- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Where did I come from?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Where did I come from?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where did I come from?

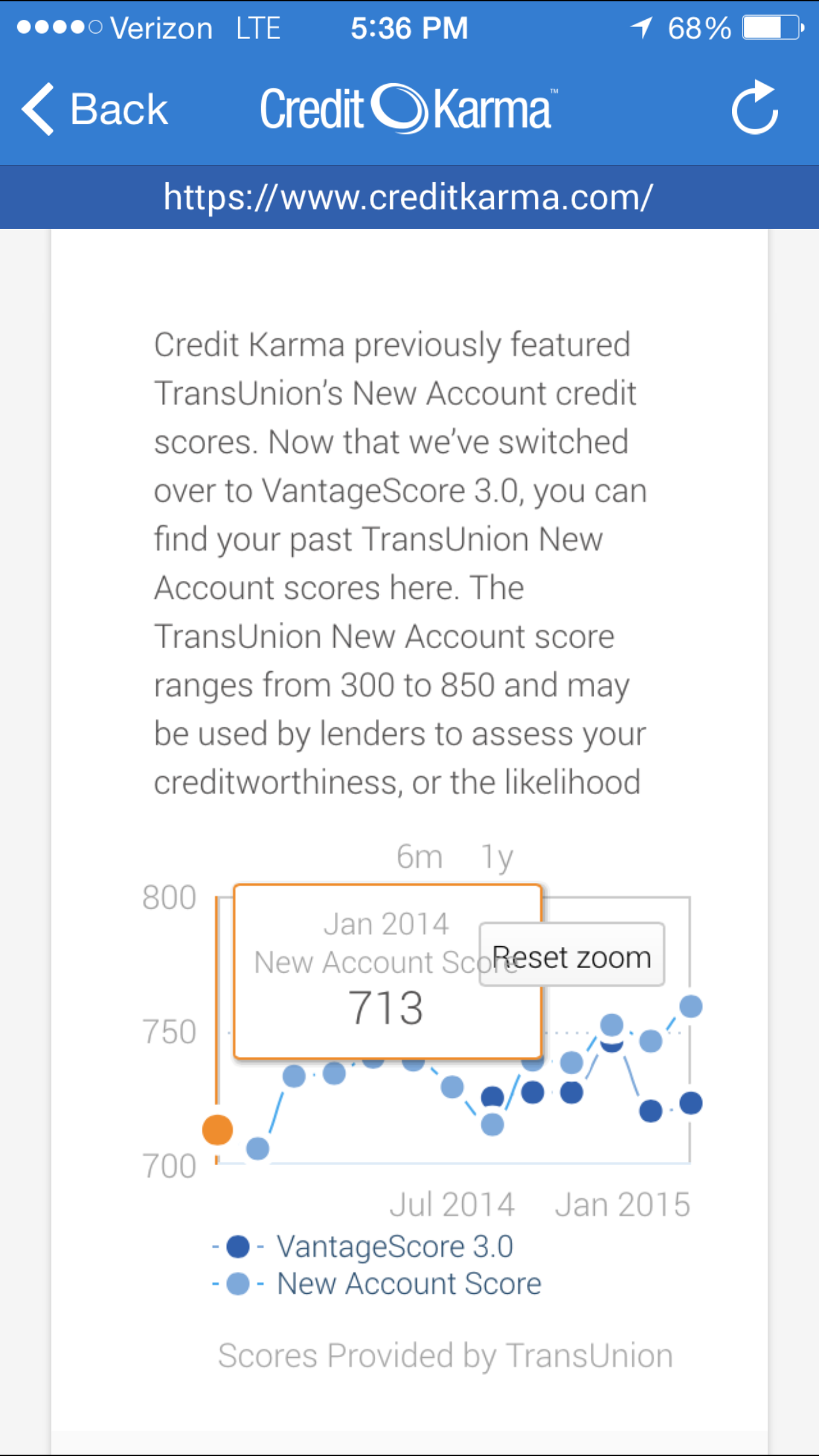

So, I have came a long way in the past 2.5 years with a TU at 750 and a EQ at 726. When I got the first credit card, I didn't know a darn thing about FICO credit scoring or the myFICO community. I blindly applied and was approved for the first card I found with no knowledge of credit at the age of 21. Since then I have built a solid foundation while almost micromanaging the credit. Yes, I'm that guy who checks Credit Karma's updated FAKO credit score every Friday along with the other lenders who provide free FICO scores as soon as they email notifying me of a score change.

