- myFICO® Forums

- This 'n' That

- myFICO® Product Feedback

- Re: myFICO® Forums is the absolute best

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

myFICO® Forums is the absolute best

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

myFICO® Forums is the absolute best

On 9/11/18 my VantageScore 3.0 was 522 and all I had was two accounts in collections, nothing else.

I don't know what my real FICO score was, I hadn't bought a subscription until late December. Didn't know there was a difference until then and how important that difference was.

1.) I disputed one of the derogs with a mountain of evidence, won on 9/11/18

2.) Opened a Capital One Platinum CC in October

3.) Got on one of my wife's maxed out CC's sometime in November, a 1500 Capital One Journey card at 98% utilization. I started paying it down every time either one of us got paid and there was money left over after bills. Chipping away every single chance I got.

4.) Disputed the second derog, also with a s' ton of evidence, won sometime in November. No more derogs on my account.

5.) Got on my wife's maxed out Capital One Platinum sometime just before Christmas, a 3500 SL at 98% utilization. Started chipping away at two of the cards at once.

6.) Paid off both of the CCs 2/21/19.

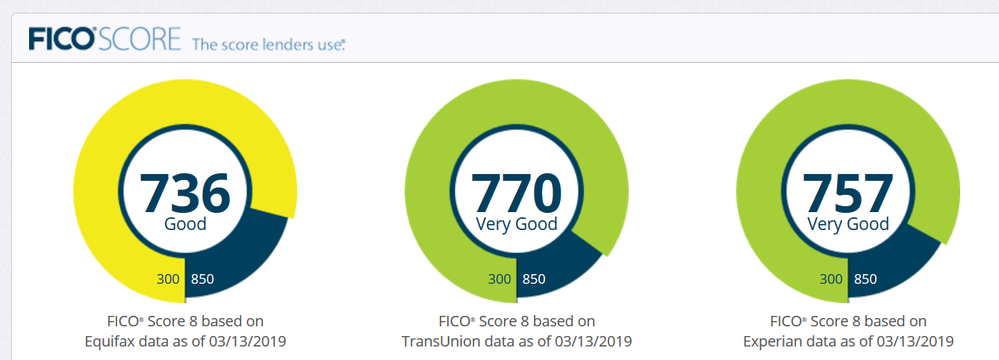

7.) Credit report says my FICO scores are now this. In SIX months. SIX f' months! That's it!

My scores as of a few minutes ago,

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: myFICO® Forums is the absolute best

That’s quite a jump! Keep up the good work

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: myFICO® Forums is the absolute best

I can't put into words how incredibly grateful I am to anyone who has taken a moment to share what they know in this forum at any time ever.

I've spent an insane amount of time reading thread after thread after thread in these forums. Some years old. I've been constantly studying and learning about how these scores work and what I can do to make them better and build a better, more stable and secure future for myself and my family.

I'm about to apply for a real credit card Friday, a promotional BT CC through a local CU in my area. I'm positive I'll get it and I'll then absorb the last of my wife's CC debt, putting her in a position to get a mortgage through her alone.

That same day I'm opening a 60 month, $3,000 Navy Federal shared secured loan, then paying it down to 9% like this forum taught a lot of us. That way I have an installment loan on my credit profile.

This kind of success and so quickly would not have been possible without the troves of knowledge this forum had to offer.

If you ever made even just one single post on this forum at one point or another, thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: myFICO® Forums is the absolute best

It’s great to hear that the forums have been of help to you. There are many great forum members here that have lots of knowledge that they are willing to share. That truly is make these forums a fantastic resource.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: myFICO® Forums is the absolute best

Be careful of your time here though unless you want 80 revolvers in the next 4 years ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: myFICO® Forums is the absolute best

What an incredible jump! Congrats on all that hard work.

Stories like these really bring a smile to my face!

Installment Loans

Current Scores 5/05/23

Current Mortgage Scores 5/05/23

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: myFICO® Forums is the absolute best

When it was all done and said, I couldn't stop smiling myself.

I knew how finnicky and unstable that score was, when I had only 3 accounts total and only one wasn't an AU account, subtble changes to my profile could have massive impacts on the score and how it'd swing and as high as it was... it'd only swing down.

This is what was on my credit profile at the time,

+ Capital One Platinum, 1% utilization, 300 credit limit, opened 10/2018

+ Capital One Platinum (AU), 0% utilization, 3500 credit limit, opened 6/2017

+ Capital One Journey (AU), 0% utlization, 1500 credit limit, opened 4/2018

So the minute everything settled to a point where I knew it'd had finally plateaued, I went down to my local Credit Union and opened a 15k Rewards Visa and refinanced a car loan in my wife's name alone.

You get 1 point (dbl for first 90 days) for every $1 spent (10,600 points gets you a $100 gift card), 2.99% APR for 12 months, NO Balance Transfer fee, 8.25% (fixed) APR after the 12 months.

I had to get my wife to apply jointly with me, there was nothing I could do. Their underwriters saw that my profile had one single CC in my name, a few days shy of 6 months old. They used MY TU 770 to dictate the rates though! They used her extensive credit profile to open the accounts with confidence.

They used the same hard pull to refinance an Auto Loan ($18,047) which was in wife's name only at the time and refinanced in _both_ our names. Went from 7.68% (64 months) to 3.74% (72 months). The car is a 2013 Subaru XV Crosstrek w/ 70k miles.

That's some pretty awesome numbers.

Esp. a fixed interest CC at 8.25% (after promotion ends) and a 3.74% on a used car with 70k plus miles?

I'm very lucky.

After paying down a lot of debt leading up to this, refinancing the last of the 14k CC debt under a single digit interest rate CC and refinancing a car loan I'm spending about $450 a less a month in bills towards credit.

I have 3 CCs now. Two at zero.

A shared secured loan for 5 yrs paid down to less than 8 percent.

An auto loan.

I have a good credit profile, in two years that is, when all the hard pulls age off and the accounts age too.

A lot of cool tricks to lead up to this and I really wanna stress one more time,

I am super grateful for all the information here to allow me to tackle this so efficently! Thanks again guys

:-)