- myFICO® Forums

- Types of Credit

- Auto Loans

- Auto insurance

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Auto insurance

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Auto insurance

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto insurance

If you have the money lying around, I would say to go for the lump sum payment. Saving is saving. If you don’t have the cash, though, and you want to use a CC, make sure the interest charged won’t cancel out any savings.

Amex Cash Magnet: 24.4k

Fidelity Visa: 21.5k

Apple Card: 13k

CapOne Venture X: 10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto insurance

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto insurance

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto insurance

I would not look at credit card payments as a comparison. The interest is a significant factor to consider, probably would be less than $70 if you did pay the balance in the same 6 months but based on my experience it is not a good habit to get in to put things on a credit card that you can't pay in full the same month. I would pay the extra $11.66 a month and not take a chance of adding to your credit card debt.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto insurance

Personally, I pay the lump sum from savings, divide that amount by 6 and put that amount back in to savings every month (so if upfront I took $330 from savings, I would put $55/month in savings for 6 months) That way at the end of 6 months you have replaced what you took from savings and still gotten the lower rate by paying it all at once.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto insurance

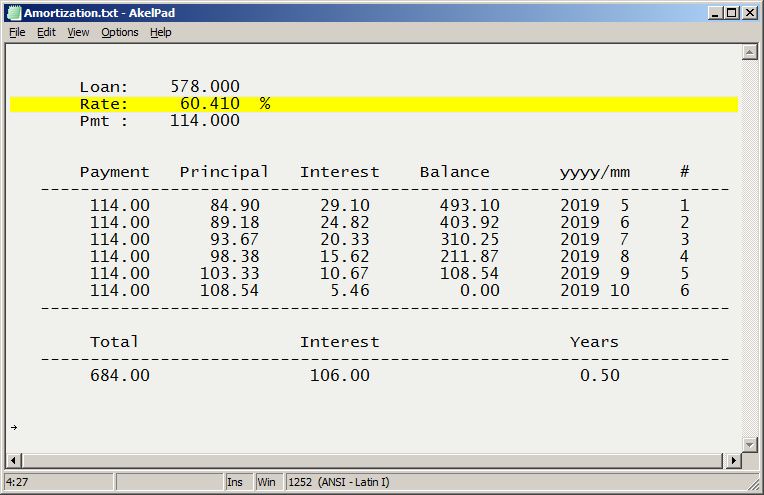

114 per month for 6 months = $ 684

684 - Lump Debt of 578 = $109 loss

109 over 6 months on 578 = over 60% interest

Best pay the 578. (Zero interest lost)

If you can't it would cost you less to put it on CC and make payments of $114 every month than pay the insurance company's 60% interest.

Most credit cards are between 11-28 %

18% = $28 interest

25% = $40 interest

$28 or $40 is less than $109

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto insurance

@ooeemusic wrote:Personally, I pay the lump sum from savings, divide that amount by 6 and put that amount back in to savings every month (so if upfront I took $330 from savings, I would put $55/month in savings for 6 months) That way at the end of 6 months you have replaced what you took from savings and still gotten the lower rate by paying it all at once.

That's exactly what I do! Except, when I found out I could pay it with my credit card, I used my Discover for the cashback, and then paid off the balance the next day. Win-win.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto insurance

@Kforce wrote:114 per month for 6 months = $ 684

684 - Lump Debt of 578 = $109 loss

109 over 6 months on 578 = over 60% interest

Best pay the 578. (Zero interest lost)If you can't it would cost you less to put it on CC and make payments of $114 every month than pay the insurance company's 60% interest.

Most credit cards are between 11-28 %

18% = $28 interest

25% = $40 interest

$28 or $40 is less than $109

The interest rate should be 32.28% (not 60%)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Auto insurance

@KLEXH25 wrote:

@Kforce wrote:114 per month for 6 months = $ 684

684 - Lump Debt of 578 = $109 loss

109 over 6 months on 578 = over 60% interest

Best pay the 578. (Zero interest lost)If you can't it would cost you less to put it on CC and make payments of $114 every month than pay the insurance company's 60% interest.

Most credit cards are between 11-28 %

18% = $28 interest

25% = $40 interest

$28 or $40 is less than $109

The interest rate should be 32.28% (not 60%)