- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- Re: Youngest age where 850 has been achieved?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Youngest age where 850 has been achieved?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Youngest age where 850 has been achieved?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Youngest age where 850 has been achieved?

I first hit 850 (EX-8) in 11/2015, age 42.

Data points for reaching EX-8 850 back then:

AoOA: 18 yrs 6 mo

AAoA: 11 yrs 3 mo

AoYA: 2 yr 7 mo (auto lease)

(TU-8 score at the time was 846)

I held 850 for 3 months until 02/16 when score dropped once I financed a car. I can't remember the exact bottom but it was low 800's and might have even dipped to the high 790's at one point. No other changes in CC utilization or other balances at the time, the sole change to my profile was a $28k car loan.

Fast foward 6 months later (06/16) both EX and TU rebounded to mid 830's, car was traded in and a new $30k car loan taken. Score takes another dip, execpt this time not as drastic. Down to 815 where it bottomed, then recovered rather rapidly for the next few months as I was quickly paying down the car loan. In 12/16, EX-8 was back to 850, 2 months later in 02/17 TU-8 hit 850 for the first time.

Data points from 12/16 when EX-8 recovered back to 850:

AoOA: 19 yrs 7 mo

AAoA: 10 yrs 9 mo

AoYA: 6 mo

(Age of 2nd Youngest Account: 11 mo)

Knock on wood, my EX-8 / TU-8 have maintained 850 ever since (approx 2.5 years). I should also point out, I paid off my 60 mo car loan in just 15 months but left a balance under $100 for the next 9 months so it would keep reporting an open loan. After the 2 year mark passed, I paid it off in full. 7 months prior to paying off the car loan, I used the SSL technique to keep an installment loan reporting (Alliant -- right before they ended the SSL program). My scores never dropped from 850 by paying the car loan off early or by opening an SSL loan.

Hope my data points help this thread!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Youngest age where 850 has been achieved?

wrote:I first hit 850 (EX-8) in 11/2015, age 42.

Looks like we have the first real world example! Thanks for Sharing, Octopus.

Despite the fear of hijacking this thread and continuing the hypothetical game, I'm wondering now how many points I'm missing in the various areas...

I know I could hunt down specific answers throughout this forum, but anyone with more knowledge than me care to share input if I share my profile?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Youngest age where 850 has been achieved?

@Anonymous wrote:

As with many of these threads, there's a lot of speculation. Many people chime in with they think someone could hit an 850 by age 30... 33... Etc. I like the real world hard data though; show me the guy that chimes in with "I'm 37 and hit an 850..." for example. I continue to look forward to those concrete data points and the lowest age that we see one reported at.

BBS...I'm 60, and the highest fico 8 I've ever attained was 836...just don't really think I'll ever get an 850. I have gotten close enough to have it in sight, but just can't make it across the finish line.

EX fico08=809 07/16/23

EQ fico09=812 07/16/23

EX fico09=821 07/16/23

EQ fico bankcard08=832 07/16/23

TU Fico Bankcard 08=840 07/16/23

EQ NG1 fico=802 04/17/21

EQ Resilience index score=58 03/09/21

Unknown score from EX=784 used by Cap1 07/10/20

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Youngest age where 850 has been achieved?

@sarge12BBS...I'm 60, and the highest fico 8 I've ever attained was 836...just don't really think I'll ever get an 850. I have gotten close enough to have it in sight, but just can't make it across the finish line.

Sarge, I think you could have an 850, but from what I recall the constraint on your profile is an AU account that reports around 50% utilization. I'm sure your age of accounts factors are in the right place, which is really what matters when you're discussing top-notch scores. I know you've said many times that the elimination of that AU account from your profile isn't an option, so I'd assume that will continue to be what holds you back from an 850.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Youngest age where 850 has been achieved?

Octopus, thanks for taking the time to provide your data points!

A few comments and questions that I have:

1 - Based on your age of accounts factors, it would appear you could have achieved an 850 sooner. I was able to hit 850 with an AoOA of 17 years, AAoA of 7.5 years and AoYA of 1 year. That being said, I would think you could have shaved 1.5 years off of all of your age of accounts factors and still been at or better than I was, meaning an 850 could have been possible for you at 40 years of age rather than 42. My question then is why that didn't happen? Perhaps you weren't actively tracking your scores at that time? If so, what did your utilization look like. I know you mentioned regarding the car loan that your utilization didn't change, but were you at AZEO during the data points you provided, or were you letting balances report naturally and could have had multiple cards with balances, higher [than ideal] reported utilization(s), etc?

2 - Great data point on achieving an 850 score with an AoYA of 6 months! CGID will enjoy that one. I also like that your Ao2ndYA was 11 months, showing that someone can achieve an 850 with multiple accounts under 12 months of age.

3 - You mentioned the addition of the auto loan and its impact on your score. To experience a drop from 850 to the low 800's or high 700's as you suggested, say a 45-55 point drop seems extremely excessive for the addition of an auto loan. In most cases that I've seen, such a profile would drop maybe into the 820-830 point range. Did you have any other open installment loans at the time? If so, at what balance(s)? Even going from a best case (1 installment loan open with < 8.9% utilization) scenario to a worst case where you had maxed out installment loan utilization, I would never expect anyone to see a 45-55 point drop.

Your feedback is appreciated!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Youngest age where 850 has been achieved?

@Anonymous wrote:Octopus, thanks for taking the time to provide your data points!

A few comments and questions that I have:

2 - Great data point on achieving an 850 score with an AoYA of 6 months! CGID will enjoy that one. I also like that your Ao2ndYA was 11 months, showing that someone can achieve an 850 with multiple accounts under 12 months of age.

What is the significance of multiple accounts under 12 months of age.?

Starting Score: Ex08-732,Eq08-713,Tu08-717

Starting Score: Ex08-732,Eq08-713,Tu08-717Current Score:Ex08-795,Eq08-807,Tu08-787,EX98-761,Eq04-742

Goal Score: Ex98-760,Eq04-760

Take the myFICO Fitness Challenge

History of my credit

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Youngest age where 850 has been achieved?

@SubexistenceWhat is the significance of multiple accounts under 12 months of age.?

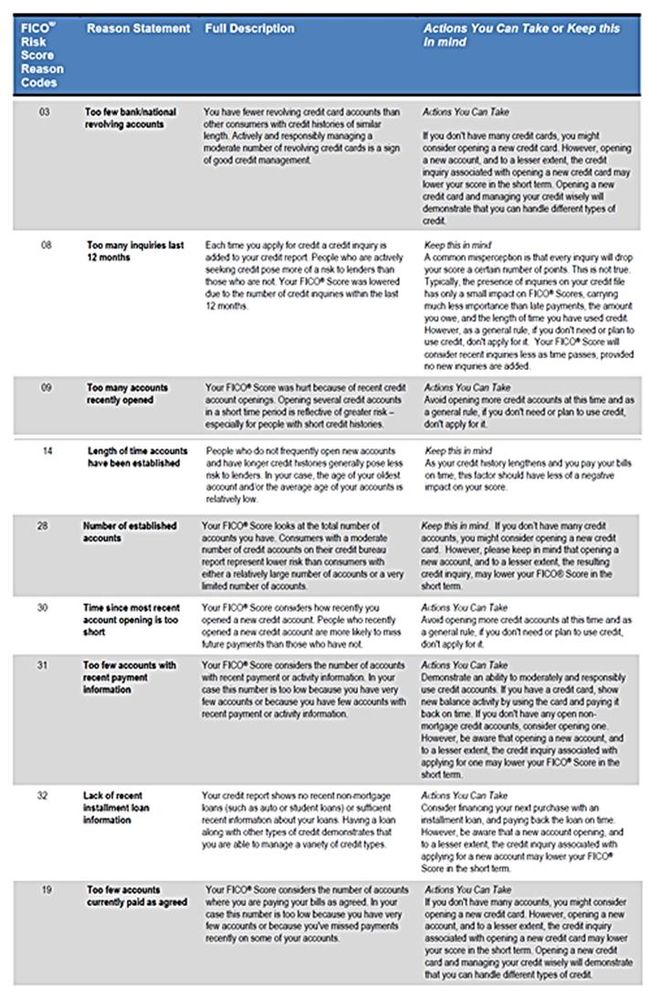

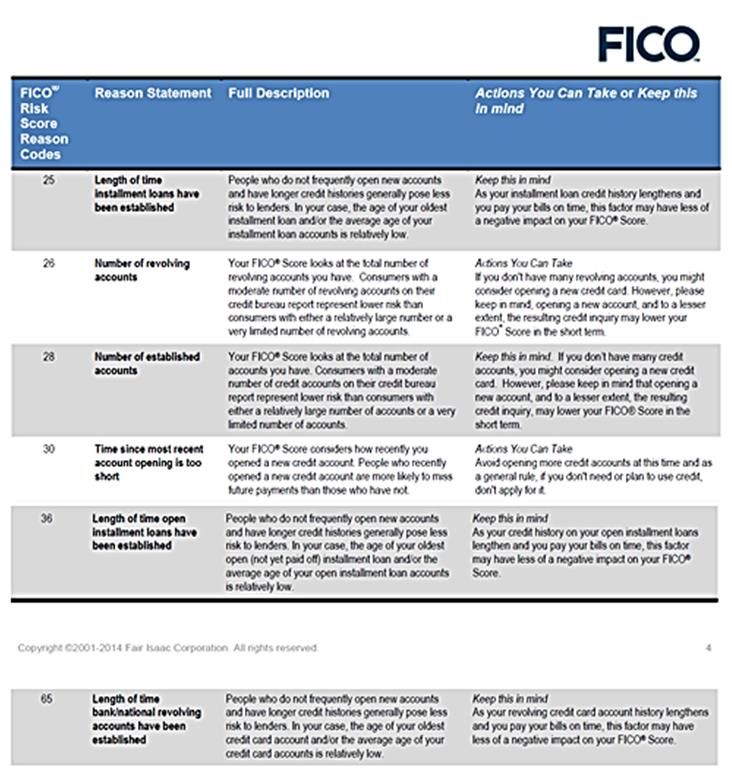

There may not be any, but as with many FICO reason statements (that are often vague) it's hard to know. Things like "length of time accounts have been established" or "length of time revolving accounts have been established" could be adversely impacted by multiple new(er) accounts. It's also believed that percentage of new accounts (say, under 12 months of age) may matter. Naturally if this is the case, the thicker the file the less it may matter.

I think the only way to be reasonably sure here would be to take someone who has an AoYA of > 12 months and have them acquire 1 new account, dropping their AoYA to 0 months. They'd probably see a small score drop first from the inquiry, then another drop maybe 2X-3X the amount of the inquiry once the account reports. An AAoA threshold crossing here would be important to rule out, which is a tough one as those points aren't well known. Once this is complete, the person would have to add another account. Again the inquiry would have to be isolated first, then see if there's any impact from the new account. AAoA would have to not cross a threshold. If there's no score drop when the second new account reports, multiple new accounts I would then say doesn't matter relative to just one.

Definitely not the easiest thing to test out, that's for sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Youngest age where 850 has been achieved?

@Anonymous wrote:Octopus, thanks for taking the time to provide your data points!

A few comments and questions that I have:

1 - Based on your age of accounts factors, it would appear you could have achieved an 850 sooner. I was able to hit 850 with an AoOA of 17 years, AAoA of 7.5 years and AoYA of 1 year. That being said, I would think you could have shaved 1.5 years off of all of your age of accounts factors and still been at or better than I was, meaning an 850 could have been possible for you at 40 years of age rather than 42. My question then is why that didn't happen? Perhaps you weren't actively tracking your scores at that time? If so, what did your utilization look like. I know you mentioned regarding the car loan that your utilization didn't change, but were you at AZEO during the data points you provided, or were you letting balances report naturally and could have had multiple cards with balances, higher [than ideal] reported utilization(s), etc?

