- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Which is best for mortgage scores? Many zero balan...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Which is best for mortgage scores? Many zero balance accounts, or fewer accounts?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Which is best for mortgage scores? Many zero balance accounts, or fewer accounts?

I'm curious as to whether it is better for one's mortgage scores to (a) have a large number of zero balance

revolving accounts, so that the percentage of cards reporting balances is lower, or (b) to have a reduced number of cards.

In my case I have 29 non-hidden revolving accounts, 22 credit cards and 7 personal lines of credit. I am at a point where I could certainly depart with some of the credit cards without shedding a tear.

Utilization is not an issue, and I don't have any problem managing the accounts.

So for me it boils down to the question of whether having fewer accounts will help or hurt my scores.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Which is best for mortgage scores? Many zero balance accounts, or fewer accounts?

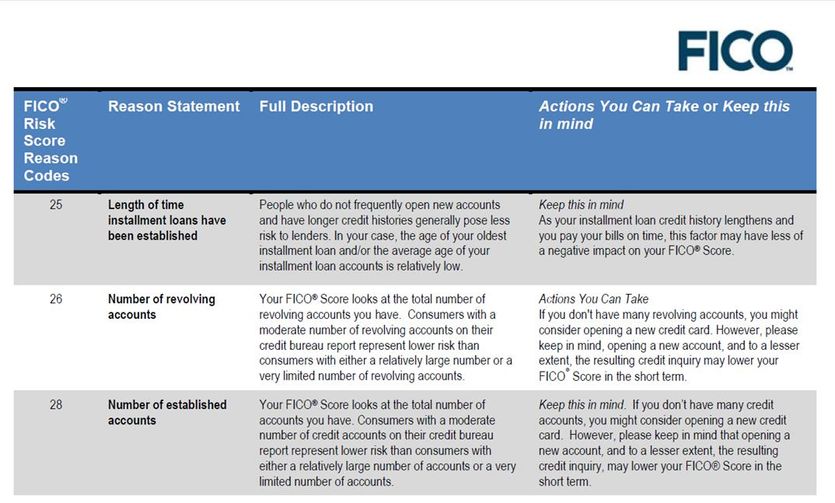

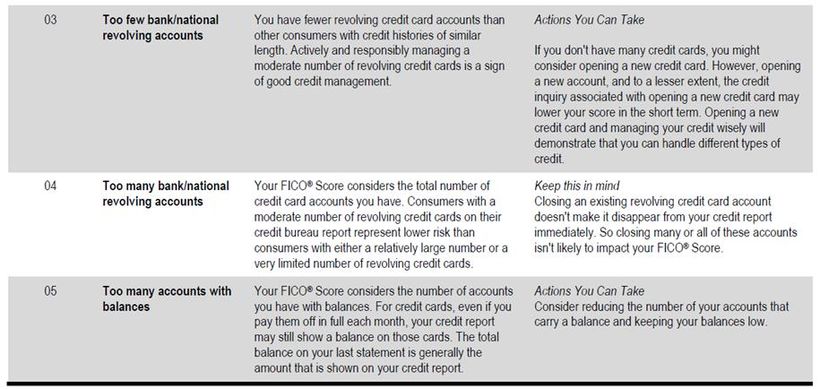

It's a balance. Too many and too few accounts are considered more risky. I'd use Fico reason codes as a guide. The specific ones pertaining to this issue are pasted below. Fico does not provide specific numbers but, I believe 11 to 20 accounts total is a sweet spot. I have 7 open + two closed accounts and I know that is sub optimal based on reason codes I have received and my drop to very good from excellent on MyFico when my file went below 11 total accounts.

As far as accounts with balances, there might be two factors involved: the absolute QTY and % of total for revolvers. For best results with the older mortgage Ficos, particularly EQ Fico 04, I'd recommend keeping # revolvers reporting balances at 3 cards or less even if you have 10 to 20 revolvers. The TU and EX mortgage counterparts are more tolerant.

Side note: One poster with 30 cards did not report any negative impact on Fico score until going over 6 cards reporting ... but that was Fico 8.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Which is best for mortgage scores? Many zero balance accounts, or fewer accounts?

