- myFICO® Forums

- FICO Scoring and Other Credit Topics

- General Credit Topics

- Synchrony what are you doing? 7 day statement peri...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Synchrony what are you doing? 7 day statement period?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony what are you doing? 7 day statement period?

@Duriel wrote:I picked up the Venmo card and they gave me a tiny limit. Ok I guess. The card reported the next day. I put some bills on it and then it reported again a week later? Now it's "almost maxed". They sat pending longer than I'm used to as well so I couldn't even pay. Oh well that's what I get for getting another synchrony card.

Synch must hire programmers who have access to the very best substances. They're insanely unpredictable. I got the Synch PayPal cards few years back because I was attracted to the 2% CB, but I was not yet on this forum, so I didn't know any better. They have been extremely generous with my CL and granting CLIs, but I also get the totally unpredictable reporting schedule. My experience says they tend to do this when you exceed the 50% threshold, or I've been relatively low (5-15%) for a sustained period of time and then go past 30%.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony what are you doing? 7 day statement period?

@Duriel wrote:I picked up the Venmo card and they gave me a tiny limit. Ok I guess. The card reported the next day. I put some bills on it and then it reported again a week later? Now it's "almost maxed". They sat pending longer than I'm used to as well so I couldn't even pay. Oh well that's what I get for getting another synchrony card.

When I got my Sync card I was so confused. It also reported shortly after using. INQ on the 15th and approved. For my Amazon card now I know their cycle after testing for several months. Reports on the 15th or 16th and balance as of the last day of the month. I wonder if my cycle is a result of when the account was opened and twice a month. The charges also pend forever so if necessary I only used after the 1st, early enough in the month for the charges to post and payment applied by the 15th. Same thing after the 15th or 16th. Use between this time and the end of the month early enough for charges to post and payment applied by the last day of the month. If not used it in either of the those cycles there's no update.

Prior to me using in early September, the last time I used the card was July and until the 9/15 update it showed last reported 7/15.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony what are you doing? 7 day statement period?

@Trudy wrote:

@Duriel wrote:I picked up the Venmo card and they gave me a tiny limit. Ok I guess. The card reported the next day. I put some bills on it and then it reported again a week later? Now it's "almost maxed". They sat pending longer than I'm used to as well so I couldn't even pay. Oh well that's what I get for getting another synchrony card.

When I got my Sync card I was so confused. It also reported shortly after using. INQ on the 15th and approved. For my Amazon card now I know their cycle after testing for several months. Reports on the 15th or 16th and balance as of the last day of the month. I wonder if my cycle is a result of when the account was opened and twice a month. The charges also pend forever so if necessary I only used after the 1st, early enough in the month for the charges to post and payment applied by the 15th. Same thing after the 15th or 16th. Use between this time and the end of the month early enough for charges to post and payment applied by the last day of the month. If not used it in either of the those cycles there's no update.

Prior to me using in early September, the last time I used the card was July and until the 9/15 update it showed last reported 7/15.

After speaking with a Synch CSR, I foound out if I paid >$300 it would post somewhat normally(2-3 days). Since I was using it a lot, I would hit multiple days(business days only) with $299, 98, 97(easier to track payments)....until balance gone. Over a few months, Synch decided I was somewhat reliable, so I could hit up to $500/day. Today, I am officially "impotent"(sic) and can pay the entire balance and have it credited in a decent time frame. However, the reporting irregularities continue and I have found no correlation with the calendar. OTOH, Synch is almost Nirvana compared to the dregs of financial society at Credit One. Please, never, EVER, fall for that 5% CB scam card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony what are you doing? 7 day statement period?

Just an update. I paid on the 5th and available credit is still not updated. Also no drop on ficos other than single digits for new accounts. Vantage also decided to reverse its decision to label me as "poor credit"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony what are you doing? 7 day statement period?

I wanted to update a previous post (in this thread) in which I explained what I had been told earlier by a CSR detailing policy on Synchrony mid-cycle balance reports -- that they occur on new accounts (for up to 6 months) if balances rise above 40% of credit limit.

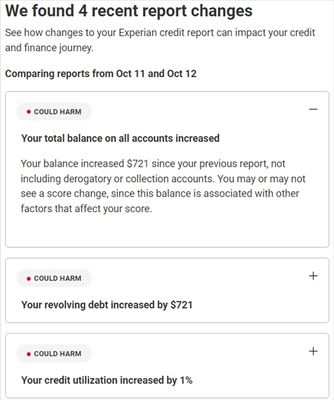

I noticed today that Synchrony did a mid-cycle balance report of a balance of $721 on my PPMC, which has a $10,000 credit limit (7.2% utilization). This was unexpected and contradicts my earlier remarks. I currently have no payment required and my three year history with Synchrony bank is clean as it is on all other accounts. The mid-cycle report was especially perplexing because the charge is in the same amount and for the same purpose as I have charged in many previous statement cycles. In the past i have frequently made exactly the same sole charge, and Sync never previously did a mid-cycle report. I speculate below that I may have run into yet another reason why Synchrony does mid-term balance reports to CBs.

I called Synchrony bank (several times) to try to figure out why they did this. One CSR claiming to be a supervisor explained "we did it because we can" which I did not find informative. But it was as informative an answer as I was able to get from the other 2 reps I spoke with.

