- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Late Payments

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Late Payments

Hello all. Do you think that having late payments removed from my credit would have a big impact on my mortgage score? I have two 30 days, a 60 day & a 90 day. Another question. What is the biggest thing that they are looking at with mortgage scores? All comments are welcome.

Current Credit Scores:

Current Credit Cards (In Order of Approval):

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Late Payments

My suggestion is to provide more detail about the accounts in order for members to give feedback. Useful information would include the names of creditors, type of accounts, account status (open, closed), dates of delinquency, etc.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Late Payments

@SOGGIE wrote:My suggestion is to provide more detail about the accounts in order for members to give feedback. Useful information would include the names of creditors, type of accounts, account status (open, closed), dates of delinquency, etc.

Mortgage Scores for Equifax - 593, Transunion - 592, & Experian - 654

Fico 8 Equifax - 634, Transunion - 648, Experian - 666.

Fico 9 Equifax - 714, Transunion - 678, Experian - 667

Average Age of Accounts - Equifax - 7 years 1 months, Transunion - 6 years 11 months, Experian - 4 years 8 months

Credit profile includes -

Navy Federal Credit Card $25,000 - 8% usage 0 late payments

Navy Federal Credit Card $200 - 0% usage 0 late payments

First Progress Credit Card $200 - 0% usage 0 late payments

Self Credit Card $400 - 0% usage 0 late payments

Citibank Credit Card - 0% usage 0 late payments

Navy Federal Secured Loan - $45 remaining 0 late payments

School Loan - $18,000 0 late payments

Fingerhut loan - Paid in Full, Closed. 0 late payments

Baddies -

Crescent Bank Car Loan - $12,000 Paid to date. 4 late payments from 2019

Capital One Credit Card - Charged off. Paid in full.

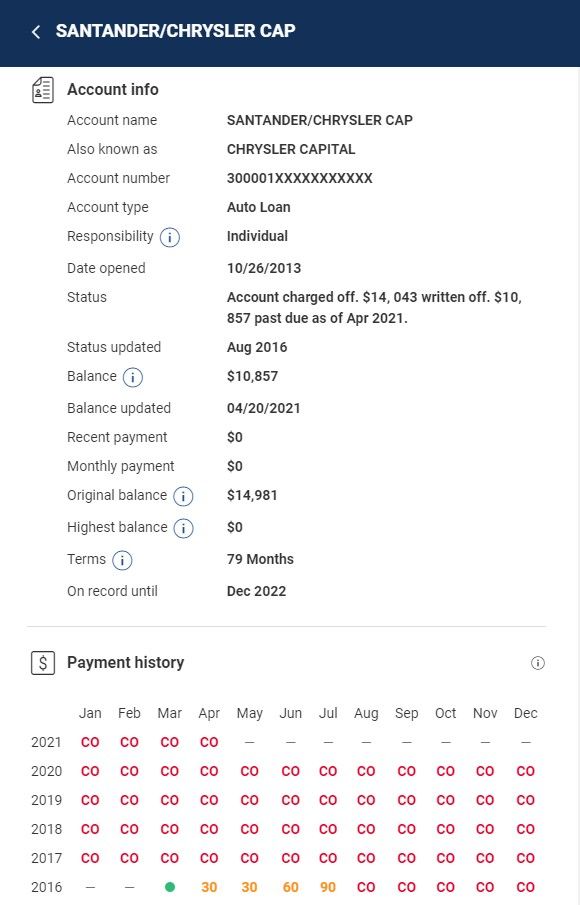

Chrsyler Capital Auto Loan - Repoed in 2014. Paying off.

Current Credit Scores:

Current Credit Cards (In Order of Approval):

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Late Payments

@Joobie wrote:Hello all. Do you think that having late payments removed from my credit would have a big impact on my mortgage score? I have two 30 days, a 60 day & a 90 day. Another question. What is the biggest thing that they are looking at with mortgage scores? All comments are welcome.

@Joobie by definition, and for every single fico version, not just the Mortgage Scores, the biggest thing they look at is payment history (includes late payments), it's 35% of the score!

So, yes, absolutely, removing them would improve every single fico version they make, probably more so than any other action you could take.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Late Payments

@Anonymous wrote:

@Joobie wrote:Hello all. Do you think that having late payments removed from my credit would have a big impact on my mortgage score? I have two 30 days, a 60 day & a 90 day. Another question. What is the biggest thing that they are looking at with mortgage scores? All comments are welcome.

@Joobie by definition, and for every single fico version, not just the Mortgage Scores, the biggest thing they look at is payment history (includes late payments), it's 35% of the score!

So, yes, absolutely, removing them would improve every single fico version they make, probably more so than any other action you could take.

Thanks for this information!!! I'm getting ready to bombard this auto loan company with goodwill emails and letters. I have no choice now.

Current Credit Scores:

Current Credit Cards (In Order of Approval):

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Late Payments

I wanted to ask, do you know when exactly that Chrysler Capital Auto Loan first went delinquent (i.e. first missed payment where you never caught up and the loan was charged off/car was subsequently repoed)? If it was repoed in 2014, then that date I'm asking about, known as the DOFD (Date of First Delinquency) should also be that same year, or even late 2013. I ask because depending on the DOFD, the account should be coming off your reports this year (7 years from DOFD).

Last App: 1/10/2023

Penfed Gold Visa Card

Currently rebuilding as of 04/11/2019.

Starting FICO 8 Scores:

Current FICO 8 scores:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Late Payments

I've been considering this also. Let us know how it turned out.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Late Payments

@OmarGB9 wrote:I wanted to ask, do you know when exactly that Chrysler Capital Auto Loan first went delinquent (i.e. first missed payment where you never caught up and the loan was charged off/car was subsequently repoed)? If it was repoed in 2014, then that date I'm asking about, known as the DOFD (Date of First Delinquency) should also be that same year, or even late 2013. I ask because depending on the DOFD, the account should be coming off your reports this year (7 years from DOFD).

This is the one Omar.

Current Credit Scores:

Current Credit Cards (In Order of Approval):

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Late Payments

@Joobie wrote:

@OmarGB9 wrote:I wanted to ask, do you know when exactly that Chrysler Capital Auto Loan first went delinquent (i.e. first missed payment where you never caught up and the loan was charged off/car was subsequently repoed)? If it was repoed in 2014, then that date I'm asking about, known as the DOFD (Date of First Delinquency) should also be that same year, or even late 2013. I ask because depending on the DOFD, the account should be coming off your reports this year (7 years from DOFD).

This is the one Omar.

What a tragedy. Life happens fast!

The earliest you can request early exclusion for that repo is 9/2022 from EX. If it is on TU and shows "estimated date of removal", you can request early exclusion 6 months prior to that date. Early Exclusion isnt really that great and often a mess with Equifax. Early exclusion removes the enitre derogatory account from your credit reports. Probably too far out if you are apping for a mortgage, though, but depends on what timeframe you are considering. If it is before the end of next year, then EE will not help because it is way too early to request it.

Lastly, if you are looking to get lates removed from this CO, you will get no points from it. CO is the worst status, so erasing the lates will do nothing for your scores. If it is a different, non-CO, account having lates removed, then it will help your scores, like the 4 x lates from 2019 on the Crescent loan, as long as it is not a CO.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Late Payments

@Anonymous wrote:

@Joobie wrote:

@OmarGB9 wrote:I wanted to ask, do you know when exactly that Chrysler Capital Auto Loan first went delinquent (i.e. first missed payment where you never caught up and the loan was charged off/car was subsequently repoed)? If it was repoed in 2014, then that date I'm asking about, known as the DOFD (Date of First Delinquency) should also be that same year, or even late 2013. I ask because depending on the DOFD, the account should be coming off your reports this year (7 years from DOFD).

This is the one Omar.

What a tragedy. Life happens fast!

The earliest you can request early exclusion for that repo is 9/2022 from EX. If it is on TU and shows "estimated date of removal", you can request early exclusion 6 months prior to that date. Early Exclusion isnt really that great and often a mess with Equifax. Early exclusion removes the enitre derogatory account from your credit reports. Probably too far out if you are apping for a mortgage, though, but depends on what timeframe you are considering. If it is before the end of next year, then EE will not help because it is way too early to request it.

Lastly, if you are looking to get lates removed from this CO, you will get no points from it. CO is the worst status, so erasing the lates will do nothing for your scores. If it is a different, non-CO, account having lates removed, then it will help your scores, like the 4 x lates from 2019 on the Crescent loan, as long as it is not a CO.

Thank you for your insight. Would getting the charge off removed completely be ideal? Also, the Goodwill quest I'm about to embark on is for my current auto loan.

Current Credit Scores:

Current Credit Cards (In Order of Approval):