- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Apple Card and US Bank Altitude Approvals

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Apple Card and US Bank Altitude Approvals

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Apple Card and US Bank Altitude Approvals

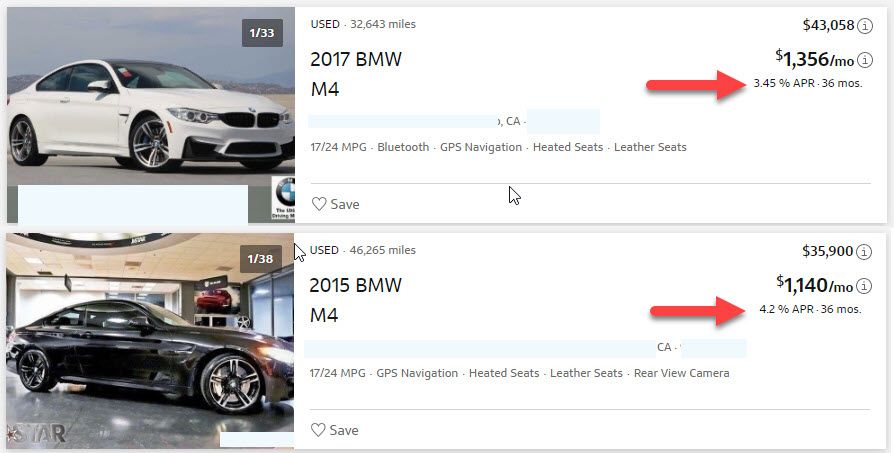

@whocares wrote:You are 100% correct. With Capital One Auto Navigator, the APR is displayed based with the vehicle listing, HOWEVER the dealer can mark up the APR for profit. That is why it is important if you do choose to use Cap1 Auto Navigator, you do various searches to compare the APRs across dealers for the vehicle you are looking for. I performed a search just now to demonstrate the difference. OIder car, more miles, and lower price yet has a higher APR than the newer model:

The Pre-Qual amount should really be the least item to be concerned with. The APR tied into that amount is what should matter most to people. In my case with Cap1, the APRs for used cars is around 3.5% which isn't the best but it certainly isn't sub-prime. Always shop around for financing just be conscious of the potential hard pulls. Since this was a SP Pre-Qual, I was curious what Cap1 would offer in comparison to my credit union. Pretty close.

I totally agree. I went in with an interest rate from my credit union. Wanted used to let someone else take the depreciation. I let them try to match the CU, I should have gone with my first instinct and just walked the check over to them from the CU. Appreciate the visual.