- myFICO® Forums

- Types of Credit

- Credit Cards

- American Express "Partially Approved" Language—Pro...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

American Express "Partially Approved" Language—Provide More Info for More Credit?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

American Express "Partially Approved" Language—Provide More Info for More Credit?

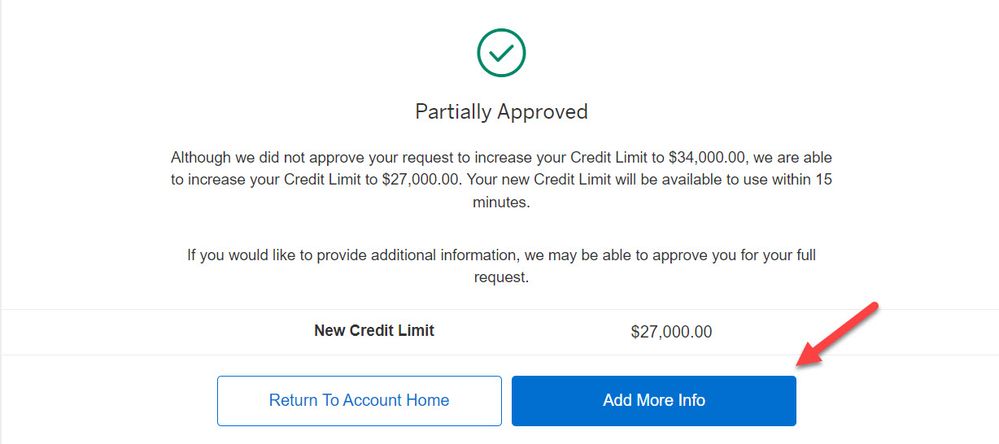

This question is purely for educational purposes, as I didn't click through when presented with the option to provide more information; however, I breached the 180 day point with American Express and thought I would take one more stab at a final CLI...have a few cards from them, all at what I thought was max exposure ($24/$25K) without income verification, bank statements, tax returns, copies of my library cards, etc, etc... ![]()

...but seems like many can get them to $35K without triggering any financial reviews and hoops through which people have to jump to get not-needed CLIs, so I fired away asking for $10K to bring me to $34K:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express "Partially Approved" Language—Provide More Info for More Credit?

@Fletcher2 wrote:This question is purely for educational purposes, as I didn't click through when presented with the option to provide more information; however, I breached the 180 day point with American Express and thought I would take one more stab at a final CLI...have a few cards from them, all at what I thought was max exposure ($24/$25K) without income verification, bank statements, tax returns, copies of my library cards, etc, etc...

...but seems like many can get them to $35K without triggering any financial reviews and hoops through which people have to jump to get not-needed CLIs, so I fired away asking for $10K to bring me to $34K:

Any ideas what information they seek when clicking the "Add More Info" button? It wasn't worth a temp flag on my daily driver waiting to substantiate all my claims/provide supporting documents/whatever else is involved with these comprehensive reviews, so I didn't click it...but now it's consuming me and wondering what would have happened next and for what they would have asked.Also, was I correct in assuming $35K(ish) is the threshold before there's a high likelihood of triggering scrutiny? While I don't fear it, being able to submit any and all supporting documents that may be needed, I don't really want to jump through hoops to get a CLI I don't need (only padding the credit to hedge on UTL figure at this point)...so passed on the opportunity to "add more info."More info will be three months of checking account statements. Many of us don't want that level of intrusiveness and just roll with what's offered.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express "Partially Approved" Language—Provide More Info for More Credit?

DW was prompted for docs at $40k, we backed down to $35k.

No issues since.

DON'T WORK FOR CREDIT CARDS ... MAKE CREDIT CARDS WORK FOR YOU!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express "Partially Approved" Language—Provide More Info for More Credit?

@reluctantgarden wrote:More info will be three months of checking account statements. Many of us don't want that level of intrusiveness and just roll with what's offered.

Indeed...received the email shortly thereafter:

Here’s what we need

If you haven’t already, please provide the three most recent bank statements from your primary personal bank account(s).

I wonder if this triggers with every subsequent CLI request every 180+ days? A sign our relationship has fully matured and we're no longer in the honeymoon phase, so best to give the CLIs a rest? ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express "Partially Approved" Language—Provide More Info for More Credit?

I just attempted to get a sp cli. I'm at 40k. For what it's worth, I too was asked for the 3 months bank statements, or grant a one time access. I agreed to one time permission. That took me to another page, stating they have access until I revoke it. While I originally gave them the access, I immediately logged into my primary bank and revoked it. That's too intrusive and, far exceeds one time access. I just thought I'd throw that out to you should you consider giving them your account log ins.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express "Partially Approved" Language—Provide More Info for More Credit?

