- myFICO® Forums

- Types of Credit

- Credit Card Applications

- No AMEX decrease, but no increase either! Making t...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

No AMEX decrease, but no increase either! Making those minimum payments.

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

No AMEX decrease, but no increase either! Making those minimum payments.

Was going to add this to the "Amex Decreasing Unused Limits

thread but locked, so mods feel free to edit/move as you wish.

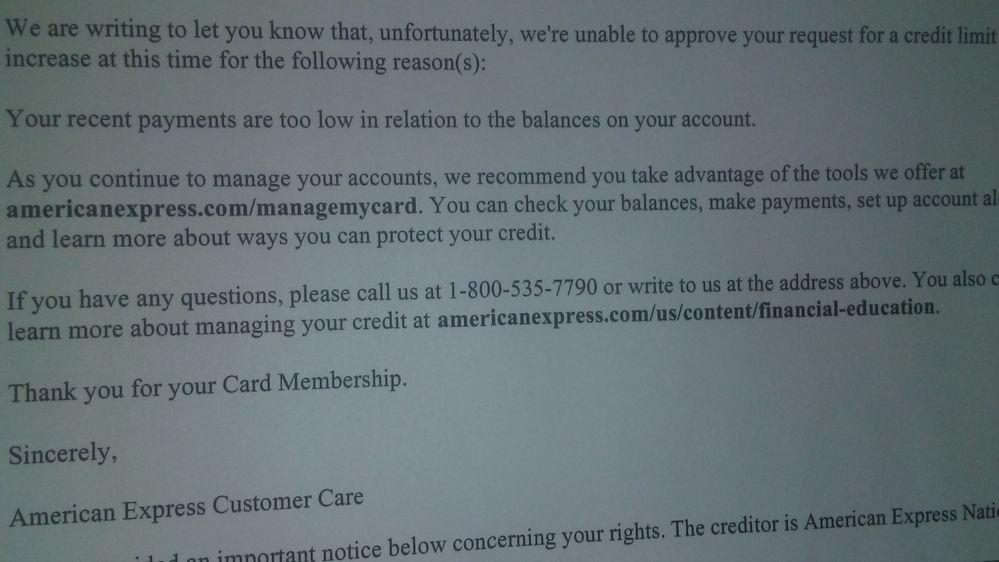

Many had mentioned about just making minimum payments. In my situation, I have 3 Amex revolvers, 2 with zero balance which I have had for many years and 1 which is on a 0% interest promo since I opened that card a few months ago. Owe less than 1K on it as of today with 10K limit and have a few months left which I will pay off fully before the end of promo. I also like just doing minimums when on promo time, and decided since I have never asked for a CLI to try. Did it online, kept coming back 7-10 days. Got message to call in for answer, but figured would wait for letter, which came today. No big deal either way as I never exceed 10% util on any individual card, <3% TCLU, but wanted to add my results for data point.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No AMEX decrease, but no increase either! Making those minimum payments.

The reason listed is in relation to payment on balances, rather than spend rate. Are you using Plan It, or just minimum payments on the account? Plan It puts you on a specific payment pace rather than extending.

The existing limits likely put you near their internal limit they are comfortable with.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No AMEX decrease, but no increase either! Making those minimum payments.

Just regular minimum payment ($35) plus extra $5 more every so often since it is still on 0% interest introductory offer. I saw in previous replies MF members were wondering if making minimum payments could affect limits, so yes it can.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No AMEX decrease, but no increase either! Making those minimum payments.

Interesting data point. Thanks for sharing.

I'll be trying to get a CLI on an AMEX 0% card in a month or so. I'm also paying the minimum. From what you show I won't be getting my hopes up.

But it doesn't make sense to me to pay faster than minimum to get a CLI on a 0% card so I might be able charge more than I can now. "Bird in the hand" and all that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No AMEX decrease, but no increase either! Making those minimum payments.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No AMEX decrease, but no increase either! Making those minimum payments.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No AMEX decrease, but no increase either! Making those minimum payments.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No AMEX decrease, but no increase either! Making those minimum payments.

This is just my 2cents

Both my AmX cards are 0% for 15 months. I have put very large charges on the ED and have paid 10-15x the minimum pymt due. The reason I do this is basically Murphy’s law. I didn’t want promotion to expire, and like some, scrambling around lookin for a BT to cover the outstanding balance before the outrageous interest rate kicks in.

So one of my charges was $5K. I just divided that by 14 so that not only is it paid off before expiration date but that AmX was getting sizeable monthly payments ($357.14/mo). Since they love transactors, I felt this would look good since at this moment in time I was a revolver.

But, of course, each his own.

|| AmX Cash Magnet $40.5K || NFCU CashRewards $30K || Discover IT $24.7K || Macys $24.2K || NFCU CLOC $15K || NFCU Platinum $15K || CitiCostco $12.7K || Chase FU $12.7K || Apple Card $7K || BOA CashRewards $6K

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No AMEX decrease, but no increase either! Making those minimum payments.

@CreditInspired wrote:

So one of my charges was $5K. I just divided that by 14 so that not only is it paid off before expiration date but that AmX was getting sizeable monthly payments ($357.14/mo). Since they love transactors, I felt this would look good since at this moment in time I was a revolver.

I've done that with PayPal and some large purchases off eBay under their "no interest if paid in X months" deals.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: No AMEX decrease, but no increase either! Making those minimum payments.

I can safely say that AmEx hates the idea of carrying a balance on their own cards. They do not discriminate on if that account is a charge card or a revolver. They will not give you a CLI for paying the minimum, ever. They want to see PIF and even better if the numbers are higher but they prefer PIF most of all. If you do a BT as a payment method for their cards they will love you as they are paid off and the amount due is someone else's problem. The only reason they offer anything other than their charge cards is because everyone else beat them to revolvers and they had to offer something similar or fall behind.

Active:

Bank of America (Customized Cash Rewards VSC, Unlimited Cash Rewards WMC{PT}), Capital One (Discover It DC, Savor WEMC), Chase (Amazon Prime VSC, Freedom Flex WEMC [x2]), Citi (Custom Cash WEMC, Dividend MC), Citizens GreenSense WMC, Curve WEMC{S}, FNBO Ducks Unlimited VSC, GBank VSC, Imprint Rakuten AC, PenFed Pathfinder Rewards VSC, Santander Ultimate Cash Back WMC, Synchrony (OnePay Walmart CashRewards MC, PayPal Cashback WMC), UMB Simply Rewards VSC[Milford Federal], US Bank (Cash+ VSC [x2], Kroger Rewards WEMC, Pick n Save/Metro Market Rewards WEMC, Shield VC)

Wishlist: AAA Daily Advantage, AOD Signature, Aven, Bellco Colorado Rewards, Nusenda Platinum Cash Rewards, PCMCU Platinum Rewards, Redstone FCU Signature