drop to zero. No more calculations into your aggregate util %'s. The status will change from “charge-off” to either “paid in full” or “settled in full,” but the account will remain on your credit file till 2026.

I'm not so sure about your statement that it will no longer have "CO status". I think you're wrong about that.

I checked my past reports, my CO's were still reflected as a CO with a comment that it was paid, but they stopped monthly reporting the CO from when it was paid

Exactly. Thanks for confirming.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What kind of increase can I expect?

@GZG wrote:

@SouthJamaica wrote:

@FireMedic1 wrote:

@kcos194 wrote:

@FireMedic1 wrote:Best part it will quit updating monthly as a CO. That helps some. But with lates and balances on other cards not knowing the %'s. Hard to tell. Though it will reflect you paid your debt settled/PIF for the fututre.

It stops updating as a CO immediately upon payoff? I thought it would still update as a CO until it fell off the report. Going to be mortgage shopping in late 2023/early 2024 so that's good to know.

No more CO status. If you pay off the account either in full or for less than the full amount owed. The balance on the account will drop to zero. No more calculations into your aggregate util %'s. The status will change from “charge-off” to either “paid in full” or “settled in full,” but the account will remain on your credit file till 2026.

I'm not so sure about your statement that it will no longer have "CO status". I think you're wrong about that.

I checked my past reports, my CO's were still reflected as a CO with a comment that it was paid, but they stopped monthly reporting the CO from when it was paid

Awesome, thanks for confirming that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What kind of increase can I expect?

@SouthJamaica wrote:

@GZG wrote:

@SouthJamaica wrote:

@FireMedic1 wrote:

@kcos194 wrote:

@FireMedic1 wrote:Best part it will quit updating monthly as a CO. That helps some. But with lates and balances on other cards not knowing the %'s. Hard to tell. Though it will reflect you paid your debt settled/PIF for the fututre.

It stops updating as a CO immediately upon payoff? I thought it would still update as a CO until it fell off the report. Going to be mortgage shopping in late 2023/early 2024 so that's good to know.

No more CO status. If you pay off the account either in full or for less than the full amount owed. The balance on the account will drop to zero. No more calculations into your aggregate util %'s. The status will change from “charge-off” to either “paid in full” or “settled in full,” but the account will remain on your credit file till 2026.

I'm not so sure about your statement that it will no longer have "CO status". I think you're wrong about that.

I checked my past reports, my CO's were still reflected as a CO with a comment that it was paid, but they stopped monthly reporting the CO from when it was paid

Exactly. Thanks for confirming.

Maybe I should have re-worded it. The monthly red or whatever color dots wont show up on a monthly basis once its $0 Balance. The word CO stays. Yes. Doesnt turn into a paid as agreed perfect account. The status as owed is done.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: What kind of increase can I expect?

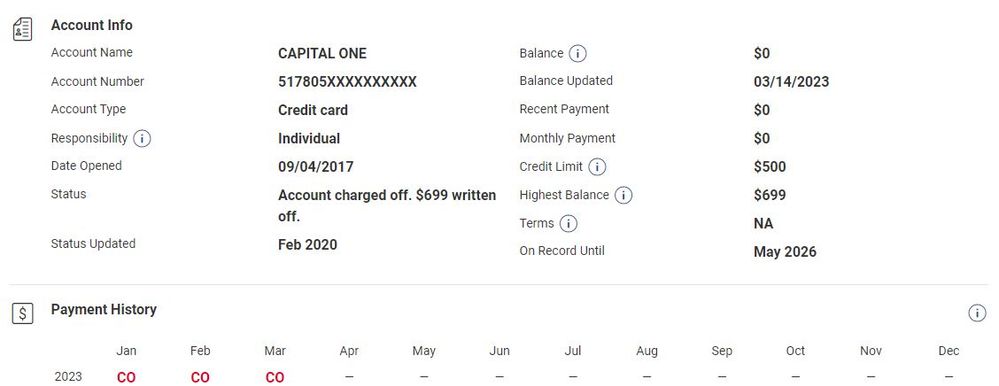

Just pulled my EX and TU reports from the annual credit report site, and the cap 1 charge off is reporting like this. Paid it 2/28. Is this accurate, or do I need to wait for a second update after ~30 days or so?