Searching the possibilties as to *any* possible cause for Synchrony's reporting -- I can identify only one possible reason. I've had several significant credit line increases (with other banks) that updated credit available in the last weeks. Possibly, what I had been told earlier (Sync reports any balance over 40% in the first 6 months after opening a new account) is accurate, but there are other reasons, including perhaps detection of a significant rise in available credit (with other banks). Butressing this theory is the timing. I made the charge on October 1. The second of three credit line increases I received was reported on Oct 12, and on the same day, Sync did the mid-cycle report. Perhaps a slender reed but it's the only thing I can think of.

Incidently the mid-term update caused the number of balances reporting to increase from one to two, which knocked 10 points off my F2 mortgage score and also trimmed other Fico scores earlier than Fico8. I don't think Fico8/9 are as senstive to balance counts as the earlier series. I'll get the points back as soon as Sync reports my balance as zero after I PIF.

Finally I would mention that one of Synchrony's CSRs mentioned that if I pay off the complete balance (short term) it is possible to call them, asking for a US supervisor, and upon verification of the zero balance Synchrony will do a second mid-term balance report to zero the balance with the CBs. Of course they must have cleared the payment before this request would be approved. He seemed pretty clear that this was definite, there should be no problem, so long as I request it from a US supervisor (first line CSRs do not have the authority according to the CSR). I may try that and will update this post with the results if I do.

Update: I did decide to pay off the entire balance and have Synchrony do another mid-cycle update to $0. I pushed my payment from another bank and Synchrony credited the payment promptly. When I asked for a US supervisor I was transfered to the mother ship, Synchrony Bank Credit Services. The supervisor was understanding and helpful. She noted that Synchrony will only perform this kind of secondary update if the balance on the account goes from >$0 to $0. She agreed that it was very unsual to see a mid-cycle report.

I ran a few of my more paranoid concerns past her, such as the possibility that Synchrony may do this to attempt to see if a cascade of AA occurs with other banks (which could happen in a situations similar those reported by others in this thread, where a low-limit card is nearly maxed out and Sync reports the balance immediately) as a test of potential weakness in the customer's credit profile, and she seemed sincere in her reply that Synchronyy would not engage in intentionally credit damaging methods of monitoring customers. I hope that is the case. The update may require 2 biz days to take reflect on credit reports, according the sup. Hasn't happened yet but I assume it will.

figure from Experian credit monitoring service:

F8 EX 767 EQ 770, TU 773, F8 BC EX 784, EQ BC 789, F9 EX 777

TCL: $124,200, reporting available: $120,995

cc utilization: 3%, auto loan: $5,456/$6850

AoOA 5Y 9M, AAoA 3Y 3M, AoYA 7M

new cc accounts 3/24, 2/12, 0/6, 0/3, INQs 12 months EX 2, EQ 1, TU 1

Personal Cards (15)

Chase/Amazon Prime Visa, Freedom Unlimited, Bank of America CCR, American Express BCP+CM, GS Apple Card (MC)

PenFed PC Rewards, Citibank DoubleCash, Discover IT + BT, Regions Cash Rewards, Wells Fargo AC, CapOne QS, Synchrony PPMC +

Closed (1): Synchony Amazon Prime

Business Cards (1)

American Express BBC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony what are you doing? 7 day statement period?

Ugh it just confuses me so much. I paid on the 5th and the available balance still hasn't updated. Do their robots/people see what's on the credit report? I'm pretty sure I'm not payment hold level risk on a $500 credit limit 🤷🏼♂️. There's got to be a mass closure coming for me. Why else would they act so oddly?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Synchrony what are you doing? 7 day statement period?

@Duriel wrote:Ugh it just confuses me so much. I paid on the 5th and the available balance still hasn't updated. Do their robots/people see what's on the credit report? I'm pretty sure I'm not payment hold level risk on a $500 credit limit 🤷🏼♂️. There's got to be a mass closure coming for me. Why else would they act so oddly?

I have noticed Sychrony is slower both crediting payment and restoring credit lines after payment ...compared to most accounts I have, but I haven't personally noticed it being quite that slow. It's a common complaint about Synchrony, as are complaints about very long hold times of largish payments from newish customers, which may correspond to what you are calling 'payment hold risk' But I would guess it's more likely just general Synchrony payment processing horsehockey than a prelude to closing your account. The low limit implies that the system reviewed your app and decided it doesn't trust you completely yet, but it approved you, and quite recently. You haven't done anything wrong, so being treated this way probably just reflects a certain level of probation, which will probably wear off (hopefully quickly). I think the first 6 months they don't trust anyone 'any further than they can throw em.'

It is Synchrony, so expect the unexpected -- But I'm pulling for you, and think you'll probably be OK.

Note: I usually 'push' payments using billpay from another bank. If they continue to be very slow processing payments made through their 'make a payment' system, you might try pushing your payments. That approach might avoid some of the slowness that seems associated with 'make a payment' at Synchrony's site.

F8 EX 767 EQ 770, TU 773, F8 BC EX 784, EQ BC 789, F9 EX 777

TCL: $124,200, reporting available: $120,995

cc utilization: 3%, auto loan: $5,456/$6850

AoOA 5Y 9M, AAoA 3Y 3M, AoYA 7M

new cc accounts 3/24, 2/12, 0/6, 0/3, INQs 12 months EX 2, EQ 1, TU 1

Personal Cards (15)

Chase/Amazon Prime Visa, Freedom Unlimited, Bank of America CCR, American Express BCP+CM, GS Apple Card (MC)

PenFed PC Rewards, Citibank DoubleCash, Discover IT + BT, Regions Cash Rewards, Wells Fargo AC, CapOne QS, Synchrony PPMC +

Closed (1): Synchony Amazon Prime

Business Cards (1)

American Express BBC