- myFICO® Forums

- FICO Scoring and Other Credit Topics

- Understanding FICO® Scoring

- impact of AAoA with scores over 800?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

impact of AAoA with scores over 800?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

impact of AAoA with scores over 800?

Except for current credit-seeking behavior and an old CFA (car loan), all is currently well in CreditLand, at least from a FICO score perspective, with scores ranging from 812 to 829 (specs in footer).

That said, my open real estate loans and all but three of my cards are infants, anywhere from 2 to 15 months old. Depending on the bureau, my current AAoA ranges from 6y4m to 7y3m. As old closed accounts age off, those values will fall.

So, assuming that my Payment History remains clean, the Amount of Debt stays controlled (less than 8% aggregate, less than 28.9% for any one card), Credit Mix remains mixed, my oldest 20-year-old card remains active and, at some point, I stop applying for cards, does anyone have a sense of how much impact a (say) 4-year AAoA will have as compared with the 'optimal' (?) 7-year, 8-month AAoA?

2023 Goal: save 3 months' net income

Starting FICO8: 666 (give or take a FICO)

[ Last INQ 12-Feb-2024 ]

| EQ | 841 | 5 INQ (Auto, CC, HELOC, 2 mort) | 7y2m |

| EX | 812 | 5 INQ (2 CC, 2 mort, HELoan) | 6y11m |

| TU | 829 | 4 INQ (3 CC, 1 mort) | 6y6m |

| 5/24 | 3/12 | AoYA 0m | AoOA 23y6m | ~3% |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: impact of AAoA with scores over 800?

It's definitely tough to say, as AAoA thresholds aren't well documented and how many points are realized from crossing those thresholds isn't well known or consistent either. My shooting from the hip guess though would be roughly 10 points per year on AAoA, give or take. So, if you're dropping (say) 2.5 years in AAoA but your AoOA is remaining constant, perhaps 25 points or so could be lost. I think that's a reasonable estimation, as if you were to drop your AAoA to 1 year [AoOA of course would have to drop as well] scores around 740-750 could be had.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: impact of AAoA with scores over 800?

All reasonable, tho' 10 points per year may be a little high. I say that because my TU score (829) has the lowest reported AAoA (6-4), and the most recent INQ (2 weeks old). EQ is 814 and, while it has an additional INQ (2.5 months old), it reports an AAoA almost a year older (7-3).

The more I think about it (and I should stop), the less impact I think the AAoA decline is likely to have.

2023 Goal: save 3 months' net income

Starting FICO8: 666 (give or take a FICO)

[ Last INQ 12-Feb-2024 ]

| EQ | 841 | 5 INQ (Auto, CC, HELOC, 2 mort) | 7y2m |

| EX | 812 | 5 INQ (2 CC, 2 mort, HELoan) | 6y11m |

| TU | 829 | 4 INQ (3 CC, 1 mort) | 6y6m |

| 5/24 | 3/12 | AoYA 0m | AoOA 23y6m | ~3% |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: impact of AAoA with scores over 800?

I also can see a case where diminishing returns and/or signal strength of AAoA changes as it increases. For example, an AAoA drop from 92 months to 80 months is less meaningful than a drop from 20 months to 8 months, even though they are both 12 month drops.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: impact of AAoA with scores over 800?

BTW, some scoring systems are known to penalize you when your AoOA is far higher than your AAoA. The logic behind this is probably that such a situation necessarily implies that you have many extremely young accounts, i.e. that you began opening lots of accounts in a short time frame, fairly recently.

The LN CBIS scoring model is one of the most transparent models out here, in its extremely detailed list of reason codes, and it does this for sure.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: impact of AAoA with scores over 800?

That's interesting, CGID.

It's possible then, under certain scoring models, than an extremely old account falling off ones CR could actually result in a score gain. Say an AoOA of 18 years is all that's required for max points under X scoring model. If a person possesses a AoOA of 40 years and their next oldest account is 20 years and that 40 year account drops off, their AoOA gets cut in half, while still being in the "best" place (>18 years). Their AAoA in this example for the sake of numbers may fall from 9 years to 8 years, making their AoOA to AAoA variance drop from 31 years to 12 years. Just something interesting to think about and consider.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: impact of AAoA with scores over 800?

@Anonymous wrote:BTW, some scoring systems are known to penalize you when your AoOA is far higher than your AAoA. The logic behind this is probably that such a situation necessarily implies that you have many extremely young accounts, i.e. that you began opening lots of accounts in a short time frame, fairly recently.

The LN CBIS scoring model is one of the most transparent models out here, in its extremely detailed list of reason codes, and it does this for sure.

Thanks, CGiD. My history certainly fits that profile. Of 14 active accounts, I've opened 11 within the past 20 months; my oldest is 20 years young..

