- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Chase Approval Odds and Thoughts?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Approval Odds and Thoughts?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Chase Approval Odds and Thoughts?

Hi Everyone. Looking for some advice. I'm interested in possibly applying for the CSP or the Chase-backed United Explorer card; Different yet similar cards I know. A little background - I've been working hard on improving my credit for several years now. Got my BofA card in 11/2018, Discover in 12/2019, and the AMEX this year in 6/2020. I've consistently kept my utilizations individually and collectively around 3%. I've been interested in getting one of the Chase cards for sometime, primarily for dining/travel rewards. However, my understanding is that Chase is pretty stringent with their credit score standards although there are some few exceptions. In light of this, I've been "gardening" the past 5-6 months. In preparation for any possible favorable future application, I also opened up a savings account at my local Chase branch and dumped in a small sum, $1K. I received a pre-selected offer for the CFU in the mail this summer, but ignored that. I just received a pre-selected offer for the CSP in the mail yesterday. I also have now have offers for Southwest, CSP, CSR, CFU, Bonvoy Boundless, FreedomFlex, and United Explorer when I login to my Chase account (where I didn't have them before). The reason I would consider the United Card over the CSP is that I've heard that the co-branded cards CAN sometimes be easier to get approved for, and I happen to be a loyal United flyer.

So the question is whether it's worth going into my local branch in person, checking for a pre-approval with the Chase rep and then applying if all looks good? Do my chances seem reasonable? Or should I continue to stay in the garden a while longer? Even if I got approved for a smaller CL, wouldn't matter to me as I can always get increases later. I'm a little paranoid on taking a 5 point hit on my score just to wind up empty-handed and would only want to pay that price if there is a good chance I'd be approved. I was thinking of making a decision by early to mid-December; The CSP pre-selected offer says it ends on 12/31 anyway. Thank you all in advance!

I've included some data points below to consider with all of this -

FICO8: 694/693/687 (as of this posting)

FICO8: Bankcard 702/714/685 (as of this posting)

AAOA: 6 yrs 11 months

Total Util: 1.7%

Total CL: $21,400

BoA BankAmericard: $0/1,500

AMEX BCP: $337/8,900

Discover IT: $27/11,000

Inquiries: 6 Exp, 1 falling off 12/5/20 and 3 falling off 6/1/21

1 auto-loan = $15,800/23,670

3 late payments falling off next year (2 of them with Chase from 2014)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Credit Card Approval Thoughts?

You can certainly go in branch for pre-approvals. If those cards in account have a black star, or green check mark, those are solid odds on approval.

Always look for black star, or green check. Solid APR and SL on apps are also something to look for. The mailers are just marketing.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Approval Odds and Thoughts?

@BuildingBetterCredit2020 no one removed your thread.

You've made multiple edits in short period of time and it triggered spam filter.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Approval Odds and Thoughts?

Thanks for the info on the spam filter. Never knew.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Approval Odds and Thoughts?

Filter is mean

You can go to the branch if you wish for added layer of assurance, but I really don't think that's a necessary step since you aren't over 5/24

Also, it's very possible you don't have in branch pre-approval, but no issues getting approved with cold app.

The choice is yours, and should you decide to visit the branch, even if you are told there is no pre-approval, that doesn't mean you wouldn't get approved.

I think you're fine with just filling out the app

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Credit Card Approval Thoughts?

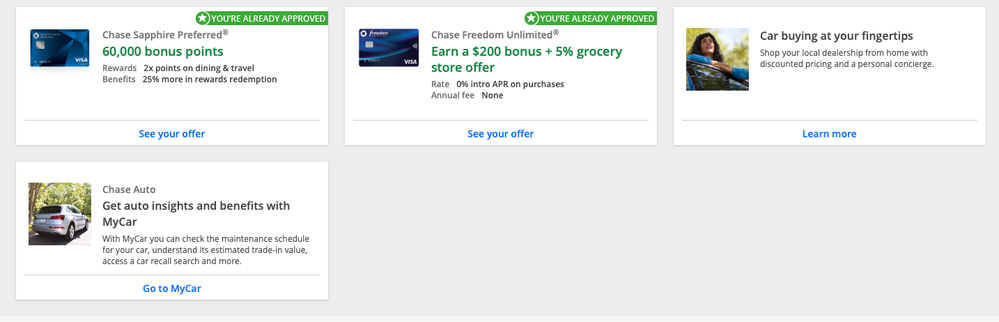

So I just got an email from Chase about a pre-approval. I logged into my savings account online when I got to work, and sure enough, there are 2 pre-approved offers - One for the CSP and the other for the CFU. They both have a green circle with a white star inside.

