- myFICO® Forums

- Types of Credit

- Credit Card Applications

- Interesting Citibank CLI data points

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Interesting Citibank CLI data points

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Interesting Citibank CLI data points

From my previous experience, Citibank has normally offered soft pull CLIs once every 180 days. While I've heard of the ability to ask for higher increases by calling customer service and accepting a hard pull, I thought the 180 day requirement always existed for Citi, including for new cards. Apparently, that's not always the case and I thought the data points might interest the community.

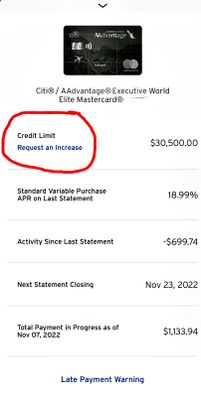

I was approved for the Citi AAdvantage Executive WEMC in October. The SL was high for recent Citi approvals at $30.5K. Still, it wasn't as high as some of my other approvals and I had hoped for a little more, especially since when I applied I had been gardening with no HPs in 24 months (and was only 1/12 new cards with a SP.)

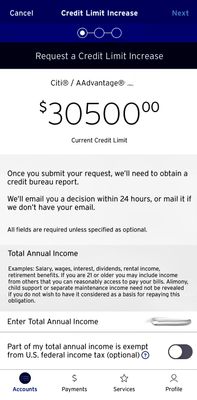

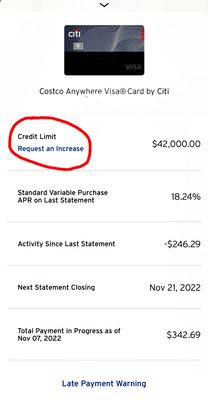

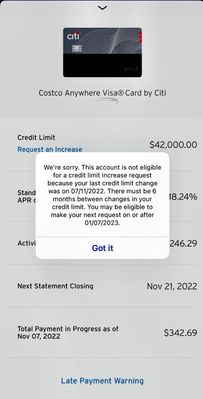

After the card was added to my Citi mobile app, I was poking around. I noticed the "CLI" button was already on the newly-approved card which surprised me. ![]() When I clicked on it, it took me to a screen to ask for a higher limit, even though I was in the first 30 days of the account. It advised they would conduct a HP. Out of curiosity, I went to my Citi Costco card and hit the ClI button. For that card, like usual, I got the message that I needed to wait since I had a recent increase. Back to the AAdvantage card, and again got the request screen with the possible HP. I hoped they might use my HP from the card approval (on EX) or that they might pull an alternate bureau. I filled out the request and submitted, in part just to see what they would do with it.

When I clicked on it, it took me to a screen to ask for a higher limit, even though I was in the first 30 days of the account. It advised they would conduct a HP. Out of curiosity, I went to my Citi Costco card and hit the ClI button. For that card, like usual, I got the message that I needed to wait since I had a recent increase. Back to the AAdvantage card, and again got the request screen with the possible HP. I hoped they might use my HP from the card approval (on EX) or that they might pull an alternate bureau. I filled out the request and submitted, in part just to see what they would do with it.

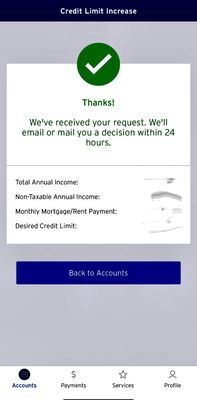

The app promised I would hear from them within 24 hours but it was closer to 36. The request was approved with a second HP on EX. See >this thread< for my approval.

Bottom line: apparently CITI does allow a SL recon through their mobile app on some cards, albeit with an additional HP. I'm not sure if the AAdvantage Executive card is unique in this respect or if other Citi cards offer the same. I'd like to hear from others with a similar experience.

Business Cards

Length of Credit > 42 years; Total Credit Limits > $947K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 97.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 32 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting Citibank CLI data points

'Once you submit your request, we’ll need to obtain a credit bureau report. We’ll email you a decision within 24 hours, or mail it if we don’t have your email.'

Current Credit Limit: $7,300'

Didn't proceed.

