- myFICO® Forums

- Types of Credit

- Credit Card Applications

- New Best Buy Credit Card System

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

New Best Buy Credit Card System

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

New Best Buy Credit Card System

redle wrote:Just wanted to update that they pushed back the changes to the 13th of August instead of the 1st. I wouldn't want to be a liar!

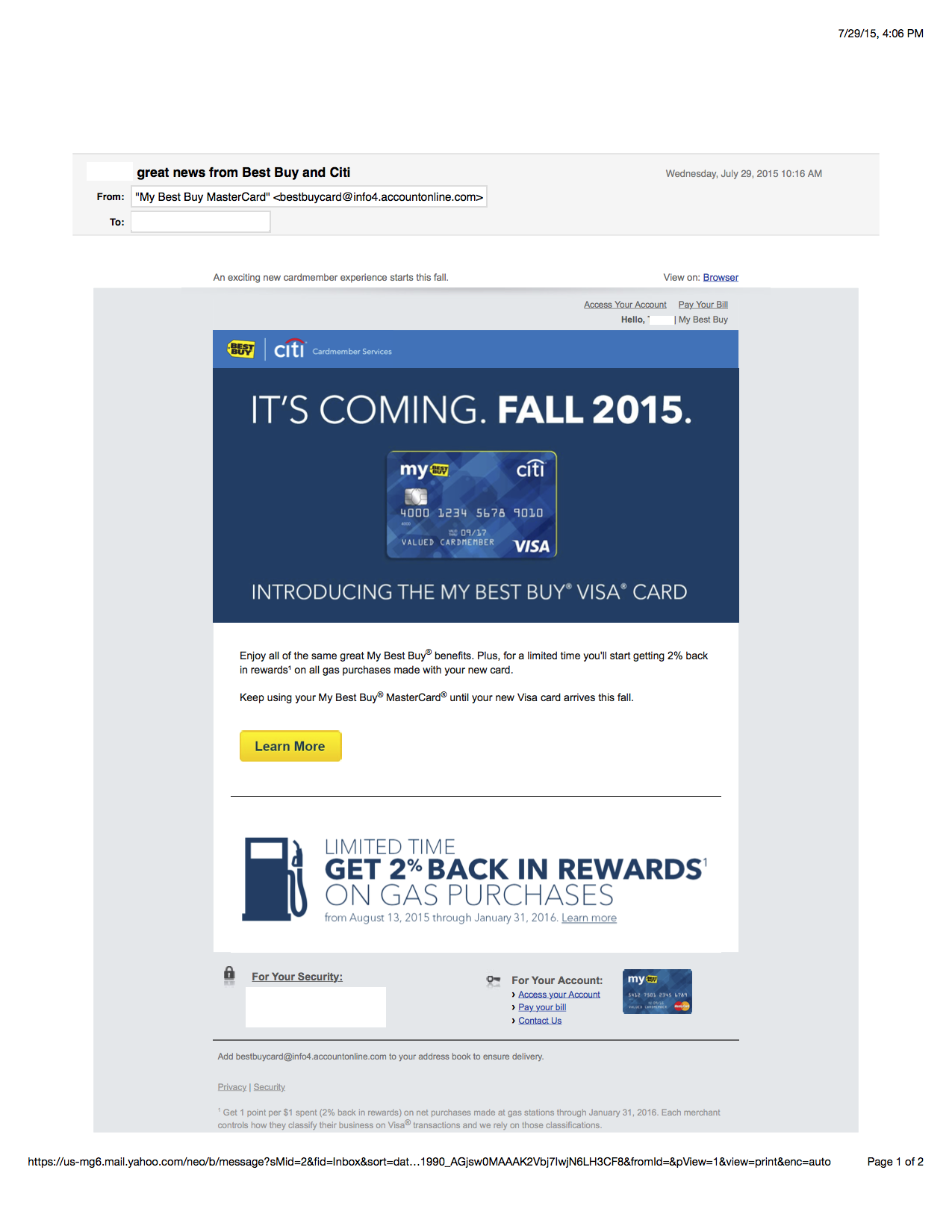

As posted by Redle a while back (thank you for this) the Best Buy Credit Card system has been revamped. The rewards are 5% back in rewards or 12 mos of 0% interest on $399 & up purchases (although 6 months for some things), 18 months on $599 & up, and 24 months on $799 & up. The intro gives you 10% rewards on your first purchase.

Also, instead of applying and waiting to see which of the 2 cards as you used to, you can now apply and pick whichever card you want (assuming you qualify, I'm assuming {lots of assumptions}).

This rewards system is supplimented with their own store (non-credit) card and if you are an Elite Plus member ($3,500* spend annually at BB) you will get 6% extra rewards.

