- myFICO® Forums

- Types of Credit

- Credit Card Applications

- How strict are Kroger cards underwriting?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

How strict are Kroger cards underwriting?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How strict are Kroger cards underwriting?

@CreditCobra wrote:There's a bunch of these, pretty sure I have them all listed below.

- Dillons Rewards World Elite Mastercard

- Fred Meyer Rewards World Elite Mastercard

- Fry's Rewards World Elite Mastercard

- Harris Teeter Rewards World Elite Mastercard

- King Soopers Rewards World Elite Mastercard

- Kroger Rewards World Elite Mastercard

- Mariano's Rewards World Elite Mastercard

- Pick 'n Save/Metro Market Rewards World Elite Mastercard

- QFC Rewards World Elite Mastercard

- Ralphs Rewards World Elite Mastercard

- Smith's Rewards World Elite Mastercard

All offer 5% on digital wallet (Apple Pay, Samsung Pay, Google Pay, Garmin Pay and LG Pay) purchases, capped at $3,000 spend per calendar year, then 1% cash back. 2% cash back in Kroger stores, and 1% on everything else.

After that they have some minor changes in benefits regarding fuel, but a better option for gas might be the Abound Visa Platinum Credit Card. For groceries only, you might be better off with the AAA Daily Advantage Visa Signature Credit Card if you're not geo-restricted.

Harris Teeter, Mariano's, Pick 'n Save/Metro Market, and Ralphs are currently offering SUBs. Earn $100 in Statement Credits when you apply, get approved and spend $500 on eligible purchases the first 90 days.

I see the main benefit to these cards for digital wallet spends that don't fall into any other category that you might already have covered, so long as that doesn't exceed $3,000 in a calendar year. As I posted previously, I have about $2,600 in insurance I can pay through Apple Pay, so this is a good fit for me. YMMV.

When I applied for my Ralphs card, I was 0/6, 2/12, and LOL/24 for new accounts. They pulled TransUnion and I was at 796 with 1/6, 2/12, and 8/24 on inquiries. Hope this helps.

It's likely a bit of a niche card, for many of us, but might be useful for some. I have no clue if you can acquire more than one of these cards, and would love to know the answer to that.

This is great data thank you very much. Right now I'm at 6/6, 10/12, 10/24. I doubt very very much I would get approved but I almost want to do it for *science!* I have 3 inquiries on EQ & they're all from US Bank/Elan.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How strict are Kroger cards underwriting?

So that was a no go. I'll report when the letter comes in. Only inquiry #4 in two years with one falling off next year so I'm not worried about that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How strict are Kroger cards underwriting?

Just as strict as with there other cards.

Business Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How strict are Kroger cards underwriting?

@CreditCobra wrote:There's a bunch of these, pretty sure I have them all listed below.

- Dillons Rewards World Elite Mastercard

- Fred Meyer Rewards World Elite Mastercard

- Fry's Rewards World Elite Mastercard

- Harris Teeter Rewards World Elite Mastercard

- King Soopers Rewards World Elite Mastercard

- Kroger Rewards World Elite Mastercard

- Mariano's Rewards World Elite Mastercard

- Pick 'n Save/Metro Market Rewards World Elite Mastercard

- QFC Rewards World Elite Mastercard

- Ralphs Rewards World Elite Mastercard

- Smith's Rewards World Elite Mastercard

All offer 5% on digital wallet (Apple Pay, Samsung Pay, Google Pay, Garmin Pay and LG Pay) purchases, capped at $3,000 spend per calendar year, then 1% cash back. 2% cash back in Kroger stores, and 1% on everything else.

After that they have some minor changes in benefits regarding fuel, but a better option for gas might be the Abound Visa Platinum Credit Card. For groceries only, you might be better off with the AAA Daily Advantage Visa Signature Credit Card if you're not geo-restricted.

Harris Teeter, Mariano's, Pick 'n Save/Metro Market, and Ralphs are currently offering SUBs. Earn $100 in Statement Credits when you apply, get approved and spend $500 on eligible purchases the first 90 days.

I see the main benefit to these cards for digital wallet spends that don't fall into any other category that you might already have covered, so long as that doesn't exceed $3,000 in a calendar year. As I posted previously, I have about $2,600 in insurance I can pay through Apple Pay, so this is a good fit for me. YMMV.

When I applied for my Ralphs card, I was 0/6, 2/12, and LOL/24 for new accounts. They pulled TransUnion and I was at 796 with 1/6, 2/12, and 8/24 on inquiries. Hope this helps.

It's likely a bit of a niche card, for many of us, but might be useful for some. I have no clue if you can acquire more than one of these cards, and would love to know the answer to that.

Great list. Thanks.

FICO 9 (2/17/24) EX 821 EQ 778TU 850

I practice AZEO - NEVER above 1% utilization across all cards.

Current lineup as of 9/23

American Express Gold | American Express Blue Cash Everyday 11K | American Express Blue Cash Preferred 10K I American Express Marriott Bonvoy Bevy 5K I American Express Hilton Honors Surpass 3K I Bank of America Customized Cash Rewards Visa 20K | Kinecta MyPerks Rewards MC 35K | TD Bank Double Up Visa 4K | USBank Platinum Visa 5K | BMO Harris Cash Back MasterCard 12K | Capital One SavorOne MC 3K | Capital One Walmart MC 2K | NFCU Amex 15K | NFCU CashRewards Visa 20K I Citi Best Buy Visa 10K I Macy’s Amex 4K I Bread Financial American Express 8K l AAA Daily Advantage Visa Signature 6K I Wells Fargo BILT World Elite MC 30K I BCU Cash Rewards Visa 8K I Chevron Techron Advantage Visa 2.5K I JCPenney Mastercard $6K I UCLA Wescom CU Rewards Visa 7K I

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How strict are Kroger cards underwriting?

@CreditCobra

Please see my post linked below.

https://ficoforums.myfico.com/t5/Credit-Cards/Kroger-Elite-Master-Card-Not-Coding-Properly/m-p/67056...

Business Cards:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How strict are Kroger cards underwriting?

@CreditCobra wrote:There's a bunch of these, pretty sure I have them all listed below.

All offer 5% on digital wallet (Apple Pay, Samsung Pay, Google Pay, Garmin Pay and LG Pay) purchases, capped at $3,000 spend per calendar year, then 1% cash back. 2% cash back in Kroger stores, and 1% on everything else.

After that they have some minor changes in benefits regarding fuel, but a better option for gas might be the Abound Visa Platinum Credit Card. For groceries only, you might be better off with the AAA Daily Advantage Visa Signature Credit Card if you're not geo-restricted.

Harris Teeter, Mariano's, Pick 'n Save/Metro Market, and Ralphs are currently offering SUBs. Earn $100 in Statement Credits when you apply, get approved and spend $500 on eligible purchases the first 90 days.

I see the main benefit to these cards for digital wallet spends that don't fall into any other category that you might already have covered, so long as that doesn't exceed $3,000 in a calendar year. As I posted previously, I have about $2,600 in insurance I can pay through Apple Pay, so this is a good fit for me. YMMV.

Thanks for pointing those out, I may need to look into some of those.

I can use Samsung Pay everywhere with a CC strip reader, even if they don't have tap to pay, and can't normally take digital wallet payments.

Current FICO8:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How strict are Kroger cards underwriting?

@markbeiser wrote:

@CreditCobra wrote:There's a bunch of these, pretty sure I have them all listed below.

All offer 5% on digital wallet (Apple Pay, Samsung Pay, Google Pay, Garmin Pay and LG Pay) purchases, capped at $3,000 spend per calendar year, then 1% cash back. 2% cash back in Kroger stores, and 1% on everything else.

After that they have some minor changes in benefits regarding fuel, but a better option for gas might be the Abound Visa Platinum Credit Card. For groceries only, you might be better off with the AAA Daily Advantage Visa Signature Credit Card if you're not geo-restricted.