MileUp, approved about 21st last month

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting Citibank CLI data points

Interesting, I'll be sure to add in a new data point in about a week when my new card arrives.

Closed Cards

Current FICO 8 Scores (As of Feb 12th, 2025):

Inquires (6/12/24):

Account Age metrics:

Updated Mar 12th, 2024

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting Citibank CLI data points

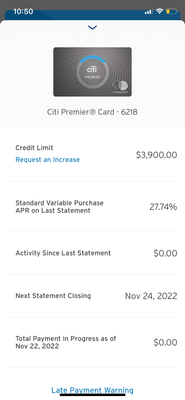

I got approved for the Citi Premier Card on November 12th as can be seen in this <<thread>>.

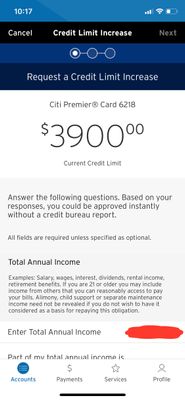

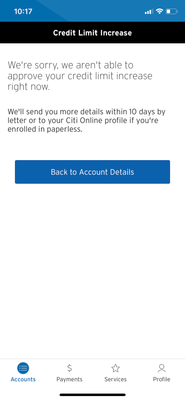

Following @Aim_High's lead, I decided to be poking around in the app to see if I could find the legendary LUV button this early on with the card. To my surprise, there it was, on a card (and account) which I had just activated moments prior. Attached are photos:

Although I didn't get approved, this was no surprise to me but also, they did not use any hard pull language and they did not do a hard pull. I wonder what the difference is. I have some upcoming expenses I might include on my first or second billing cycle and maybe I go to this page later to see if the language changes at all. Very interesting differences in my opinion, I wonder why there is a difference in language, it may possibly be because you have already used your card for some purchases whereas I have not.

Closed Cards

Current FICO 8 Scores (As of Feb 12th, 2025):

Inquires (6/12/24):

Account Age metrics:

Updated Mar 12th, 2024

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting Citibank CLI data points

@Mones wrote:I got approved for the Citi Premier Card on November 12th as can be seen in this <<thread>>.

Following @Aim_High's lead, I decided to be poking around in the app to see if I could find the legendary LUV button this early on with the card. To my surprise, there it was, on a card (and account) which I had just activated moments prior. Attached are photos:

Although I didn't get approved, this was no surprise to me but also, they did not use any hard pull language and they did not do a hard pull. I wonder what the difference is. I have some upcoming expenses I might include on my first or second billing cycle and maybe I go to this page later to see if the language changes at all. Very interesting differences in my opinion, I wonder why there is a difference in language, it may possibly be because you have already used your card for some purchases whereas I have not.

Very interesting data points, @Mones, and thanks for that contribution. I'm surprised they offered to do a soft pull for you but did a hard pull for my $5K increase. Citi has normally been soft pull for me on my Costco and other cards I've had with them. I'm not sure what the difference could be unless it's due to my Citi TCL. Before the increase, I had the Costco card at $42K and AAdvantage at $30.5K so I had total Citi exposure of $72.5K. Maybe I was getting into the territory where they wanted to do a more thorough check before extending more credit. Or maybe it was just due to the large limit ($30.5K) they had already approved on the card. But yes, it's true that I had the card for a month and had swiped many times already.

By the way, the CLI button is still visible on my Costco as well as AAdvantage card accounts, but now I get the "You've had an increase on this account so you'll have to wait" message on both accounts.

Business Cards

Length of Credit > 42 years; Total Credit Limits > $947K

Top Lender TCL - Chase 156.4 - BofA 99.9 - CITI 97.5 - AMEX 95.0 - NFCU 80.0 - SYCH - 65.0

AoOA > 32 years (Jun 1993); AoYA (Oct 2024)

* Hover cursor over cards to see name & CL, or press & hold on mobile app.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Interesting Citibank CLI data points

I get the following when requesting a limit increase on my Citi Rewards card. I went for it and was denied no hard pull.

"Answer the following questions. Based on your responses you could be approved instantly without a credit bureau report."