- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- Credit score of 512 :(

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Credit score of 512 :(

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credit score of 512 :(

Hey group,

To start I understand this is my fault and mine alone, and I am extremely embarrassed by this. I am 28-years-old, an EMT, and a student. I live in a large city with extremely expensive rent, and unfortunately low income with not a ton of free time as I work full time and go to school full time (in a field that will guarantee me a better income).

After taxes and the $100 I put into my savings bi-weekly, my take home is $1400 a month before overtime, which I can get but isn't consistent.

Bills are about $1000 a month, as rent is taken care of by my spouse. She believes our debts are our own and that I should take care of them myself. Fair with me, I don't want to field comments on that as it is what we have agreed upon.

ANYWAYS:

Here are my debts. This includes currently CCs, charge-offs, and collections:

CREDIT CARDS:

Citi Double Cash: $7,621 balance with $9,000 limit. Payment is $144 a month at 0% for 5 years because it is closed

Citi AA Gold: $9,149 balance with $10,400 limit. Payment is $164 a month at 0% for 5 years because it is also closed

Capital One QS: $450 balance on $500 credit line. APR is 24%

Capital One Platinum: $589 balance on $500 credit line. APR is 25%

CHARGE-OFFS:

Verizon: $2,100 updating monthly and won't do PDF or settlement (last time I called and asked anyways)

Car loan: $500 remaining, car was voluntary repo 4 years ago when I first moved to this city and took a decrease in pay

Collections: $250 LVNV for old Capital One Card. Updates monthly. DOFD is 6/15.

I am guessing my outrageous utilization is what is killing me the most. Also had 2, 30-day lates on each Cap One card recently. I know that was stupid and will hurt my scores, but when it was between groceries and the CC payment, went with groceries.

My question is do I focus on saving or paying off debt? Would like to eventually work on raising my credit score to be able to rent a better apartment together in the future. I have about $400 extra every month. Savings is currently low, at $1,000.

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score of 512 :(

@Anonymous wrote:Hey group,

To start I understand this is my fault and mine alone, and I am extremely embarrassed by this. I am 28-years-old, an EMT, and a student. I live in a large city with extremely expensive rent, and unfortunately low income with not a ton of free time as I work full time and go to school full time (in a field that will guarantee me a better income).

Dont be embarrassed. Most of us have been right where you are. Be proud you're doing something about it

After taxes and the $100 I put into my savings bi-weekly, my take home is $1400 a month before overtime, which I can get but isn't consistent.

Bills are about $1000 a month, as rent is taken care of by my spouse. She believes our debts are our own and that I should take care of them myself. Fair with me, I don't want to field comments on that as it is what we have agreed upon.

ANYWAYS:

Here are my debts. This includes currently CCs, charge-offs, and collections:

CREDIT CARDS:

Citi Double Cash: $7,621 balance with $9,000 limit. Payment is $144 a month at 0% for 5 years because it is closed Just continue paying

Citi AA Gold: $9,149 balance with $10,400 limit. Payment is $164 a month at 0% for 5 years because it is also closed Just continue paying

Capital One QS: $450 balance on $500 credit line. APR is 24%

Capital One Platinum: $589 balance on $500 credit line. APR is 25% Over the linit, you have to bring it down, especially if it's an open account. Pay enough to drop it below the CL while taking interest into account.

CHARGE-OFFS:

Verizon: $2,100 updating monthly and won't do PDF or settlement (last time I called and asked anyways) They wont PFD.

Car loan: $500 remaining, car was voluntary repo 4 years ago when I first moved to this city and took a decrease in pay Continue making payments

Collections: $250 LVNV for old Capital One Card. Updates monthly. DOFD is 6/15. They wont PFD.

I am guessing my outrageous utilization is what is killing me the most. Also had 2, 30-day lates on each Cap One card recently. I know that was stupid and will hurt my scores, but when it was between groceries and the CC payment, went with groceries.

My question is do I focus on saving or paying off debt? Would like to eventually work on raising my credit score to be able to rent a better apartment together in the future. I have about $400 extra every month. Savings is currently low, at $1,000.

Thank you.

Hi and welcome to the forums

It's a good thing you're putting something away for savings.

Depending on how much you have already, I'd stop for a few months, till you at least pay off/pay down those small Cap One accounts. The reason for that is that you want to preserve them. If they get closed, your only options for a while would be secured cards, and you dont want to be putting money into deposits at this time.

Just continue with payments on closed accounts.

Once you salvage your Cap one cards, go back and start making payments on the accounts that are in collections and updating. Dont worry about the scores for right now. Worry about the interest and your finances first

Good luck

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score of 512 :(

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score of 512 :(

I would not use savings. OP already has lates on those accounts. If they happen to have an emergency and need money, where will it come from and what happens when their only cards get closed?

Pay down as fast as possible, yes.

Dump all the savings and be in the same place that caused financial issues, no.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score of 512 :(

I'm with Remedios, don't use your savings, keep growing that. Take any extra you have from any overtime and snowball the cards. Start with the ones that are still open and maxed out first. Don't use them if possible and just get the balances down. Once that is there tackle the car and finally the closed accounts. It will start to go faster once you get a few of these knocked out which may not take long if you can grab a little extra money from overtime or a side gig.