Harris Teeter, Mariano's, Pick 'n Save/Metro Market, and Ralphs are currently offering SUBs. Earn $100 in Statement Credits when you apply, get approved and spend $500 on eligible purchases the first 90 days.

I see the main benefit to these cards for digital wallet spends that don't fall into any other category that you might already have covered, so long as that doesn't exceed $3,000 in a calendar year. As I posted previously, I have about $2,600 in insurance I can pay through Apple Pay, so this is a good fit for me. YMMV.

Thanks for pointing those out, I may need to look into some of those.

I can use Samsung Pay everywhere with a CC strip reader, even if they don't have tap to pay, and can't normally take digital wallet payments.

@CreditCobra I would avoid the abound card unless you really want to bank with them.

They don't allow you to pay from an external account, you can't transfer money into their checking/savings directly you have to push it from the originating bank, offer no cli ever, to get a new limit you have to re-apply for the card, you have to fund the original account via check or get a Ploc in addition to the credit card.

All of these things are are minor annoyances, and have a solution and they have some nice features like free lifelock, and no fee BT (but not 0apr) but the question becomes why?

Redstone has a great 5% gas/dinning card with a ton of 3% categories and 1.5% base

AAA has a great 5% gas 3 groceries

custom cash could be 5% gas

penfed and sam's have 4ish percent gas and there are others.

I know every card and issuer has a customer that loves them and it works out great for them, but my experience with abound is firmly in the I regret ever applying for Fort Knox (abound) FCU.

I wasn't aware all the Kroger cards get 5% on mobile wallet now I have to decide if I want to go ham on a bunch of 3k/yr cards lol

Thanks for the list, as USB cards can they be managed from within the USB app or do you have to install an app/visit a different webpage for each? I tend to do all my banking on my iPhone.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How strict are Kroger cards underwriting?

@Beefy1212 wrote:

@markbeiser wrote:

@CreditCobra wrote:There's a bunch of these, pretty sure I have them all listed below.

All offer 5% on digital wallet (Apple Pay, Samsung Pay, Google Pay, Garmin Pay and LG Pay) purchases, capped at $3,000 spend per calendar year, then 1% cash back. 2% cash back in Kroger stores, and 1% on everything else.

After that they have some minor changes in benefits regarding fuel, but a better option for gas might be the Abound Visa Platinum Credit Card. For groceries only, you might be better off with the AAA Daily Advantage Visa Signature Credit Card if you're not geo-restricted.

Harris Teeter, Mariano's, Pick 'n Save/Metro Market, and Ralphs are currently offering SUBs. Earn $100 in Statement Credits when you apply, get approved and spend $500 on eligible purchases the first 90 days.

I see the main benefit to these cards for digital wallet spends that don't fall into any other category that you might already have covered, so long as that doesn't exceed $3,000 in a calendar year. As I posted previously, I have about $2,600 in insurance I can pay through Apple Pay, so this is a good fit for me. YMMV.

Thanks for pointing those out, I may need to look into some of those.

I can use Samsung Pay everywhere with a CC strip reader, even if they don't have tap to pay, and can't normally take digital wallet payments.@CreditCobra I would avoid the abound card unless you really want to bank with them.

They don't allow you to pay from an external account, you can't transfer money into their checking/savings directly you have to push it from the originating bank, offer no cli ever, to get a new limit you have to re-apply for the card, you have to fund the original account via check or get a Ploc in addition to the credit card.

All of these things are are minor annoyances, and have a solution and they have some nice features like free lifelock, and no fee BT (but not 0apr) but the question becomes why?

Redstone has a great 5% gas/dinning card with a ton of 3% categories and 1.5% base

AAA has a great 5% gas 3 groceries

custom cash could be 5% gas

penfed and sam's have 4ish percent gas and there are others.

I know every card and issuer has a customer that loves them and it works out great for them, but my experience with abound is firmly in the I regret ever applying for Fort Knox (abound) FCU.

I wasn't aware all the Kroger cards get 5% on mobile wallet now I have to decide if I want to go ham on a bunch of 3k/yr cards lol

Thanks for the list, as USB cards can they be managed from within the USB app or do you have to install an app/visit a different webpage for each? I tend to do all my banking on my iPhone.

