- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Discover CLI - Hard pull??

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Discover CLI - Hard pull??

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Discover CLI - Hard pull??

Discover currently the lowest @7,700. Except Discover my average CL is about 20,000. A few weeks ago, I called to inquire about the possibility of CLI and was told I could initiate after Feb 20 - I think the last CLI was 500 on 1/20. I rately use it, thus I do not expect much from Discover.

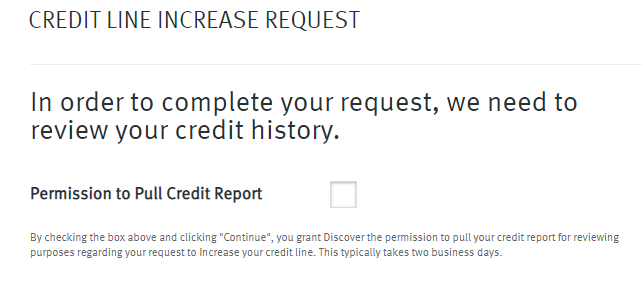

I tried CLI today and got this. I would not permit them to pull my profile unless I expect double / triple increase... but my experience with Discover has been tiny scrumbles each time.

Is Discover CLI hard pull now?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover CLI - Hard pull??

It's still a soft pull unless they request to do a hard pull in which case they will ask you as they did.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover CLI - Hard pull??

It’s soft pull unless the system flags something in your profile warranting a hard pull. The language will be present stating they need to do so as you can see but I personally wouldn’t waste a HP on it.

Either way way good luck

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover CLI - Hard pull??

Okay...more puzzles now.

When Discover can look though my profile through soft pull any time they want, why would they want HP?

I applied only one card last 12 months - not counting biz cards...and I am certain Discover has an access to the history. Anyone had any similar experience?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover CLI - Hard pull??

It might not hurt to wait 91-days before requesting a CLI with Discover. Discover automatically gave me a CLI after the first 90-days, but denied my phone request 30-days after the initial CLI. I then called Discover 91-days after the last CLI and really put the charm on during the call, which resulted in $2K CLI. I've also read in the community that you can hit the CLI button on your account directly AFTER you are approved for a CLI over the phone, but I doubt I have the guts to even try it.

I am no expert on Discover after having the card for only six-months as of today, but it seems like 91-days is more reliable in my modest experience than the 30-day intervals I've been reading about in the community. Best of luck to you!!!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Discover CLI - Hard pull??

Disco, or any other creditor can do a HP at their discretion. I think we're so used to seeing SP done that we expect it now. I would wait 91 days to ask for a CLI and see how that goes. Good luck, OP!