- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Chase Trifecta - Looking for guidance

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase Trifecta - Looking for guidance

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Trifecta - Looking for guidance

@jibc1978 wrote:Hi!

Just got approved for CSP with a $13,800 CL!

how long should i wait before applying for a CFU or CFF? 30 days? 3 months?

Thank you for any feedback you may have!

Congrats on the CSP approval!

When I got into the Chase family; I applied and was approved for both CSP and CFU on the same day, but this was years ago (2014). I think I was so nervous as I was just getting my credit back on track, I think I had two windows open with both apps lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Trifecta - Looking for guidance

@jibc1978 wrote:Hi!

Just got approved for CSP with a $13,800 CL!

how long should i wait before applying for a CFU or CFF? 30 days? 3 months?

Thank you for any feedback you may have!

Since you were approved yesterday technically you can apply today with at least some chance of approval. You might want to wait 3 months.

FICO 8 (EX) 838 (TU) 846 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Trifecta - Looking for guidance

thank you all for the replies!

what should the course of action be? i have my eyes set on CFU (concensus would be to apply in 3 months, wondering if i could get approved in a month hehe) and then CFF further down the road.

Is completing the trifecta the best play here? aim is to maximize points to use for travel.

CSP puts me at 1/24 so i have room to grow, as always any ideas would be greatly appreciated!

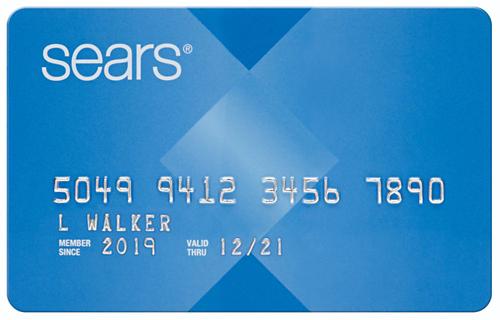

Business Cards:

Store Cards:

Credit Health:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Trifecta - Looking for guidance

@jibc1978 wrote:thank you all for the replies!

what should the course of action be? i have my eyes set on CFU (concensus would be to apply in 3 months, wondering if i could get approved in a month hehe) and then CFF further down the road.

Is completing the trifecta the best play here? aim is to maximize points to use for travel.

CSP puts me at 1/24 so i have room to grow, as always any ideas would be greatly appreciated!

If it were me I would go for the freedom flex next, cfu gives you 3x dinning and drug stores 1.5 base earning csp already gives 3x dinning and so does the freedom which also gives 3x drugstores, what freedom gives is 5x rotators this quarter is grocery and so is the sub making a 9x return(base + 4% + sub). since you want to wait 30 days (I personally wouldn't) I would bank on next quarters 5x bonus giving you more points than the .5x difference on the base rate. The CFU to me is least important card for the trifecta.

As I mentioned above I would at least try for the Freedom now and try to max as many points as you can from grocery now. Historically Amazon, gas, and paypal, restaurants are also quarterly bonuses. If you were to spend 500 at grocery stores this month even if you had to buy a few giftcards to do it you would get 49% equivalent cashback and 61.25% when redeemed for travel. How much non category spending at 1.5x vs 1x would you have to make to catch up to that? The Freedom is just a superior card.

The only reason I would wait on a freedom card with your profile is if you were worried about not making the 3k sub requirement.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Trifecta - Looking for guidance

@Beefy1212 thanks for the feedback! everything you commented makes sense, as an aside, the reason to wait the 90+ days is that i read that Chase doesnt like velocity and i'm trying not to get the second CC app shutdown eventully because of this. am i being too careful?

Business Cards:

Store Cards:

Credit Health:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Trifecta - Looking for guidance

@jibc1978 wrote:@Beefy1212 thanks for the feedback! everything you commented makes sense, as an aside, the reason to wait the 90+ days is that i read that Chase doesnt like velocity and i'm trying not to get the second CC app shutdown eventully because of this. am i being too careful?

I would say based on the credit profile info you shared and the sl they gave you on the CSP and others commenting 2 cards but not 3 within 30 days is okay I personally would risk it. Even if they say no and recon also says no 2 inquiries vs 1 90 days from now on a 1/24 profile won't matter much if at all. I am a risk taker I would roll the dice, but it is not my app and not my profile. You need to decide your own level of risk. But for me stacking 40% cb with 9% cb is worth shooting your shot.

Carpe Diem "seize the day"

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Trifecta - Looking for guidance

So it wasn't as straight forward as with the CSP (had to make a couple of phone calls to clear some stuff out) but got approved for a CFF with a $8,800 SL

thank you all for the guidance! now i go tend the fields for a while ![]()

Business Cards:

Store Cards:

Credit Health:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase Trifecta - Looking for guidance

Congrats on your approval! I am going to lock this thread now, but you can continue the discussion in the Approvals board if you wish.