- myFICO® Forums

- Bouncing Back from Credit Problems

- Rebuilding Your Credit

- FBCS (federal bond and collection service) and PFD...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

FBCS (federal bond and collection service) and PFD (pay for delete) letter

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FBCS (federal bond and collection service) and PFD (pay for delete) letter

Hello All,

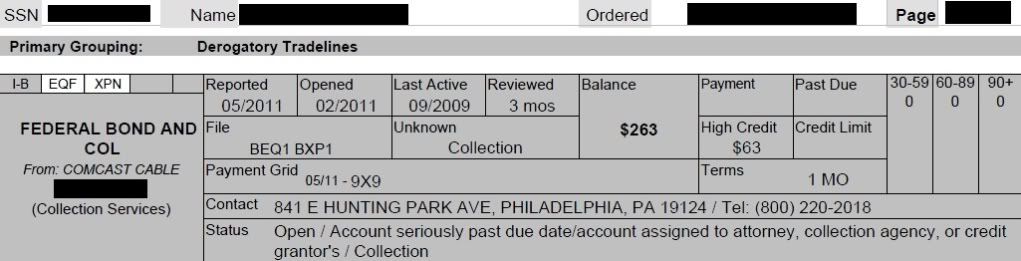

First thing I want to say is thank you to everyone for posting on this site, it has supplied me with a lot of information. I just wanted to join to give you guys my story. I've lately been trying to buy my first home. I went to get pre approved and when they ran my credit I had a collection for comcast that had been sold to a CA called Federal Bond and Collection Servces. I just sent them a certified PFD (pay for delete) letter last week and am hoping to hear something back from them soon. The dept orginally was only for $63.00 (which I'm not sure what for as it's been years since ive had comcast) but at this moment it's in collections for $263. Paying the dept isn't the issue so I have no problem paying in full if it's deleted from my credit report. I figure if they deny my PFD letter then I will request validation of the dept and the contact the credit reporting agencies. I used a PFD I found online and edited it a bit. Hopefully it works! What do you all think!

Thank you!

Zack

Federal Bond & Collection Service

841 E Hunting Park Ave

Philadelphia, PA 19124

(800) 220-2018

Re: Collection Account for Comcast Cable #: XXXXXXXXXX

Amount: $263.00

To Whom It May Concern:

This letter is to inform you that the validity of this debt is disputed. I am not sure of the account number, as I have never heard from you regarding this account. The account number I have is the one listed on my Experian credit report.

In the spirit of compromise, I am willing to pay this account IN FULL if you agree to immediate deletion of this account from any and all credit reporting agencies (Equifax, Experian and TransUnion). The purpose of this settlement is merely to have this item removed from my credit files. It is not to be construed as an acknowledgment of liability for this debt in any form.

If you agree to the terms and accept this agreement, certified funds for the settlement amount of two hundred and sixty three dollars ($263.00) will be sent to Collection Agency in exchange for full deletion of ALL references regarding this account from my credit files and full satisfaction of the debt. As certified funds will be used for payment, there shall be no waiting period regarding the deletion of this account from the credit reporting agencies.

Collection Agency agrees to delete ALL information regarding this account from the credit reporting agencies WITHIN TEN CALENDAR (10) DAYS following receipt of payment as specified above and will not discuss the terms of this settlement with anyone, excluding your client on this account. If contacted by any third party, including credit-reporting agencies, Collection Agency will not acknowledge that any settlement offer was made, accepted or executed and will, in fact, deny knowledge of any such account.

If you agree to the above terms, please prepare a letter on your company letterhead explicitly agreeing to the same terms as the above settlement offer and have it signed by an authorized representative of Collection Agency. It will be implied that this letter shall constitute a legally binding contract, enforceable under the laws of my state.

Your response must be postmarked no later than 15 days from your receipt of this settlement offer or this offer will be withdrawn and I will request full validation of this alleged debt, as provided for by the Fair Debt Collection Practices Act.

Please address all correspondence regarding this account to:

Zack

(address)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: FBCS (federal bond and collection service) and PFD (pay for delete) letter

Zack's situation almost sounds like mine. I've been reading A LOT about this company FBCS and have been trying to figure out the best way to get any debt information from them and all the tactic's I've read sounds great, but this company doesn't respond so I thought I'd post my situation and see if I could get some suggestions.

I only recently found out I had a collection reported against me on my credit report. I got a letter from Bill Me Later saying they reviewed my account and determined since I had a recent negative mark on my credit report, they were lowering my credit. They included the reporting agency and key factors adversely affecting my credit. Shocked, I got my free copies of my credit report. Low and behold Equifax reported a collection from Federal Bond and Collection reported on 2/2011 (just like Zack's) for Comcast Cable (just like Zack's) in the amount of $203 (similar amount to Zack's), it also showed the first delinquency was 11/2009. The thing is - I've NEVER had an account with Comcast cable. I've been with the same cable company who provides phone, internet and cable for me since 2005 and it's not Comcast. I don't have phone service or cell service through Comcast, never did.

After getting my credit reports from Equifax and Experian online (I had to call Transunion - for some reason I couldn't get mine online from them) and having this collection show up on both, I filed a dispute with each reporting agency. The curious thing is this $203 debt only shows that's it's gone to collections on my credit reports. It doesn't show this so called Comcast account being 30, 60, 90, or 120 days late so I'm hoping the credit agencies will realize that when investigating my dispute.

The more I read about this company, the more fishy this sounds. I am curious to know if Zack's so called Comcast account is the same as the account number listed on my credit report. The last three digist of the account number listed under the collection is xxxxxx766. I called Comcast and gave them the account listed. They said that account doesn't come up in their system. They verified I was calling from California and said all their accounts with 8155.

Does anyone have any suggestions? Should I wait to hear from the credit reporting agencies regarding my dispute? I'm eager to get this off my record; it has already affected my credit score and I'd tather not have the interest rate go up on my two credit cards because of this.

Any help would be appreciated.

Betty Rubble