2 - Great data point on achieving an 850 score with an AoYA of 6 months! CGID will enjoy that one. I also like that your Ao2ndYA was 11 months, showing that someone can achieve an 850 with multiple accounts under 12 months of age.

3 - You mentioned the addition of the auto loan and its impact on your score. To experience a drop from 850 to the low 800's or high 700's as you suggested, say a 45-55 point drop seems extremely excessive for the addition of an auto loan. In most cases that I've seen, such a profile would drop maybe into the 820-830 point range. Did you have any other open installment loans at the time? If so, at what balance(s)? Even going from a best case (1 installment loan open with < 8.9% utilization) scenario to a worst case where you had maxed out installment loan utilization, I would never expect anyone to see a 45-55 point drop.

Your feedback is appreciated!

Hi Brutal,

1. At age 40, I was actively watching my score but had 2 other open installment loans (car leases) on my profile. One was opened at age 40, the other at age 39. Both of these still had high payoff balances as they were 3 year terms. I'm assuming that FICO considered my utilization too high on those 2 loans, therefore 850 was not yet feasible? CC utilization was still under 1% with AZEO being practiced. By age 42, one of those loans was fully paid and the other had a small balance remaining under 9%.

2. Yes, AoYA was just 6 mo by the time my score rebounded back to 850. I was not expecting it to get there for at least 12 months so that was a pleasant surprise. Regarding the Ao2ndYA, I should point out this was a paid car loan account, as a result of me trading in my car. So the youngest account was the new car loan (6 mo), 2nd youngest was paid loan on traded car (11 mo).

@3. I took a drop down the low 800's for sure, not sure why it was so much. The only thing I can think of is that when I pulled my report, I saw 7 inquiries from the dealer rate shopping my loan. I'm not sure if FICO mistakenly scored them individually instead of just 1 inquiry as they're required to do? CC utilization was still less than 1%, with AZEO being followed. I did also have the one other installment loan left, mentioned above that was opened @ age 40 with a very low balance remaining on it.

I'm glad to hear my data points helped the thread. I'll be happy to answer any other questions or clarify any data points I might have missed.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Youngest age where 850 has been achieved?

@Subexistence wrote:

@Anonymous wrote:Octopus, thanks for taking the time to provide your data points!

A few comments and questions that I have:

2 - Great data point on achieving an 850 score with an AoYA of 6 months! CGID will enjoy that one. I also like that your Ao2ndYA was 11 months, showing that someone can achieve an 850 with multiple accounts under 12 months of age.

What is the significance of multiple accounts under 12 months of age.?

A few things here.

There is data from multiple posters indicating thresholds at 6 months and some data suggesting 3 months as well for AoYA. Whether or not these thresholds impact score is scorecard/file dependent. A majority of reported data comes from thicker profiles with more payment history and these profiles likely don't experience any score changes associated with 3 or 6 month AoYA boundries.

For example, negative impact associated with new account opening(s) would be more substantial for:

A) a revolver only profile having 3 cards with AoYA at 14 months, AAoA at 22 months and AoOA at 3 years that adds two new accounts

compared to:

B) A aged profile with an open installment loan + 6 open cards with AoYA at 8 months, AAoA at 42 months and AoOA at 12 years that adds the same two new accounts.

A well established clean profile opening a couple new accounts represents less risk my the mere fact of having a lengthy ontime payment history. The young/clean/not thick profile suffers from a limited # of accounts, a short length of time accounts have been established and too few accounts currently paid as agreed. Sufficient payment history is lacking for case A. Thus, new accounts and account utilization levels are assigned more weight than the (B) profile.

Side note: Another reason the (B) profile won't react as strongly as (A) is because it already has a AoYA under 12 months age.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950