You may want to also take part of the snowball funds and add to savings until you can get a few months salary built up in it. That will give you a cushion and keep you out of this situation in the future.

This is a really good thread which may apply here

First Goal Score: 750+ Reached 3/2019

Next Goal all over 800

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score of 512 :(

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score of 512 :(

I second the DO NOT BE SHY/EMBARRASSED I started when I was a early 29 XD It's NEVER to late to get your life together NEVER!!! I would rid yourself of the collections when you can that will help boost your score as well but then work on a balance for the rest I have it set up so one of my cards is due the beginning of the month one in the middle and one at the end so if a hard time did ever hit I can rely on one of the later ones to help me out but don't make that your only and ultimate plan the plan is to be comfortable and only using as little as possible of your credit unless it's a die hard have to type situation. Once you lower your utilization and get the collections off you will see a LARGE jump or should at least! That is from personal experience ![]() Also plan out what cards work best for you and build on that one to help if you are ever stuck in the future too. People don't NEED more than 3 good cards so more doesn't always equal better! Good luck and keep us posted!

Also plan out what cards work best for you and build on that one to help if you are ever stuck in the future too. People don't NEED more than 3 good cards so more doesn't always equal better! Good luck and keep us posted!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score of 512 :(

I agree with @Remedios about savings though. No point going from the frying pan into the fire.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score of 512 :(

@Anonymous wrote:

Fair enough. Still learning about this each day! It's why I put the disclaimer. It seems I have more to learn.

We're all learning as we go, nothing wrong with that. It's good to have you with us.

That's what the board is for, pretty much bouncing ideas off of each other

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Credit score of 512 :(

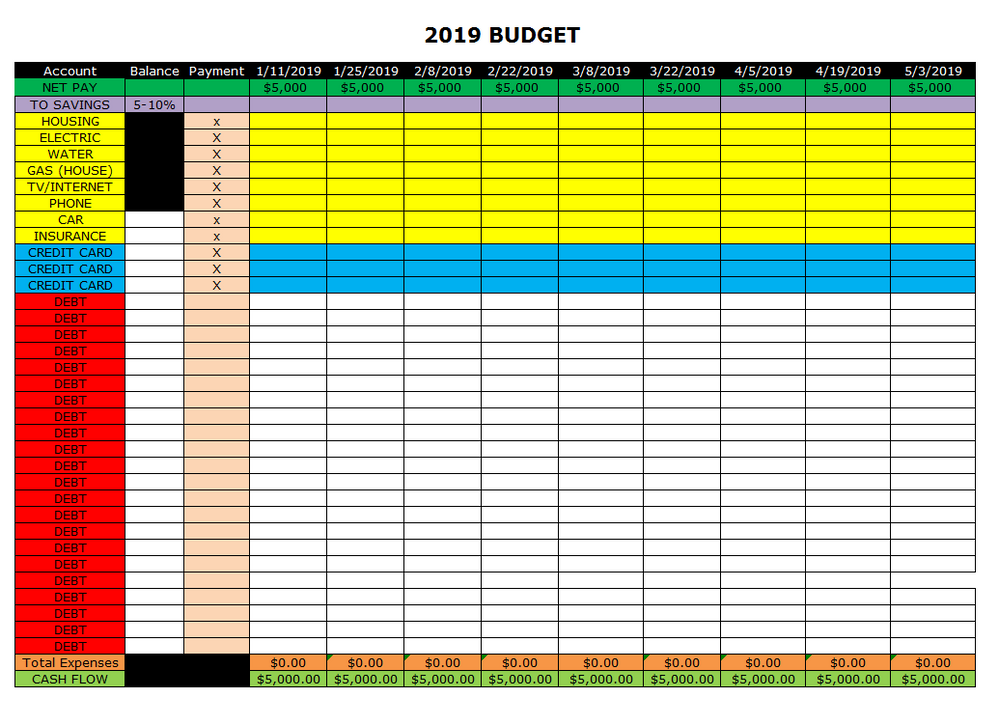

Here's the big thing, and I know I sound like a broken record because I always tell everyone this, is you MUST have a written budget where you can track all of your spending, down to the penny! Right now as you are getting on track it's important that you start to build a solid foundation that starts with sound financial discipline. Before I started to make a budget, I was always winding up with more month than money, robbing Peter to pay Paul, & never a steady cash flow. Once I wrote down ALL my expenses & what I was spending my paycheck on I was able to get a grip on my finances & start attacking my debt. I took all my monthly obligations, such as rent, utilities, car payment, phone, insurance, etc and allocated half of each amount every paycheck (every two weeks). By doing this I knew how much I actually had left over in cash flow to last me till next paycheck. This also steadied out my cash flow so I knew how much I was going to have every pay period. I found this method much easier than having a lot of cash flow one paycheck, then being broke the following when I had to pay everything.

You want to see where your money is going & identify your spending habits. From there, you'll be able to trim unnecessary spending & create cash flow, which will help you pay off your debt. You also want to continue saving part of your paycheck EVERY TIME you get paid.

Learn & understand that credit cards should not be used to buy things that you don't have the money for yet- that is how people get in debt. Use your credit cards as a convenient alternative to carrying cash with you, & pay them off every month, using the AZEO method. It will take some getting used to, but once you have your finances under control you will be amazed at how much more money you actually have!

Your budget should look something like this: