- myFICO® Forums

- Types of Credit

- Credit Cards

- Adding the minor child as AU ...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Adding the minor child as AU ...

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adding the minor child as AU ...

I just added my daughter on my Discover More over the phone. The rep asked her Name ONLY, and verified my mailing address. The rep did not ask her SSN nor design of a card. They sent me a basic design one, which is fine with me because I am keeping it. I am not going to give a card to her to take a chance to get screw up my CR by her.

Q1. How can they tell that she is minimum qualified age or not?

Q2. If they can’t tell the age, may be ask to add my son (14) also … what do you think?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just curious thought on adding AU

@Anonymous wrote:I just added my daughter on my Discover More over the phone. The rep asked her Name ONLY, and verified my mailing address. The rep did not ask her SSN nor design of a card. They sent me a basic design one, which is fine with me because I am keeping it. I am not going to give a card to her to take a chance to get screw up my CR by her.

Q1. How can they tell that she is minimum qualified age or not?

Q2. If they can’t tell the age, may be ask to add my son (14) also … what do you think?

What is minimum qualified age?

I don't think there is any legal age for AU, although Creditors may have their own policy on this.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just curious thought on adding AU

If you add him before he is 18, when he turns 18 he will already have an established credit history and score without waiting the generally 6 months after obtaining first card to get a fico score... This will help him a ton when looking for his first card. I had a card under my parents since I was 16 and when I turned 18 the first card I got on my birthday was Citi and they gave me 5k!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just curious thought on adding AU

I was added to my moms Discover via the website. Was added on my cr 5 days later.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding the minor child as AU ...

Thanks everyone! Ok, I am more confident to add him to mine now.

Question:

a) Is it better to add him on to other than Discover More? or it doesn't matter?

b) Is it better to add him on to high CL cc? or older age cc?

c) He have joint saving accts with each parents with NFCU. Is it possible that they may say "No" because they knows my son's age?

d) Is it better with multiple ccs?

e) If you are going to add your child or if your parents is going to add you, which card do you choose?

My ccs in order of most often use:

1. Chase Freedom VISA 08/05' ~ 8.6 k

2. Chase Freedom World MC 09/06' ~ 9.0 k

*Report Highest of $5232.

3. Citi Driver's Edge MC 01/08' ~ 8.6 k

4. Discover More 01/08' ~ 2.5 k

*09/10' add my daughter as AU

5. Amex Blue 12/05' ~ 8.0 k

*use once a month with small purchase

6. Chase MC (Wa-Mu Platinum) 02/09' ~ 6.0 k

*use every 4~6 months with small purchase

7. NFCU nRewards 10/99' ~ 5.0 k

*use every 4~6 months with small purchase

8. NFCU cashRewards 05/09' ~ 3.0 k

*use every 4~6 months with small purchase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just curious thought on adding AU

I would want to be on the oldest account that has one of the lowest balances :-)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding the minor child as AU ...

My ccs in order of most often use:

1. Chase Freedom VISA 08/05' ~ 8.6 k

2. Chase Freedom World MC 09/06' ~ 9.0 k

*Report Highest of $5232.

3. Citi Driver's Edge MC 01/08' ~ 8.6 k

4. Discover More 01/08' ~ 2.5 k

*09/10' add my daughter as AU

5. Amex Blue 12/05' ~ 8.0 k

*use once a month with small purchase

6. Chase MC (Wa-Mu Platinum) 02/09' ~ 6.0 k

*use every 4~6 months with small purchase

7. NFCU nRewards 10/99' ~ 5.0 k

*use every 4~6 months with small purchase

8. NFCU cashRewards 05/09' ~ 3.0 k

*use every 4~6 months with small purchase

The lowest balance is $0 on the five of ccs and carry the balance on three ccs.

I just signed up for 7days Free trial on myFico Score Watch. It gave me ... WOW !! number.

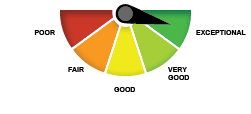

Is this will help my child if I add him on mine? I hope so ... ![]()

FICO® Score Summary

Your score is well above the average score of U.S. consumers and clearly demonstrates to lenders that you are an exceptional borrower.

What’s helping your FICO® score

Number of your accounts with a missed payment 0 accounts

Ratio of your revolving balances to your credit limits 1%

For FICO High Achievers [?], this ratio is 7%, on average

Your oldest account was opened 10 Years, 11 Months ago

Average age of your accounts 5 years

You've shown recent use of credit cards.

Inquiries You have no inquiries affecting your FICO® score.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Just curious thought on adding AU

Great scores!

Definitely add him on amex and NFCU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding the minor child as AU ...

@Anonymous wrote:Great scores!

Definitely add him on amex and NFCU

Thanks! Now I need to keep up with it. ![]()

Amex ... not sure about this ... there is thread talking negative about AU on it.

NFCU ... as long as they don't reject my request due to my child's age, yes I would love to ...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Adding the minor child as AU ...

I just added my son to my Discover More after I spoke with their rep. Same as last time when I added my daughter, he (rep) only asked my son's name and verified my last four SSN and mailing address. This will be his birthday present! ![]() This time, he (rep) let me choose the card design and I choose Tree Frog from Wildlife. *They no longer have one that I got ... Dolphin with half black. But, they added more designs. I requested them to add Pets Bird design for future option. Anyway, he get to use this card when we go out together under my supervision.

This time, he (rep) let me choose the card design and I choose Tree Frog from Wildlife. *They no longer have one that I got ... Dolphin with half black. But, they added more designs. I requested them to add Pets Bird design for future option. Anyway, he get to use this card when we go out together under my supervision. ![]()