- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Annoyed with Comenity

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Annoyed with Comenity

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Annoyed with Comenity

I applied for Caesars Rewards Visa

The notice I instantly recieved said

We're glad you'd like to open a Caesars Rewards® Visa® Credit Card account.

We just need to take a closer look at your application before making our decision.

Please look for our reply by mail in about 10-14 business days.

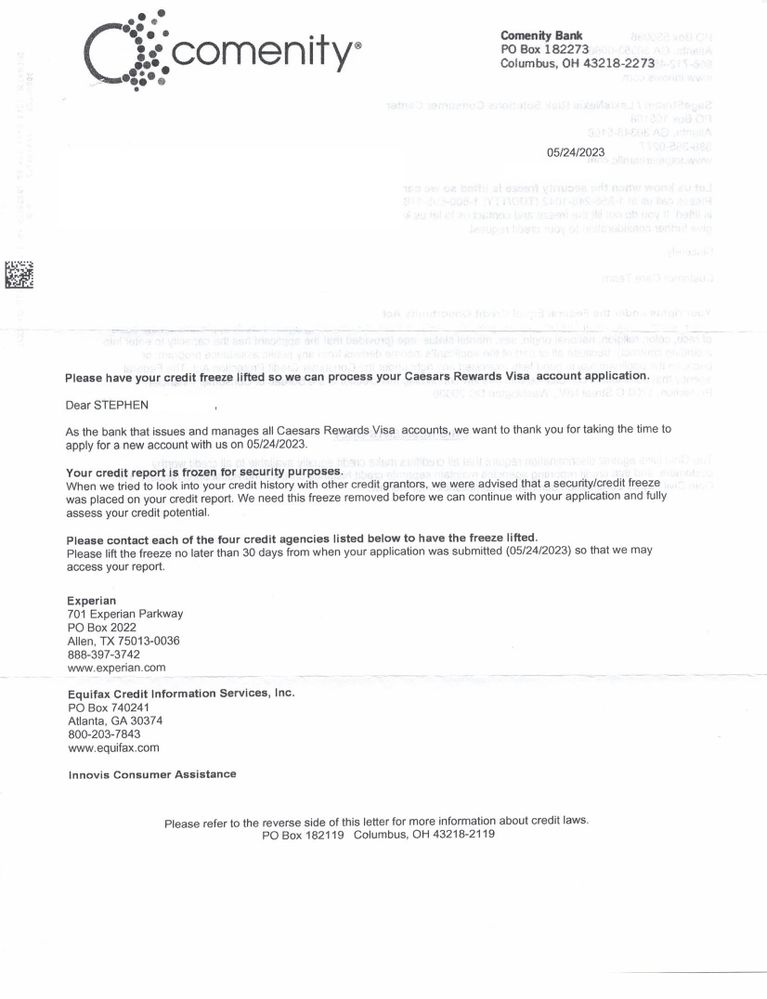

Then I recieved the attached letter in the mail.

They want me to unlock Experian, Equifax, Safestream, and Innovis.

Wow this is a lot of bureaus to check, I got Amex Platinum with only Experian and Transunion unlocked. Apple Card with only Transunion.

I called them today to find out the process. First of all the agent was very rough and agressive.

She told me that since my bureaus were frozen, when I unfreeze them and call them back, they would run it again resulting in a second hard inquiry.

I tried asking her nicely in several ways if they could use the Transunion report they already got and just do a soft unquiry on the other bureaus. She told me no the process would start all over from the beginning. I asked her if they would be willing to remove the first hard inquiry agfter they did the second one, and she told me to contact the credit bureau about that.

I am not sure if this is worth pursuing becuase unlockinig Innovis and Sagestream is not easy like the major bureaus.

Based on the customer service she provided, I am aprehensive about this bank.

The reason I am interested is because I have Caesars Diamond status and I stay at Caesars properties often.

Thoughts? Not sure if I should proceed and have a second hard inquiry with chance they will reject me for something else stupid. My scores are all mid-750s. 1 late payment 4 years ago.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Annoyed with Comenity

Its best to have all 3 CRA's thawed when you apply. We cant talk about gaming the system freezing one hoping they check another. Sage and Innovis is used by many. Cap1 loves Innovis. So its on you now how bad you want it. Ask yourself is another HP worth it for the card you want.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Annoyed with Comenity

Are you over six hard inquiries for the year. I don't see how much value you will get out of the card since you are at diamond level

Barclay(jetblue, arrival)

Bofa(US pride, premium, travel, cash, Suzy komen)

Citi(Premier, Double cash, Costco)

Fnbo(Mlife)

Amex(everyday, cash, Hilton)

Blockfi

Caesars rewards

Sofi

Gemini

Cap One Savor One

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Annoyed with Comenity

@OllieTamale The creditor will choose from where it pulls the information from per their established credit policies. The consumer will not be the one to choose for the creditor from which source they obtain any information. Trying to do so will make you look suspicious to the creditor. Basically what is in the report you do not want the creditor to pull from that they should know. Would be the question in the creditor's mind.

Discover 09/90 19,000, JCPenney 10/2008 4,700 US Bank Cash 12,000 Citibank Custom Cash 5/2015 11,100 State Dept. FCU 15,000 06/2023 , 02/2024 Redstone FCU Signature VISA 10,000 Banking: Ally Bank Credit Unions: Lafayette FCU Fortera FCU State Department FCU Pelican CU

Pelican State CU Redstone FCU

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Annoyed with Comenity

Personally, I'm not a fan of Comenity/Bread.

Your scores are good to get the card if you follow their request to thaw.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Annoyed with Comenity

I wouldn't worry about the first HP. Your credit bureaus were frozen so they could not access them, much less give you an initial HP. You would only get one HP if you should decide to move forward and reapply. The CSR did not know what she was talking about.

Comenity is definitely not one of the best credit card issuers so I would think hard about whether you want a card with them and if it will benefit you. Hopefully they would be pulling just one of the two main bureaus if you decided to move forward and not both. Best of luck if you should decide to continue.