OUTSIDE BEST BUY | |||

2% BACK IN REWARDS Dining out & grocery purchases³ |  | ||

Limited time only, through January 2016 2% BACK IN REWARDS on gas purchases3 |  | ||

1% BACK IN REWARDS Everyday purchases4 |

So...who is now considering getting a BB card? Do you like the changes (Visa by Citi now)? Would you pick 5% rewards or 12 months of no interest? I would like both but obviously we can't have it all, am I right?

Active Cards: Chevron Texaco, Amex BCE, Barclays Ring, Chase Freedom, Chase Freedom Unlimited, Best Buy Visa, Marvel MC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Best Buy Credit Card System

Not bad card IMO... 5% off best buy or 0% financing and 2% on food and what not and 1% on all else.. Not bad at all from what I can see, unless I am missing something?? Might be a future applicaiton depending.. No use for the store card and if they allow for you to apply straight for the visa then this might be good for alot of people? How is their UW as bad as regular Citi's?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Best Buy Credit Card System

@CreditCuriousity wrote:Not bad card IMO... 5% off best buy or 0% financing and 2% on food and what not and 1% on all else.. Not bad at all from what I can see, unless I am missing something??

I must admit, it's more confusing once you open up the Terms...there is a MC and Visa Platinum version and a MC and Visa Gold version...it doesn't clearly indicate whether you will have the AF or not (I guess you find out once you apply and choose??) Can somebody apply and screenshot the page for us? Lol...

I like the 5 months of 2% gas but anyone with Chase Freedom or Discover right now wouldn't dare put gas on anything but those. ![]()

Active Cards: Chevron Texaco, Amex BCE, Barclays Ring, Chase Freedom, Chase Freedom Unlimited, Best Buy Visa, Marvel MC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Best Buy Credit Card System

Ya I skiimed over the terms and they were about as clear as mud.. I couldn't see on the application where you pick either the Visa or the store card either.. Didn't fill it in, but didn't see it on first page of application.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Best Buy Credit Card System

@SecretAzure wrote:

@CreditCuriousity wrote:Not bad card IMO... 5% off best buy or 0% financing and 2% on food and what not and 1% on all else.. Not bad at all from what I can see, unless I am missing something??

I must admit, it's more confusing once you open up the Terms...there is a MC and Visa Platinum version and a MC and Visa Gold version...it doesn't clearly indicate whether you will have the AF or not (I guess you find out once you apply and choose??) Can somebody apply and screenshot the page for us? Lol...

I like the 5 months of 2% gas but anyone with Chase Freedom or Discover right now wouldn't dare put gas on anything but those.

There won't be the MC version after this month. They will change into Visa.

http://www.mybestbuyvisacard.com/FAQs.html

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Best Buy Credit Card System

Also didn't see 2% on dining/grocery that you spoke of

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Best Buy Credit Card System

@CreditCuriousity wrote:Also didn't see 2% on dining/grocery that you spoke of

It's on the front page of the advertisement. Weird if it isn't on the terms.

I'm wondering if my Chase Freedom 3% at best buy+Store Points (I'm an Elite member {not plus}) which is 1.1 reward points per dollar spent and 3% cashback from Chase would equal 4.1% back...wouldn't it? It would take a while to get the BB rewards to kick in but not so bad.

Active Cards: Chevron Texaco, Amex BCE, Barclays Ring, Chase Freedom, Chase Freedom Unlimited, Best Buy Visa, Marvel MC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Best Buy Credit Card System

@CreditCuriousity wrote:Also didn't see 2% on dining/grocery that you spoke of

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Best Buy Credit Card System

@SecretAzure wrote:

@CreditCuriousity wrote:Also didn't see 2% on dining/grocery that you spoke of

It's on the front page of the advertisement. Weird if it isn't on the terms.

I'm wondering if my Chase Freedom 3% at best buy+Store Points (I'm an Elite member {not plus}) which is 1.1 reward points per dollar spent and 3% cashback from Chase would equal 4.1% back...wouldn't it? It would take a while to get the BB rewards to kick in but not so bad.

Correction: 1% extra for 2% total through Chase Rewards. 3.1% back then?

Also, thanks Ron for all the pics! ![]()

Active Cards: Chevron Texaco, Amex BCE, Barclays Ring, Chase Freedom, Chase Freedom Unlimited, Best Buy Visa, Marvel MC

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: New Best Buy Credit Card System

@CreditCuriousity wrote:Ya I skiimed over the terms and they were about as clear as mud.. I couldn't see on the application where you pick either the Visa or the store card either.. Didn't fill it in, but didn't see it on first page of application.

You may be approved for one of four My Best Buy® Credit Cards based on creditworthiness, issued by Citibank.

Ron.