- myFICO® Forums

- Types of Credit

- Credit Cards

- I think its finally time for me to get in with Ame...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

I think its finally time for me to get in with Amex

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think its finally time for me to get in with Amex

@zyzzus wrote:anyone got answers to the backdating question?

You might be able to, although I don't know if you can get the MSD updated if your card is issued before your AU status posts. Depends on how quickly Amex's systems update and how closely they're linked.

01/10/2016 698/711/730 but still to and fro a bit

Climbing to 700 and beyond. It's too cold for gardening.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think its finally time for me to get in with Amex

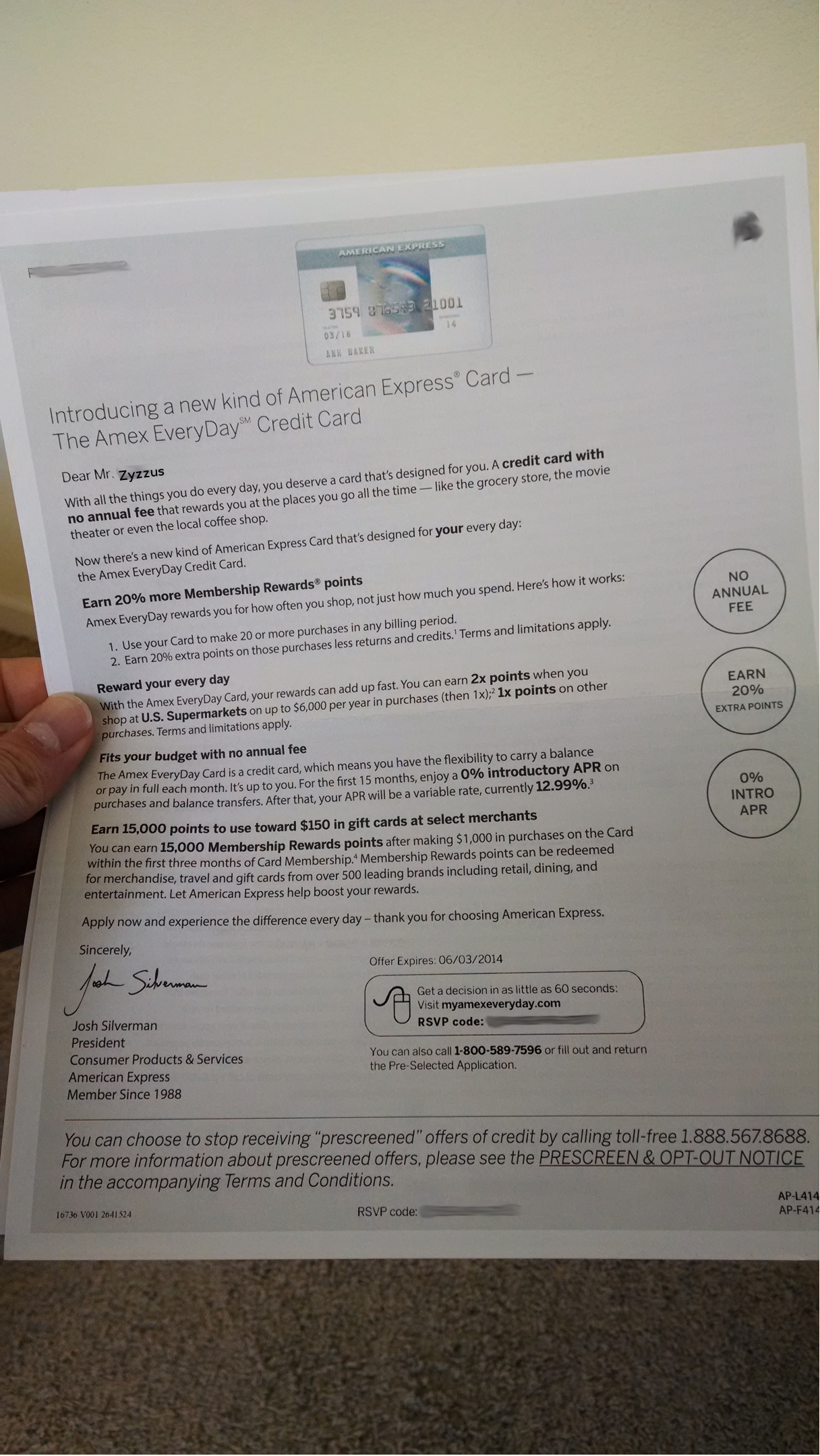

I received this same offer last week. Haven't decided if I want it yet or not. But way cool!

Gardening Since 4/3/2017

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think its finally time for me to get in with Amex

Nice offer! To answer your question about backdating, if your mom is only now just adding you as an AU, your MSD would be 4/2014 anyway. AUs do not backdate to the primary cardholder's MSD. So you wouldn't really gain anything by waiting to become her AU and have it post to your reports. You might as well just go for this offer if this is the card you desire from Amex. Good luck! ![]()

My Wallet: Amex Gold NPSL; Amex Optima Platinum $25K; Amex BCE $12K; Apple Card $20K; BofA Travel Rewards Visa Sig $67.6K; Cap1 Quicksilver Visa Sig $10K; CSP $28.2K; Chase Freedom $13K; Chase Freedom Unlimited $21.4K; Citi Costco Visa $19.3K; Citi Double Cash $13.5K; Citi Simplicity Visa $23.3K; Discover IT $50K; Fidelity Visa $25K; NFCU Flagship Visa Sig $40K; NFCU More Rewards Amex $30K; PenFed Plat Rewards Visa Sig $50K; Sears MC $10.1K; US Bank Altitude Go Visa Sig $20K; US Bank Cash+ Visa Sig $26K; Wells Fargo Rewards Visa Sig $14K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think its finally time for me to get in with Amex

@CribDuchess wrote:Nice offer! To answer your question about backdating, if your mom is only now just adding you as an AU, your MSD would be 4/2014 anyway. AUs do not backdate to the primary cardholder's MSD. So you wouldn't really gain anything by waiting to become her AU and have it post to your reports. You might as well just go for this offer if this is the card you desire from Amex. Good luck!

That makes sense. I have neglected to read a lot about amex to begin with because i was fairly bitter they denied me like three times before now .

thank you for the response.

I BELIEVE this card is better than BCE if i use points for travel (by better i mean better value).

I don't spend enough to warrant preferred on either card.

Thanks <3 this forum.

Capital One Quicksilver- $5,400 | Chase Freedom - $8,000 | Chase Freedom Unlimited- $13,000 | Chase Amazon -$5,000 | Priceline Visa -$10,000 | US Bank Cash+ - $18,200 | Fidelity Visa -$10,000 | Sallie Mae- $10,000 | DCU Platinum $12,000 | Discover IT - $10,000 | Amex EveryDay - $25,000 | Amex BlueCash Everyday- $9,800 | Citi DoubleCash - $18,000 | Sapphire Preferred- $13,000 | Freedom Unlimited- $7,000 | Blispay- $12,000 | Chase Sapphire Reserve- $18,000 | Consumers Credit Union Visa Sig Cash Rebate- $25,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think its finally time for me to get in with Amex

I received the samething in the mail the other day too. I just recently got an Amex Costco True Earnings and was thinking about getting that too. I haven't decided on whether to apply or not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think its finally time for me to get in with Amex

@zyzzus wrote:

@CribDuchess wrote:Nice offer! To answer your question about backdating, if your mom is only now just adding you as an AU, your MSD would be 4/2014 anyway. AUs do not backdate to the primary cardholder's MSD. So you wouldn't really gain anything by waiting to become her AU and have it post to your reports. You might as well just go for this offer if this is the card you desire from Amex. Good luck!

That makes sense. I have neglected to read a lot about amex to begin with because i was fairly bitter they denied me like three times before now .

thank you for the response.

I BELIEVE this card is better than BCE if i use points for travel (by better i mean better value).

I don't spend enough to warrant preferred on either card.

Thanks <3 this forum.

Given your other cards, it really all comes to down to how you would MR. Clearly, BCE has little to no value for you (Sallie Mae does better on the main spend, and they are each 1% on the other stuff). But the Fidelity Amex is going to be accepted whereever the Everday is, so you have to value 1.2MR (assuming you can do 20 per month) higher than 2% cash back, and 2.4MR higher than the Sallie Mae 5% etc.

But if you just want a starter Amex, I would go for the Everyday because it has the potential to have value, and the BCE just doesn't!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think its finally time for me to get in with Amex

@longtimelurker wrote:

@zyzzus wrote:

@CribDuchess wrote:Nice offer! To answer your question about backdating, if your mom is only now just adding you as an AU, your MSD would be 4/2014 anyway. AUs do not backdate to the primary cardholder's MSD. So you wouldn't really gain anything by waiting to become her AU and have it post to your reports. You might as well just go for this offer if this is the card you desire from Amex. Good luck!

That makes sense. I have neglected to read a lot about amex to begin with because i was fairly bitter they denied me like three times before now .

thank you for the response.

I BELIEVE this card is better than BCE if i use points for travel (by better i mean better value).

I don't spend enough to warrant preferred on either card.

Thanks <3 this forum.

Given your other cards, it really all comes to down to how you would MR. Clearly, BCE has little to no value for you (Sallie Mae does better on the main spend, and they are each 1% on the other stuff). But the Fidelity Amex is going to be accepted whereever the Everday is, so you have to value 1.2MR (assuming you can do 20 per month) higher than 2% cash back, and 2.4MR higher than the Sallie Mae 5% etc.

But if you just want a starter Amex, I would go for the Everyday because it has the potential to have value, and the BCE just doesn't!

Yeah... I've set myself up for cashback because its really easily quantfiable for me but I'd really like to get in with Amex just to finally say I have.

I need to see how MR can be redeemed.... thanks lurker

Capital One Quicksilver- $5,400 | Chase Freedom - $8,000 | Chase Freedom Unlimited- $13,000 | Chase Amazon -$5,000 | Priceline Visa -$10,000 | US Bank Cash+ - $18,200 | Fidelity Visa -$10,000 | Sallie Mae- $10,000 | DCU Platinum $12,000 | Discover IT - $10,000 | Amex EveryDay - $25,000 | Amex BlueCash Everyday- $9,800 | Citi DoubleCash - $18,000 | Sapphire Preferred- $13,000 | Freedom Unlimited- $7,000 | Blispay- $12,000 | Chase Sapphire Reserve- $18,000 | Consumers Credit Union Visa Sig Cash Rebate- $25,000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think its finally time for me to get in with Amex

My mom got this same offer. She got approved and the cards in the mail. Yay her. lol.

In my new wallet: American Express Green EMV: PSL $2000 | BankAmericard Cash Rewards Visa EMV: $2500 | Citi AAdvantage Platinum Select World MasterCard: $6400 | Barclaycard Arrival World MasterCard: $1000 | Discover IT: $2500 | Amazon Rewards Visa Signature: $1500 | Chase Freedom: $1500 | Capital One QuicksilverOne MasterCard: $2100 | Target: $2800 | J.Crew $21,550 | Marvel (Captain America) MasterCard: $6000

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think its finally time for me to get in with Amex

@injustifiiable wrote:My mom got this same offer. She got approved and the cards in the mail. Yay her. lol.

Heh, Amex continued their lackluster tradition with me: There was an EDP offer in my mailbox, and yet it was addressed to someone else entirely. Three different offers now to two different people, neither of which me at an address I've had for 9 years.

Promotional mailings! ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: I think its finally time for me to get in with Amex

@zyzzus wrote:

My mother opened BCE last year. If I get added as AU before being approved for this I get to backdate?

I have experian on ice... I'll need to thaw correct? From the small amount of reading I've done this card trumps bce as long as I use points to travel?

I have a lot of cards reporting balances right now and just paid off an auto loan. Going to let these payments report have one card show a balance and give it one final whirl. If they deny me again I'll give up lol

Zyzzus, did you decide to apply?

Gardening Since 4/3/2017