I havce the Abound card, and it's my main gas card. I typically buy all my gas at Costco, and it works perfectly there, I can pay this card using an external account, so I'm not sure what roadblock you're running into. The limit is a little low, but I typically pay it off every week orr two so it's never been a problem.

The Redstone card does look good, but alas I couldn't get accepted to their credit union, despite several video calls. AAA Daily Cash will become my main groceries card if/when US Alliance ends their 6% cash back on groceries, likely at the end of the year.

I use my Custom Cash exclusively for eating out.

The Kroger card for 5% cash back on digital wallet spend has been perfect for me so far. I'm mostly using it to pay for insurance (via the State Farm mobile app and using Apple Pay).

Stats (updated: 4/21/2024):

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How strict are Kroger cards underwriting?

@CreditCobra

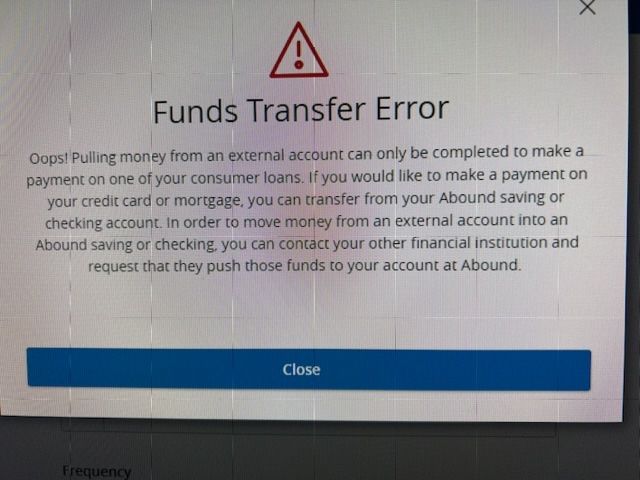

This is the error I get when attempting to pay a credit card bill, it specifically says you can't pay a credit card from an external account. You also can't pull money into your abound accounts but have to push it to the savings/checking account from an external source.

It isn't the end of the world, they just pissed me off with all the non-sense they gave me setting up the account. I have never dealt with a bank or credit union more determined to not get my money.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: How strict are Kroger cards underwriting?

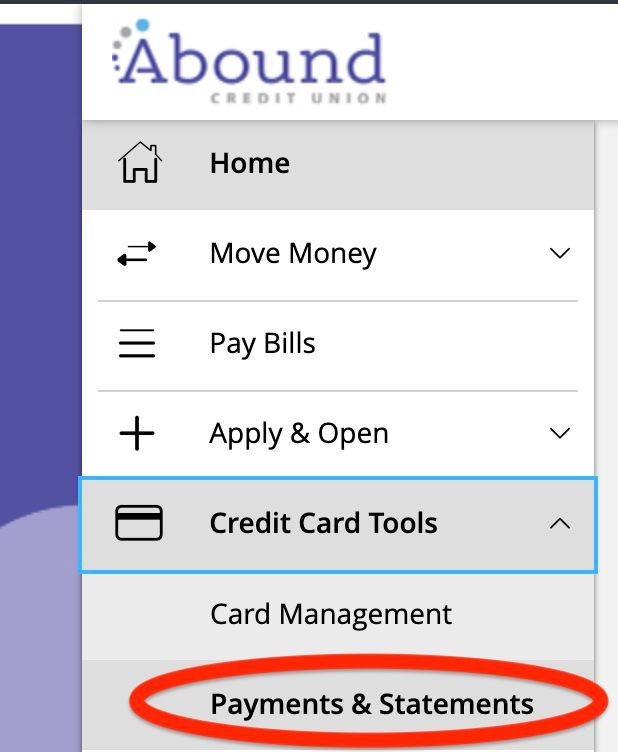

I think you might be trying to make a transfer from the wrong place. Under Credit Card Tools, Payments & Statements.

Stats (updated: 4/21/2024):