2023 Goal: save 3 months' net income

Starting FICO8: 666 (give or take a FICO)

[ Last INQ 12-Feb-2024 ]

| EQ | 841 | 5 INQ (Auto, CC, HELOC, 2 mort) | 7y2m |

| EX | 812 | 5 INQ (2 CC, 2 mort, HELoan) | 6y11m |

| TU | 829 | 4 INQ (3 CC, 1 mort) | 6y6m |

| 5/24 | 3/12 | AoYA 0m | AoOA 23y6m | ~3% |

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: impact of AAoA with scores over 800?

@CGID That is awesome information, can you please guide me to the source, so I can read more about it please?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: impact of AAoA with scores over 800?

@expatCanuck wrote:Except for current credit-seeking behavior and an old CFA (car loan), all is currently well in CreditLand, at least from a FICO score perspective, with scores ranging from 812 to 829 (specs in footer).

That said, my open real estate loans and all but three of my cards are infants, anywhere from 2 to 15 months old. Depending on the bureau, my current AAoA ranges from 6y4m to 7y3m. As old closed accounts age off, those values will fall.

So, assuming that my Payment History remains clean, the Amount of Debt stays controlled (less than 8% aggregate, less than 28.9% for any one card), Credit Mix remains mixed, my oldest 20-year-old card remains active and, at some point, I stop applying for cards, does anyone have a sense of how much impact a (say) 4-year AAoA will have as compared with the 'optimal' (?) 7-year, 8-month AAoA?

I believe it would have a very large impact, like 20 or 30 points or even more in FICO 8, and an even larger impact on the mortgage scores.

Total revolving limits 741200 (620700 reporting) FICO 8: EQ 703 TU 704 EX 691

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: impact of AAoA with scores over 800?

@Anonymous wrote:That's interesting, CGID.

It's possible then, under certain scoring models, than an extremely old account falling off ones CR could actually result in a score gain. Say an AoOA of 18 years is all that's required for max points under X scoring model. If a person possesses a AoOA of 40 years and their next oldest account is 20 years and that 40 year account drops off, their AoOA gets cut in half, while still being in the "best" place (>18 years). Their AAoA in this example for the sake of numbers may fall from 9 years to 8 years, making their AoOA to AAoA variance drop from 31 years to 12 years. Just something interesting to think about and consider.

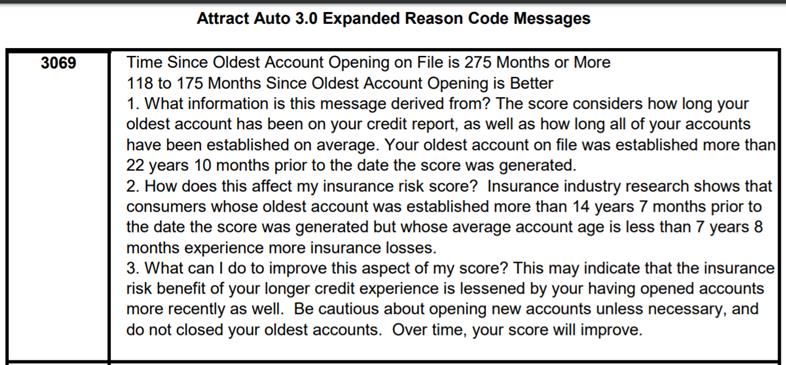

The LN CBIS model negatively impacts score for a lengthy AoOA if and only if the file has an AAoA under 7 years 8 months (code 3069). Substantial new credit behavior with an otherwise lengthy age of file may be indicitive of an older person running low on funds that may be more likely to file a claim. It could also be a young person using an AU account to inflate credit history. Perhaps account churners also correlate to increased claim frequency.

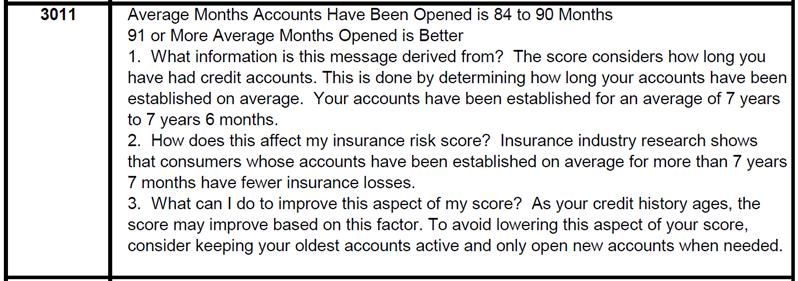

BTW: Per code 3011 it is best to have an AAoA over 7 years 6 months anyway.

Fico 8: .......EQ 850 TU 850 EX 850

Fico 4 .....:. EQ 809 TU 823 EX 830 EX Fico 98: 842

Fico 8 BC:. EQ 892 TU 900 EX 900

Fico 8 AU:. EQ 887 TU 897 EX 899

Fico 4 BC:. EQ 826 TU 858, EX Fico 98 BC: 870

Fico 4 AU:. EQ 831 TU 872, EX Fico 98 AU: 861

VS 3.0:...... EQ 835 TU 835 EX 835

CBIS: ........EQ LN Auto 940 EQ LN Home 870 TU Auto 902 TU Home 950