- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Capital One CLI Denied

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital One CLI Denied

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital One CLI Denied

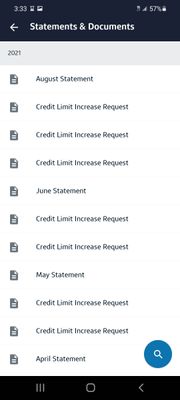

I think my QuickSilver card is bucketted since I can't get an increase and stuck on 3K (started 500 and part of my rebuilder card). I run the pre-approval capital one link and got 3 cards pre-approved including Savor. I called their customer service to just do a product change to savor and they told me that Savor is not included for Product Change. I'm not going to apply for now since I hate that 3 hard pulls but it's crazy how they can pre-approved you for another card instead of just giving you an increase.

> >CREDIT UNION

EX- 585, TU- 583, EQ- 563 | CURRENT SCORE UPDATED: 2/2023 -> FICO 8 EX 754 TU 741 EQ 755 | FICO 9 EX 747 EQ 763 TU 756

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Denied

@blazerein, one of the things I learned from my own Capital One experience is that they love to see heavy use of their cards. My QS went from a (former Platinum) $500 CL to $8,750 but it took a lot of spend, time, and patience. 4-6 months prior to requesting a CLI, I would let $500-$1,000 report as a balance on my monthly statement. And 90% of the time, I would get approved for a CLI. If you still want to give your QS a chance, perhaps this is something that will work for you as it obviously did for me. Good luck!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Denied

Im not sure a 3k C1 card is bucketed, especially if it started at $500. Heavy use might cure that but with it being well known on this board that getting cli from Cap One on any of their cards is like pulling teeth, imo its probably best to play the cli game with other lenders much easier to grow. Even though i cant have any Cap One cards, through everyone elses experience, i dont think id want one anyway if i wanted a growth card but thats just me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Denied

Opened April 21, 2017. Stuck at $300. I've closed all my other accounts. I've been through 3 auto loans with them in this time.

Never missed a payment on anything. I really want to close it but it's one of my oldest accounts. Instead I just hit the CLI button everytime I login (and remember). Maybe one day?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Denied

I've had the Quicksilver card now seven months. They have me a SL 7,500 and I've used the card sparingly,charged on it very month. I think I've racked up almost $3000 I purchases since opening. So, I decided to hit the love button for an increase the other day and I was flat out denied. It stated "usuals was too low on the account". I'm not spending enough. Oh well...

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One CLI Denied

I use mine heavy but I dont leave a balance on it, I pay it off every month. Are you saying it hurts when you pay it off monthly?