- myFICO® Forums

- Types of Credit

- Credit Cards

- Chase Interest question

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Interest question

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase Interest question

I did a balance transfer on my freedom 2 months ago and have been payin it down. I didn't use the card after the balance transfer the first month. But this month I used it for a few small charges (about $250) and made a payment of over $1100 on the card towards the balance that I owe.

My statement just cut and I see an interest charge of roughly $2. I thought, as long as you pay more than you charge that month, you're not subject to interests?

I would like someone to please explain to me in a clear simple language how this works. I could have paid cash or used one of my other cards for the charges if I knew I would be paying interest on it.

(1 Car Loan @2.74%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Interest question

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Interest question

Amount?

(1 Car Loan @2.74%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Interest question

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Interest question

I know this because I ran into the same issue with a BT on my Freedom. In my case, multiple reps told me no interest would be charged on purchases if I pay them by due date (just like you thought as well). When that didn't happen, a supervisor reviewed the tapes, credited the interest charges due to their error in explanation, and explained this Blueprint feature. I then used the feature with no issues for months.

Let me know if you have any questions!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Interest question

^This.

I have a long term BT on my Slate card, was nosing around the Blueprint option, and set that up to go along with my auto payment of the minimum payment. Did some small charges, let the calculated Blueprint payment autopsy, and no interest cost.

You can set up the Minimum Payment along with Full Pay to catch the new charges automatically, then pay extra for the faster rate you want to pay down the BT, or set up a Finish It component to your Blueprint trifecta to just let the autopay handle everything for you.

And in my experience, B of A is also possible to get in front of new charges, by paying them soon after they post, to avoid interest cost when carrying a BT.

US Bank, however, charges their minimum $2 interest, and that kept triggering a new $2 minimum until I called to get it shut off.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Interest question

@Anonymous wrote:

With your Freedom, you can activate the Blueprint Full Pay feature. If you do this, charges you make (purchases) in the ACTIVATED Blueprint categories you choose will not accrue interest any interest if you pay them in full by the due date on the first statement they appear on even if you are carrying a balance (purchase, transfer, or otherwise). You will have a new "Blueprint Payment Due" amount every statement that includes your total Blueprint Full Pay charges and your minimum payment due for the rest of your account balance. Paying the Blueprint Payment Due will satisfy your minimum payment requirement.

I know this because I ran into the same issue with a BT on my Freedom. In my case, multiple reps told me no interest would be charged on purchases if I pay them by due date (just like you thought as well). When that didn't happen, a supervisor reviewed the tapes, credited the interest charges due to their error in explanation, and explained this Blueprint feature. I then used the feature with no issues for months.

Let me know if you have any questions!

How do I activate this blue print feature? Although, I will probably put this card away until the card is paid in full by next March(could be earlier). However this feature would be nice to have activated to avoid payin $2 interest next time

(1 Car Loan @2.74%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Interest question

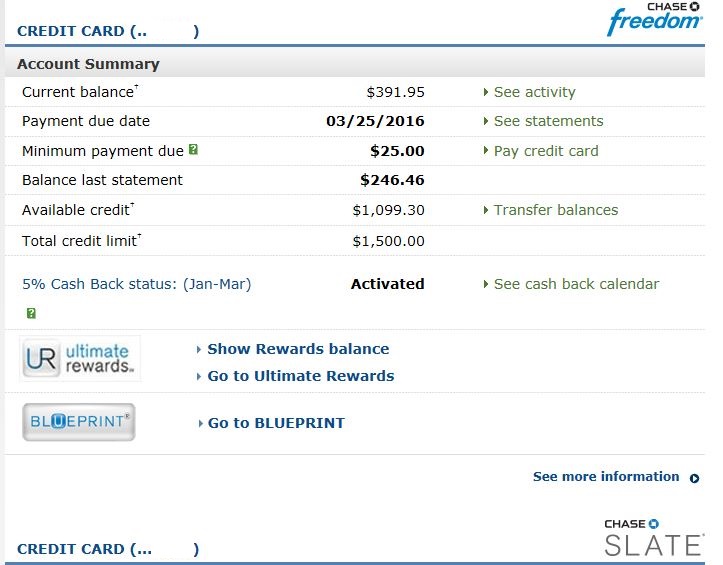

on your Chase Online account, there's a big fat "Blueprint" button associated with Freedom, Slate or CSP accounts. Click that.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content