While I don't understand the need for $10s of thousands of CL, I also don't understand the fear of providing 3 month's worth of statements for it either. I guess I just don't understand. :gotme:

;

;Everyday 3% CB:

;

;Everyday 5%:

;

;Companion Card:

;

;Everyday 2.2% CB:

;

;Retired to sock drawer after AOD (kept alive w/ 1 purchase every 6 mo):

;

;On my radar:

;

;Still Waiting for an Invite:

;

;No hope:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express "Partially Approved" Language—Provide More Info for More Credit?

@ptatohed wrote:While I don't understand the need for $10s of thousands of CL, I also don't understand the fear of providing 3 month's worth of statements for it either. I guess I just don't understand. :gotme:

I feel like, the bank/tax documents request are about flagging you for extra services to sell you, they don't need full tax returns for 1-2 years to verify your income and I don't feel they need to see my cash flow across accounts either. Particularly for those of us with multiple checking and savings accounts I highly doubt they have a forensic accountant tracking where our money is going, they just want to see if we would have the kind of cash laying around to make it worth their time to get us signed up for their money market account etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express "Partially Approved" Language—Provide More Info for More Credit?

@ptatohed wrote:While I don't understand the need for $10s of thousands of CL, I also don't understand the fear of providing 3 month's worth of statements for it either. I guess I just don't understand. :gotme:

Thanks for sharing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express "Partially Approved" Language—Provide More Info for More Credit?

@Fletcher2 wrote:

@reluctantgarden wrote:More info will be three months of checking account statements. Many of us don't want that level of intrusiveness and just roll with what's offered.

Indeed...received the email shortly thereafter:

Here’s what we need

If you haven’t already, please provide the three most recent bank statements from your primary personal bank account(s).

I wonder if this triggers with every subsequent CLI request every 180+ days? A sign our relationship has fully matured and we're no longer in the honeymoon phase, so best to give the CLIs a rest?

it's bascially a scoring system that takes everything into account, report, file, spend, history, current lines with amex, amex underwriting, how much you're requesting at once (amex is more agreeable to smaller CLIs if your history with them and file, income, spend, isn't strong enough for larger CLIs). It wouldn't surprise me if smaller CLIs granted you more points in the CLI determination scoring system.

too few points = auto reject

not enough points, but close = bank statements for partial/full approval

not enough points but somewhat closer = partial approval, denial for rest

not enough points, but closer = partial approvaal + bank statements for further approval

enough points = full approval

there's no 'magic limit' that will automatically trigger it, it's all based on your report and your spend and your history with amex. Typically most normal people with normal people income start seeing it around $25-$35k though

at some point you might reach the unsecured limit/income limit and the only way to know is to ask for small $5k CLIs every 6 months

3/6, 5/12, 14/24

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: American Express "Partially Approved" Language—Provide More Info for More Credit?

@GZG wrote:

@Fletcher2 wrote:

@reluctantgarden wrote:More info will be three months of checking account statements. Many of us don't want that level of intrusiveness and just roll with what's offered.

Indeed...received the email shortly thereafter:

Here’s what we need

If you haven’t already, please provide the three most recent bank statements from your primary personal bank account(s).

I wonder if this triggers with every subsequent CLI request every 180+ days? A sign our relationship has fully matured and we're no longer in the honeymoon phase, so best to give the CLIs a rest?

it's bascially a scoring system that takes everything into account, report, file, spend, history, current lines with amex, amex underwriting, how much you're requesting at once (amex is more agreeable to smaller CLIs if your history with them and file, income, spend, isn't strong enough for larger CLIs). It wouldn't surprise me if smaller CLIs granted you more points in the CLI determination scoring system.

too few points = auto reject

not enough points, but close = bank statements for partial/full approval

not enough points but somewhat closer = partial approval, denial for rest

not enough points, but closer = partial approvaal + bank statements for further approval

enough points = full approval

there's no 'magic limit' that will automatically trigger it, it's all based on your report and your spend and your history with amex. Typically most normal people with normal people income start seeing it around $25-$35k though

at some point you might reach the unsecured limit/income limit and the only way to know is to ask for small $5k CLIs every 6 months

Sage advice. Many thanks. I like the smaller $5K asks to gauge where I am with them...just added an Alexa reminder to ask for a paltry $5K in 180 days. Good call. Thanks again!