I can't remember exactly when I started using Credit Karma (yes, I know it's a FAKO). However, I can only see achieves as far back as Jan. of 2014. I was first began building credit in Jan. of 2013 I believe. It shows I had 713 TU FAKO, with a 706 after acquiring the second card (Chase Freedom). I imagine a lot can change in a year of building credit.

As I grow while building and managing the credit. I can't help but wonder, where did I come from? What were the scores that I had when I was first excited to be approved for that Capital One Platinum card with only a $300 limit? I know everyone doesn't start with the same credit score, but I'm extremely curious about this. Is there any possibility I could call Capital One and ask them if they still have the credit scores they had when I was first approved for their credit card? If not, where can I find this out?

Thank you for your help!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where did I come from?

Sorry, I actually was meaning to post this in the Understanding FICO® Scoring section.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where did I come from?

If you did not receive the best terms for a CC approval (or if you were denied), a lender is required to send you a copy of the FICO score they used to reach a decision. Likely, you didn't keep that letter. As for how long the CCC would maintain a copy of that letter, it's hard to say. Many records purge at different times and companies all have different standards as far as when to purge records.

I doubt Cap One's frontline CSRs would have any access to historical records like that. if you feel it's important enough, you could reach out to the Cap One EO. However, I hesitate to advise that, since I'm not sure how fruitful such an effort would be.

Based on your initial CL on the platinum, I would guess that your FICO scores were in the low 600s at the time. What did your profile look like at the time of approval?

Start: 619 (TU08, 9/2013) | Current: 809 (TU08, 3/05/24)

BofA CCR WMC $75000 | AMEX Cash Magnet $64000 | Discover IT $46000 | Disney Premier VS $43600 | Venmo VS $30000 | NFCU More Rewards AMEX $25000 | Macy's AMEX $25000 Store $25000 | Cash+ VS $25000 | Altitude Go VS $25000 | Synchrony Premier $24,200 | Sony Card VS $23750 | GS Apple Card WEMC $22000 | WF Active Cash VS $18,000 | Jared Gold Card $16000 | FNBO Evergreen VS $15000 | Citi Custom Cash MC $14600 | Target MC $14500 | BMO Harris Cash Back MC $14000 | Amazon VS $12000 | Freedom Flex WEMC $10000 | Belk MC $10000 | Wayfair MC $4500 ~~

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where did I come from?

@SunriseEarth wrote:If you did not receive the best terms for a CC approval (or if you were denied), a lender is required to send you a copy of the FICO score they used to reach a decision. Likely, you didn't keep that letter. As for how long the CCC would maintain a copy of that letter, it's hard to say. Many records purge at different times and companies all have different standards as far as when to purge records.

I doubt Cap One's frontline CSRs would have any access to historical records like that. if you feel it's important enough, you could reach out to the Cap One EO. However, I hesitate to advise that, since I'm not sure how fruitful such an effort would be.

Based on your initial CL on the platinum, I would guess that your FICO scores were in the low 600s at the time. What did your profile look like at the time of approval?

Never been denied. I typically get a FICO score along with the approval, however I didn't think to keep this when I was younger. Since then I have always kept the 'welcome' information that includes terms & conditions, polices, fee schedules as well as the FICO score in a filing cabinet.

I completely agree, I doubt a representative would have access. I would hate to bother an EO about something so trifling. I suppose if I'm ever on the phone with a Capital One EO in the future, than I will inquire on this subject.

When I was approved for the Capital One platinum I wasn't aware that one could obtain a free credit report. I had no history as it was a new file.