- myFICO® Forums

- Types of Credit

- Credit Card Approvals

- Chase FU Approval (First Chase Card)

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chase FU Approval (First Chase Card)

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase FU Approval (First Chase Card)

I have received the HP today and decreased my points from 755 to 752, so only -3 points on EX.

I cant see the TU and EQ currently but probably they would receive a similar decrease.

Thank you for all the kudos!

Credit History 3.5 Year

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase FU Approval (First Chase Card)

@Yacatisma wrote:I have received the HP today and decreased my points from 755 to 752, so only -3 points on EX.

I cant see the TU and EQ currently but probably they would receive a similar decrease.

Thank you for all the kudos!

3 points is nothing! .. Enjoy your new Chase card![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase FU Approval (First Chase Card)

Congrats on your approval and nice SL too!

@Yacatisma wrote:I have a question for you guys.

Does CFU report the ''payments'' to all credit bureaus?

Chase reports to all bureaus the statement balance shortly after statement cut. However (and this is exclusive to Chase), if you pay a Chase card to a zero balance at any time, that zero balance will report immediately. Something to keep in mind if you're practicing AZEO, it's easier to have a non Chase card be the one reporting a non zero balance.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase FU Approval (First Chase Card)

that's good to know!

thanks for that

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase FU Approval (First Chase Card)

@Yacatisma wrote:Hello everyone, a couple of days ago I asked you guys if those offers were legit or not.

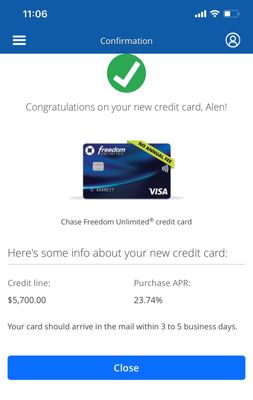

Today I pull the trigger for CFU and instantly approved for $5700.00 starting cli on my first Chase card.

APR seems high but really don't care since I always PIF before statement cuts. %5 cash back on Lyft is going to be an amazing deal for me because I commute to work with Lyft every day.

I have my data points on my signature and have been banking with Chase for 2 years with my DD account. I received a notification from EX telling me that Chase checked my report but there is no HP showing up right now, I will post an update on how it affected my score.

So after my all inquiries (except this one) are cleaned out in 2021, my next target is going to be one of the Amazon cards.

Let me know if you have any questions.

Awesome!! Chase is the nicest lender out there! Enjoy the new relationship ;-)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase FU Approval (First Chase Card)

@Anonymous wrote:

@Yacatisma wrote:Hello everyone, a couple of days ago I asked you guys if those offers were legit or not.

Today I pull the trigger for CFU and instantly approved for $5700.00 starting cli on my first Chase card.

APR seems high but really don't care since I always PIF before statement cuts. %5 cash back on Lyft is going to be an amazing deal for me because I commute to work with Lyft every day.

I have my data points on my signature and have been banking with Chase for 2 years with my DD account. I received a notification from EX telling me that Chase checked my report but there is no HP showing up right now, I will post an update on how it affected my score.

So after my all inquiries (except this one) are cleaned out in 2021, my next target is going to be one of the Amazon cards.

Let me know if you have any questions.

Awesome!! Chase is the nicest lender out there! Enjoy the new relationship ;-)

I would not go as far as saying that they are the nicest lender out there. You see each lender has their own peculiarities which means as long as you play by their rules they will work with you. Now since J.P. Morgan Chase has the largest amount on deposit in the United States they have a conundrum. They cannot let the money sit or it will erode in value. They also cannot recklessly lend as then people will default and or file for bankruptcy causing a massive loss. What this bank can do is look into minor improvements in their system so your life is better. Since they report to the beureu's every day without needing to consolidate to make the volume sending a new zero balance to them is cheap. There is also the chance that they will not need to report a higher balance on the statement date. Almost all the other lenders need to do some consolidation to get the correct volume. Most of the other big banks probably report every other day in larger batches. The smaller banks might be doing 3-5 days. Throwing zero balances in just increases costs because now a batch might have two updates for one account and needs to either be filtered or paid for multiple times. Likewise they can offer better rewards on the cards because they run their own credit processing in house via Chase Paymentech. Think of how little it costs when MasterCard or Visa has no need to handle the transaction because the issuer and acquirer is the same. All in all each issuer has their own ups and downs that make them successful. None are perfect but most of the ones on this board in approvals are decent with some good points.

Active:

Bank of America (Customized Cash Rewards VSC, Unlimited Cash Rewards WMC{PT}), Capital One (Discover It DC, Savor WEMC), Chase (Amazon Prime VSC, Freedom Flex WEMC [x2]), Citi (Custom Cash WEMC, Dividend MC), Citizens GreenSense WMC, Curve WEMC{S}, FNBO Ducks Unlimited VSC, GBank VSC, Imprint Rakuten AC, PenFed Pathfinder Rewards VSC, Santander Ultimate Cash Back WMC, Synchrony (OnePay Walmart CashRewards MC, PayPal Cashback WMC), UMB Simply Rewards VSC[Milford Federal], US Bank (Cash+ VSC [x2], Kroger Rewards WEMC, Pick n Save/Metro Market Rewards WEMC, Shield VC)

Wishlist: AAA Daily Advantage, AOD Signature, Aven, Bellco Colorado Rewards, Nusenda Platinum Cash Rewards, PCMCU Platinum Rewards, Redstone FCU Signature

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase FU Approval (First Chase Card)

@Anonymous wrote:

Chase reports to all bureaus the statement balance shortly after statement cut. However (and this is exclusive to Chase), if you pay a Chase card to a zero balance at any time, that zero balance will report immediately. Something to keep in mind if you're practicing AZEO, it's easier to have a non Chase card be the one reporting a non zero balance.

So if you paid your chase card to $1, instead of $0 it doesn't immediately report?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase FU Approval (First Chase Card)

@Jazee wrote:

@Anonymous wrote:Chase reports to all bureaus the statement balance shortly after statement cut. However (and this is exclusive to Chase), if you pay a Chase card to a zero balance at any time, that zero balance will report immediately. Something to keep in mind if you're practicing AZEO, it's easier to have a non Chase card be the one reporting a non zero balance.

So if you paid your chase card to $1, instead of $0 it doesn't immediately report?

If your statement balance is $1, Chase will report that, the same as any other statement balance. Chase will additionally report your balance to the credit bureaus any time it is $0, whether on the statement close date or not.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chase FU Approval (First Chase Card)

Congrats on the card!