- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Where will my FICO 8's be in 3 months?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Where will my FICO 8's be in 3 months?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where will my FICO 8's be in 3 months?

So, I've got a bunch of cool little things going on with my profile over the course of the next 2.5 months. Based on the changes I'm about to list below, I'm looking for anyone to take a stab at what my scores may rise to when I do a mid-May pull.

Current scores are EX 827, TU 836, EQ 831. Those are with AZEO or AZE2 in place (doesn't matter which).

AoOA is 16.9 years currently, so 3 months it will have crossed 17 years.

AoYA is 10 months currently, so in 3 months it will have crossed 1 year.

AAoA is 6.9 years on EX, so that will cross 7 years. AAoA is 7.6 years and 7.2 years on TU/EQ, so those will be at 7.9/7.5 years, respectively.

Scoreable inquiries:

EX has 2 currently, will be 0 in 3 months.

TU has 1 currently, will be 0 in 3 months.

EQ has 2 currently, will be 1 in 3 months.

I currently have 3 open installment loans (1 mortgage, 2 autos) on my CR. One auto loan was closed a few weeks ago and just needs to report as such. The other auto loan I'll be closing by the end of this month. So, 3 months from now, both auto loans will no doubt show closed with just my mortgage remaining. Installment loan utilization won't change more than 3% though (no threshold crossing) since the mortgage is much larger than the auto loans.

Negative reason codes I get from FICO 4 are:

- Time since most recent account opening is too short.

- Length of time revolving accounts have been established.

Negative reason codes I get from FICO 8 Bankcard are:

- Time since most recent account opening is too short.

- Too many accounts with balances.

I'm hoping the AoYA crossing 1 year will eliminate the first reason code from both models. Opinions on that?

Length of time revolving accounts have been established. Not sure if that's pointing to AoOA, AoYA or AAoA. With all increasing and possibly crossing thresholds, possibly that reason statement goes away.

Too many accounts with balances... Well, I have 11 total open accounts (on my CR) currently, 4 of which have balances with AZEO. That number in 3 months will be 2 accounts (1 revolver and 1 mortgage) due to the 2 auto loans being closed. Not sure if that will impact this negative reason code.

Anyway, based on the above data if anyone would care to take a stab at any potential score increases I may scoop up I'd love to hear your input. I'm excited to see 3 months from now where I stand.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where will my FICO 8's be in 3 months?

Wow! Nice scores already!

Seeing how you are 14 to 23 points away from 850, I think you might hit 850 in at least one of your reports. I'm thinking if anything is holding you back it is the new CC. Before my app spree a year ago, where I picked up 1 mortgage and 3 CCs, my youngest account, a credit card, was about three years old. I had the "Time since recent account opening is too short" message too. It didn't disappear until that CC turned 2 years old.

About 4 years ago a reporter interviewed a person that had an 850 score and also a FICO representative about what a person's report looks like that has an 850 score.

This is what the FICO rep said an 850 report looks like:

- 5 to 8 CCs with the youngest at least 2 years old and the AA being 5 years

- A thiry year mortgage that has been paid down for 10 years

- One old paid off auto loan

- One open auto loan that has less than 1 year to be paid off

- A HELOC with a zero balance

You have everything it takes for an 850 score.

I think BrutalBodyShots will have a trio of 850s within 1 year, 2 years at the very latest, as long as you just keep paying on time and don't open any new accounts!

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where will my FICO 8's be in 3 months?

I know that 850 scores have been had with AoOA in the 17-20 year range and AAoA in the 7-8 year range as long as AoYA is > 1 year, so I'm thinking in 3 months I'll be just about in the right place as far as age of accounts go.

I'm curious about the age of youngest revolver. If the algorithm does indeed see a revolver as "young" until it reaches 2 years, I'd have another year to go. I'd be interested to know what type of penalty is associated with that, though.

I guess the best data points out there would be if anyone with a revolver that's only 1.5 years old has been able to hit 850? 1 year old? 6 months old if they had some buffer built into their 850? I wonder if TT has any data on the subject.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where will my FICO 8's be in 3 months?

I have some limited ballpark data regarding inquiries on my report that may give a bit of an idea of what may happen with the changes to scoreable inquiries that I mentioned in the original post above.

On EX last year in going from 2 scoreable inquiries to 4, I lost 14 points from 822 to 808. That seemed like a lot. A couple of months later the first 2 scoreable inquiries passed the 1 year mark and back at 2 scoreable inquiries again my score was at 823. With these 2 remaining scoreable inquiries coming off soon, I'm not sure if it's realistic to expect a 14 point gain from them. That would be great if it was the case, I just feel like that's unlikely for whatever reason.

