- myFICO® Forums

- Types of Credit

- Credit Cards

- BT question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

BT question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

BT question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT question

@Jaylima91 wrote:

Other than the fact that your utilization on a BT would change. Do any of the two banks report anything to the CRAs of a "Balance Transfer" being performed on the account? Like maybe on comments section or something?

No, nothing will show on your report other than the changed balances between accounts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT question

@Jaylima91 wrote:

Ok and also, will the other bank see that it's a BT or will it just seem like a regular payment made to that account?

Does anyone know the answer to this?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT question

@Jaylima91 wrote:

@Jaylima91 wrote:

Ok and also, will the other bank see that it's a BT or will it just seem like a regular payment made to that account?Does anyone know the answer to this?

It'll look like a PIF, in regards to the balance being zeroed out, but any UW worth their weight will obviously see one go (for example) from 7k to 0k, and suddenly another card goes from 0k to the same rough amount. Especially if the card reports your brackets (balance/payment/minimum due) every month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT question

@Jaylima91 wrote:

@Jaylima91 wrote:

Ok and also, will the other bank see that it's a BT or will it just seem like a regular payment made to that account?Does anyone know the answer to this?

I did a BT last month from Barclays NFL to Cap One QS, my payment details:

PAYMENTS, CREDITS & ADJUSTMENTS FOR ACCOUNT #xxxx

1 24 APR CAPITAL ONE ONLINE PYMTAuthDate 22-APR ($50.00)

2 30 APR ELECTRONIC PAYMENT ($1,151.24)

The $50 payment was the min payment made online, in case the BT didn't credit in time. The 2nd large payment credited as "electronic payment" was the BT, they could probably dig through the details and find it originated from Barclays, but with thousands if not millions of payments each month I highly doubt they would bother.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BT question

@DaveInAZ wrote:

@Jaylima91 wrote:

@Jaylima91 wrote:

Ok and also, will the other bank see that it's a BT or will it just seem like a regular payment made to that account?Does anyone know the answer to this?

I did a BT last month from Barclays NFL to Cap One QS, my payment details:

PAYMENTS, CREDITS & ADJUSTMENTS FOR ACCOUNT #xxxx

1 24 APR CAPITAL ONE ONLINE PYMTAuthDate 22-APR ($50.00)

2 30 APR ELECTRONIC PAYMENT ($1,151.24)

The $50 payment was the min payment made online, in case the BT didn't credit in time. The 2nd large payment credited as "electronic payment" was the BT, they could probably dig through the details and find it originated from Barclays, but with thousands if not millions of payments each month I highly doubt they would bother.

Well, this is on the CC bank where the BT is leaving. That will report to the CRA as 1,251.24, if it reports a payment at all. The balance end of one month drops by that amount (presuming no other charges) to what the ending balance is after the BT.

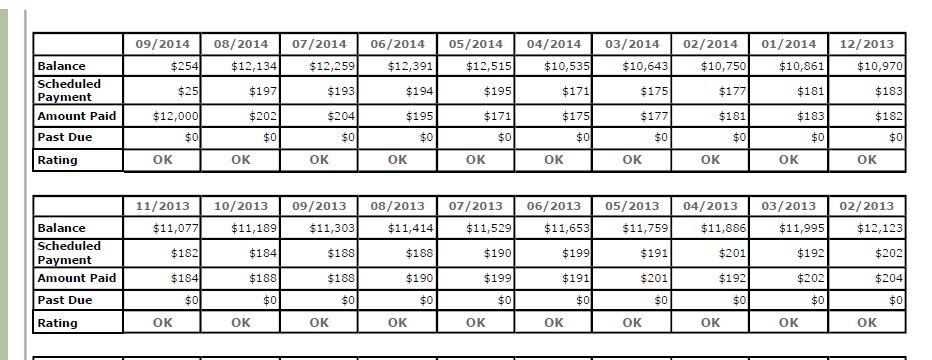

This is a BT I made off of my BofA AMEX to US Bank in August, to take advantage of a 0% US Bank offer: Amount Paid shows as the $12k, and would add the payment if I had made one.

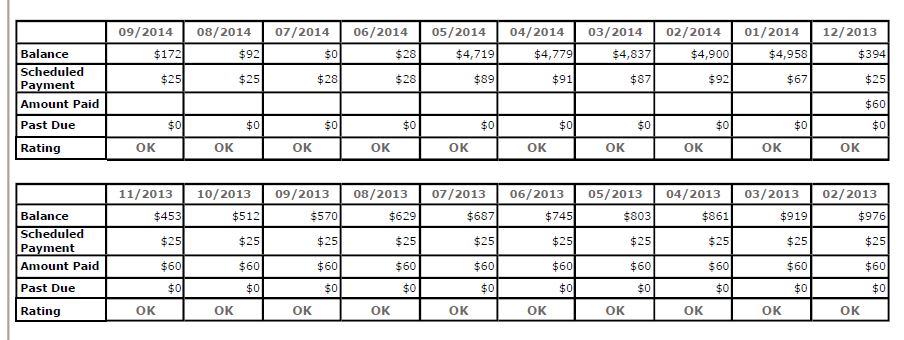

This is a BT off of Capital One that I made in May 2014, moving a balance from CapOne to my BofA MC account for another 0% BT. Note that CapOne shows no payment at all, even comparing to the monthly payments I was making on the carried balance for several months prior.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765