I have received the negative reason statement that TT mentions...

Too many accounts with balances

... when I have a very low ratio of cards showing a balance to total number of open cards. For example, I have received it when I had 2 out of 13 cards showing a balance. On the other hand, the total number of accounts I had with balances was 4: two revolving and two loans.

This makes me consider two things as possible or even likely:

(1) That while the mortgage models may well consider ratios, they may also consider the integer number of accounts.

(2) That the wording of the reason code may be important -- FICO has no problem saying "revolving" or "bankcard" when it wants to. But the wording just refers to "accounts", which may include loans.

It's possible that the integer number of 4+ accounts may be important. And thus it is one more reason if preparing for a mortgage to have exactly one card reporting a balance, especially if you have two open loans.

I have gotten that reason statement when my scores were in the 780s with no derogs, good age, and ultralow utilization. So it must have been a significant penalty -- not just 1-2 points.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Which is best for mortgage scores? Many zero balance accounts, or fewer accounts?

@Thomas_Thumb wrote:It's a balance. Too many and too few accounts are considered more risky. I'd use Fico reason codes as a guide. The specific ones pertaining to this issue are pasted below. Fico does not provide specific numbers but, I believe 11 to 20 accounts total is a sweet spot. I have 7 open + two closed accounts and I know that is sub optimal based on reason codes I have received and my drop to very good from excellent on MyFico when my file went below 11 total accounts.

As far as accounts with balances, there might be two factors involved: the absolute QTY and % of total for revolvers. For best results with the older mortgage Ficos, particularly EQ Fico 04, I'd recommend keeping # revolvers reporting balances at 3 cards or less even if you have 10 to 20 revolvers. The TU and EX mortgage counterparts are more tolerant.

Side note: One poster with 30 cards did not report any negative impact on Fico score until going over 6 cards reporting ... but that was Fico 8.

Wow. Thank you for that.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Which is best for mortgage scores? Many zero balance accounts, or fewer accounts?

@Anonymous wrote:I have received the negative reason statement that TT mentions...

Too many accounts with balances

... when I have a very low ratio of cards showing a balance to total number of open cards. For example, I have received it when I had 2 out of 13 cards showing a balance. On the other hand, the total number of accounts I had with balances was 4: two revolving and two loans.

This makes me consider two things as possible or even likely:

(1) That while the mortgage models may well consider ratios, they may also consider the integer number of accounts.

(2) That the wording of the reason code may be important -- FICO has no problem saying "revolving" or "bankcard" when it wants to. But the wording just refers to "accounts", which may include loans.

It's possible that the integer number of 4+ accounts may be important. And thus it is one more reason if preparing for a mortgage to have exactly one card reporting a balance, especially if you have two open loans.

I have gotten that reason statement when my scores were in the 780s with no derogs, good age, and ultralow utilization. So it must have been a significant penalty -- not just 1-2 points.

I'm focusing on zero balance accounts.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Which is best for mortgage scores? Many zero balance accounts, or fewer accounts?

I think a good strategy might be to wait until "too many revolving accounts" starts popping up as a negative reason code, and then start slowly closing them down until it goes away.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Which is best for mortgage scores? Many zero balance accounts, or fewer accounts?

Please note the "keep in mind" associated with reason code 04.

Based on that statement it appears that closed accounts are being considered in the attribute analysis.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Which is best for mortgage scores? Many zero balance accounts, or fewer accounts?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Which is best for mortgage scores? Many zero balance accounts, or fewer accounts?

@Thomas_Thumb wrote:Please note the "keep in mind" associated with reason code 04.

Based on that statement it appears that closed accounts are being considered in the attribure analysis.

Good point. So nothing would be gained by closing them (except maybe many years down the road).

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 687

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Which is best for mortgage scores? Many zero balance accounts, or fewer accounts?

Also, while it's complete speculation on my part, I highly doubt that "too many or too few accounts" is a significant scoring factor. If the "sweet spot" number of accounts is say 11-20, I personally can't see having 8 or having 23 for example adversely impacting score more than maybe 5-9 points, tops. I certainly don't think it would be a worthwhile strategy to add more accounts or start closing accounts (if it mattered) for a small single-digit point gain.