On TU last year in going from 1 to 2 scoreable inquiries my score didn't move. This was on a dirty file though; my 764 score remained at 764. A few months later the first scoreable inquiry passed the 1 year mark and my score remained at 764. With 0-1 inquiries possibly being "binned" together, going from 1 to 0 in the near future may have no impact at all on my score, even with my file being clean now.

On EQ last year in going from 1 scoreable inquiry to 2 I lost 7 points from 841 to 834. A few months later when the first inquiry became unscoreable, my score was 835, but I don't feel there's any clean data there as it seems the new accounts were impacting the score... otherwise you'd think I would have gained back the 7 I lost. A little later on, I went from 1 back to 2 and I lost 4 points. Now I'll be going from 2 back to 1, so perhaps I get back 4-7 points? Who knows.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where will my FICO 8's be in 3 months?

Yeah, once you are in the upper echelon of scores like you are the scoring seems to be a little squirrely. It seems a lot plays into how much buffer that you have in other metrics, like oldest account and AAoA.

You are for sure on the road to 850s. My concern is the new credit card. It seems that for people to hit the trio of 850s that most people that I remember, didn't have any newer accounts. The last puzzle piece that you are missing might be the AoYA. You see it all the time on here. The only thing keeping scores down is the lack of well aged reports and to get to 850 you need super well aged reports. I see your scores climbing a point or 2 every month until your new credit card ages to 2 years and then you will be at 850 across the board. But...Like you say...Who really knows? (Time for TT to chime in!)

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where will my FICO 8's be in 3 months?

In the myFICO score simulator it says my EQ score would go from 707 to 832 in the next 24 months if I paid down my high UTI with the next 24 monthly payments. That is a HUGE increase but think about it. The only thing that would change is my UTI, AAoA and AoYA.

You just need a bit more time and with your healthy and thick reports that probably have a few built in buffers it might only take you until your AoYA is 1 year and 6 months old.

Starting Score: EQ 653 6/21/12

Current Score: EQ 817 3/10/20 - EX 820 3/13/20 - TU 825 3/03/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where will my FICO 8's be in 3 months?

@Anonymouswrote:So, I've got a bunch of cool little things going on with my profile over the course of the next 2.5 months. Based on the changes I'm about to list below, I'm looking for anyone to take a stab at what my scores may rise to when I do a mid-May pull.

Current scores are EX 827, TU 836, EQ 831. Those are with AZEO or AZE2 in place (doesn't matter which).

AoOA is 16.9 years currently, so 3 months it will have crossed 17 years.

AoYA is 10 months currently, so in 3 months it will have crossed 1 year.

AAoA is 6.9 years on EX, so that will cross 7 years. AAoA is 7.6 years and 7.2 years on TU/EQ, so those will be at 7.9/7.5 years, respectively.

Scoreable inquiries:

EX has 2 currently, will be 0 in 3 months.

TU has 1 currently, will be 0 in 3 months.

EQ has 2 currently, will be 1 in 3 months.

I currently have 3 open installment loans (1 mortgage, 2 autos) on my CR. One auto loan was closed a few weeks ago and just needs to report as such. The other auto loan I'll be closing by the end of this month. So, 3 months from now, both auto loans will no doubt show closed with just my mortgage remaining. Installment loan utilization won't change more than 3% though (no threshold crossing) since the mortgage is much larger than the auto loans.

Negative reason codes I get from FICO 4 are:

- Time since most recent account opening is too short.

- Length of time revolving accounts have been established.

Negative reason codes I get from FICO 8 Bankcard are:

- Time since most recent account opening is too short.

- Too many accounts with balances.

I'm hoping the AoYA crossing 1 year will eliminate the first reason code from both models. Opinions on that?

Length of time revolving accounts have been established. Not sure if that's pointing to AoOA, AoYA or AAoA. With all increasing and possibly crossing thresholds, possibly that reason statement goes away.

Too many accounts with balances... Well, I have 11 total open accounts (on my CR) currently, 4 of which have balances with AZEO. That number in 3 months will be 2 accounts (1 revolver and 1 mortgage) due to the 2 auto loans being closed. Not sure if that will impact this negative reason code.

Anyway, based on the above data if anyone would care to take a stab at any potential score increases I may scoop up I'd love to hear your input. I'm excited to see 3 months from now where I stand.

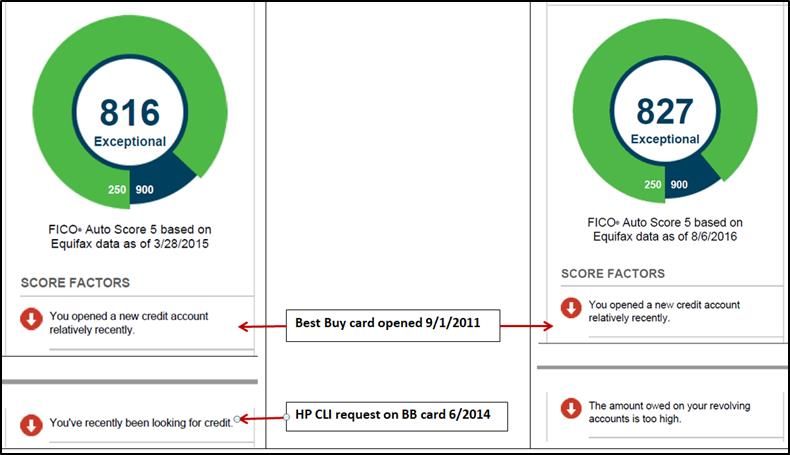

The increase in AoYA to over one year is important and will gaiin points. Unfortunately, the "time since most recent" has been reported up to 2 years and I received "you opened an account relatively recently" with my youngest account at 4 years 11 months back in 2015. I would not attribute any score gain to changes in AAoA.

The drop in inquiries to zero on two CRAs and one on the other is big. I know you can be at 850 with a single inquiry.

As mentioned many times, the too many accounts with balances includes revolvers, charge cards and installment loans. If your total drops to three or less with balances, that reason statement should go away.

Your scores should increase significantly. Assuming your mortgage B/L is under 69%, my guess on Classic Fico 8 is EQ 845, TU 850, EX 850. Your EQ Bankcard Fico 8 as reported by Citi likely will be in the 870s with your EX and TU Bankcard scores being 10 to 15 points higher. Unfortunately, Citi's BC score updates have a long lag time.

P.S. The industry enhanced Auto Fico algorithms do specifically look for an Auto loan on file and can award "bonus points" if you have one. The Classic and Bankcard Ficos do not appear to differentiate installment loans based on Auto. The only time I received a: "you have no recent activity from an Auto loan" was on EX Auto Enhanced Fico score 2 (Fico 98 version).

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where will my FICO 8's be in 3 months?

TT, thanks for your insight. A couple of questions though.

Why do you think you still had the "opened an account too recently" statement in the past when your youngest account was 4 years 11 months? That seems ridiculous that a nearly 5 year old account could still be imposing a penalty. If it indeed was, I would have to think it was extremely small, no?

Regarding the inquiry drops, I know you and I have discussed possible "binning" in the past. I would think for sure I'll see a score increase on EX in going from 2 to 0 and possibly the same going from 2 to 1 on EQ... but on TU in going from 1 to 0 don't you think that may not have any impact?

Good to know that 3 or less total accounts (across all types) with balances should result in the too many accounts with balances reason statement going away. Is that simply a hard number? Like 4+ yields that statement regardless of total number of accounts? I find it interesting that percentage isn't taken into account at all. Good to know!

Thanks for your score predictions. Is there any reason in particular why you think I'd be able to achieve 850 on TU and EX but come up 5 points short on EQ with Classic FICO 8? As far as Bankcard 8, I'm at 851 there now and that was with 3/8 of my revolvers reporting balances, which I believe is hitting me with some sort of penalty. Not sure what AZEO would do to that 851, but I'll find out next cycle. What is the biggest constraint to hitting 900 on Bankcard 8 relative to 850 on Classic 8?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where will my FICO 8's be in 3 months?

@Thomas_ThumbP.S. The industry enhanced Auto Fico algorithms do specifically look for an Auto loan on file and can award "bonus points" if you have one. The Classic and Bankcard Ficos do not appear to differentiate installment loans based on Auto. The only time I received a: "you have no recent activity from an Auto loan" was on EX Auto Enhanced Fico score 2 (Fico 98 version).

I forgot to comment on this part of your post above TT. Do you know if the auto loan has to be open, or does it look for the presence of any auto loans (open or closed) on your CR? I know most models like to see open loans, but in the case of an auto loan I could see it considering a 5 or 7 year closed loan that's still present on a credit report as having some value. Then again, whether or not that would be considered "recent" if closed is arguable. But, if FICO likes to call a 4 year 11 month old revolver "recently opened" surely it can consider a 4 year 11 month closed auto loan as "recent" as well, no? ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Where will my FICO 8's be in 3 months?

Wording of reason statements is key:

The one I received regarding accounts specifically says "relatively recently" not recently. To me that means older than what might be considered new or recent.

The reason statement associated with my Auto Fico score mentioned something like "no recent activity from an Auto loan". That could be inferred as meaning no open account since closed accounts don't show activity. However, the statement is not definitive. Last auto loan I had was paid off and closed in1989. Actual wording pasted below.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950