- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Getting ready to App for 3 cards next week - notic...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Getting ready to App for 3 cards next week - noticed something on MyFico 3B "fraud alert"

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting ready to App for 3 cards next week - noticed something on MyFico 3B "fraud alert"

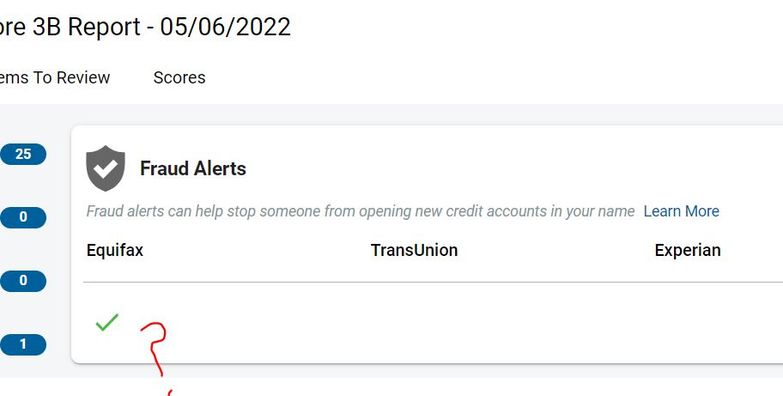

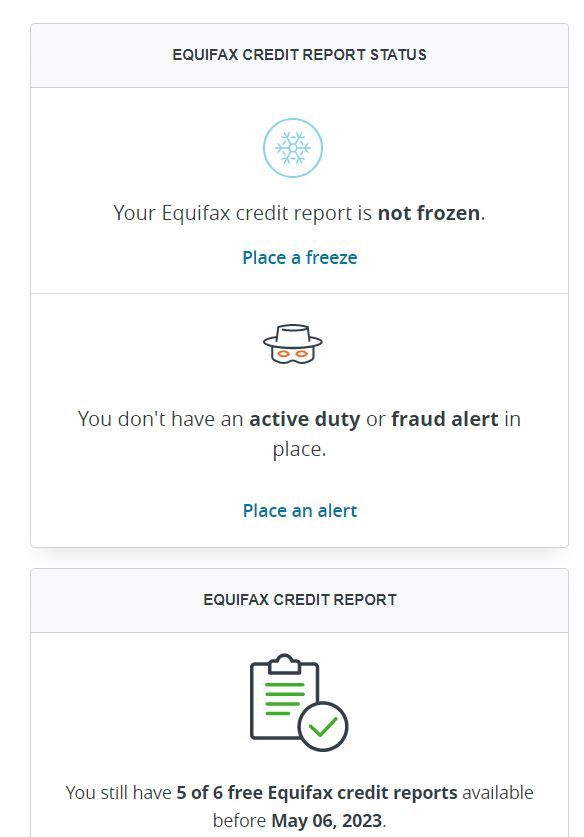

So I am getting ready to run a few Apps next week and while reviewing my recent Credit Reports noticed something peculiar under my last MyFico3B.... a notification under Equifax for fraud alert that I had never recognized before. I then pulled my reports from my last Experian CreditChecktotal pull and there was nothing indicating any fraud alerts.... so then I went to myEquifax and pulled 1 of 6 allowed reports and it also shows nothing regarding any fraud alert.

I am trying to strategize which apps I want to run and researching HPs.... I have 1 INQ in last 2.5 years and that is on Equifax and curious if this equifax fraud alert showing on MyFico 3B will have any affect on what I may app for next week if there are any EQ HPs involved? I have 1 new account in last 2.5 years and that was PenFed last May which pulled Eq and I had no issue... instant approval. Is this fraud notice something to act on before apping?

18 Credit Cards - 16% Util -TLOC= $152,300 -16 w/ zero balance, -2 accts 85% util | 1 Auto loan 50% paid 1.99% | Started rebuild early 2018 w/ 3 cap 1 CC's and 1 Shell Gas card - $3400 TLoC. -All scores lower 500s

Last Baddie Just Fell Off | Jumped in Garden Jan 2020 after acquiring New Car Loan and app spree on the same day (5 CC's) My scores had just hit my all time highs 1 week before Car Loan App Dec 2019 - All lower 800's

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting ready to App for 3 cards next week - noticed something on MyFico 3B "fraud alert&qu

That certainly does look like a fluke considering MyFico is pulling from EQ and re-presenting the data they receive to you in their consolidated report. If you when you pulled on EQ and it wasn't there and I can see from the screenshots when you logged in that it wasn't there...those are good signs.

I would try one more 3rd party like AnnualCreditReport and see if you can pull it without issue and what it states. Even with the fraud alert, that would not lead to an automatic denial and instead the FI would be required to contact you to verify who you are. Typically fraud alerts have a phone number associated with them on who to call so pulling from Annual may show you an alert and then you can investigate further. I hope it's not the result of a mixed file and just a software glitch

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting ready to App for 3 cards next week - noticed something on MyFico 3B "fraud alert&qu

Of course this would only matter if some of the cards you plan on applying for use EQ. However you could also check Credit Karma and see if this is showing up under there as well. This may be some weird Experian fluke.

Usually, a fraud alert is put on there by you and just requires the FI to take additional steps to verify it is you who are applying.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Getting ready to App for 3 cards next week - noticed something on MyFico 3B "fraud alert&am

@GatorGuy wrote:Of course this would only matter if some of the cards you plan on applying for use EQ. However you could also check Credit Karma and see if this is showing up under there as well. This may be some weird Experian fluke.

Usually, a fraud alert is put on there by you and just requires the FI to take additional steps to verify it is you who are applying.

I learned firsthand a number of years ago that an issuer can also put out a fraud alert if they suspect suspicious activity on an account. I've also had Equifax put one on my report after claiming they were notified by Transunion (if any of the 3 major CRAs gets a fraud alert they are supposed to report it to the other 2 major CRAs) where Transunion confirmed that my TU report didn't have one and they never notified EQ. A call back to EQ got it removed from my report.

You can call EQ to confirm if you do have an alert on your file and who ostensibly reported it, and if so you can choose to address it with whomever supposedly reported it and also work to get it removed.

Having one is a nuisance as you'll have to go through additional verification steps every time you apply for credit (no instant approvals!) but having one doesn't keep you from getting credit.

FICO 8 (EX) 838 (TU) 846 (EQ) 850

FICO 9 (EX) 850 (TU) 850 (EQ) 850

$1M+ club

Artist formerly known as the_old_curmudgeon who was formerly known as coldfusion