Question: How rock solid are these pre-approvals for me? Pretty good odds? One over the other? I have 2 HPs showing on my FICO report, am at 2/24 (So I am under the 5/24 rule limit). Is it worth pulling the trigger with all the info I've listed above?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Credit Card Approval Thoughts?

On a sidenote, it is listing on my Chase account through credit journey that I have 6 HPs even though that doesn't show on my FICO report. I know I have one HP falling off this week actually.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Credit Card Approval Thoughts?

@BuildingBetterCredit2020 wrote:So I just got an email from Chase about a pre-approval. I logged into my savings account online when I got to work, and sure enough, there are 2 pre-approved offers - One for the CSP and the other for the CFU. They both have a green circle with a white star inside.

Question: How rock solid are these pre-approvals for me? Pretty good odds? One over the other? I have 2 HPs showing on my FICO report, am at 2/24 (So I am under the 5/24 rule limit). Is it worth pulling the trigger with all the info I've listed above?

Just to clarify, the 5/24 restriction doesn't apply to HPs, it's in reference to the number of accounts opened in the past 24 months.

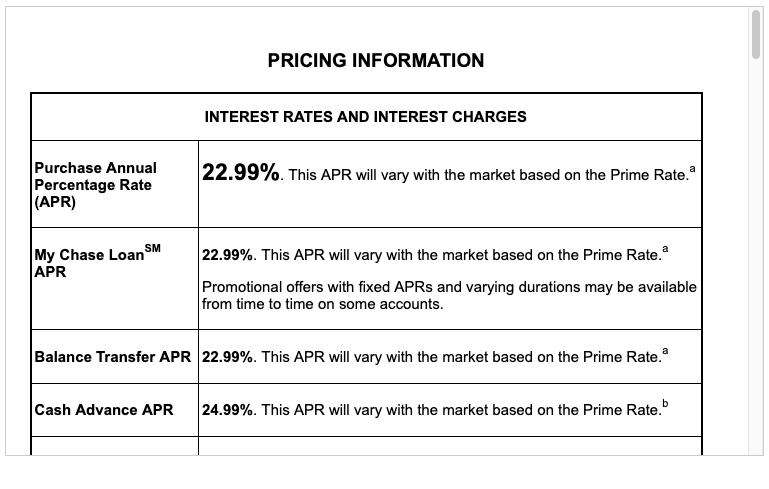

While inquiries can stills be a factor in their UW criteria, having a pre-approved offer can bypass the 5/24 restriction in the majority of cases. Check the APR, especially for those green check marks/black star offers. If it's solid, then it's likely a slam dunk.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Credit Card Approval Thoughts?

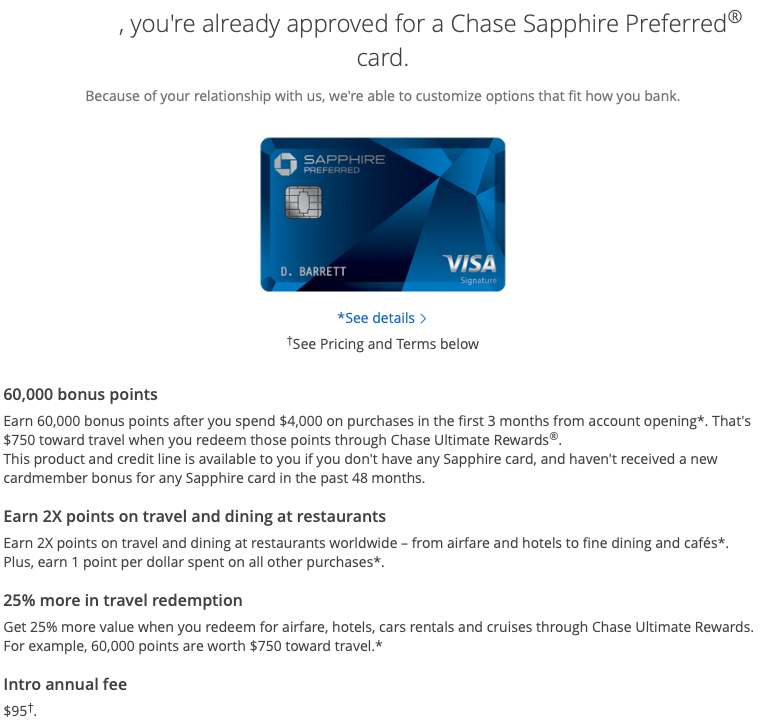

So it seems there is a fixed APR which bodes well. The odd thing though is that the email I received said, "You're Preapproved!". But when I login to my account it says I'm already approved as can be seen below.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Credit Card Approval Thoughts?

You're basically good to go as long as there hasn't been a tectonic shift in your credit profile over the last couple of months. You get to decide if you want the CSP or the CFU, accept the one you want.

FICO 8 (EX) 838 (TU) 846 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion