- myFICO® Forums

- Types of Credit

- Credit Cards

- AMEX Authorized User Pending

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AMEX Authorized User Pending

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Authorized User Pending

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Authorized User Pending

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Authorized User Pending

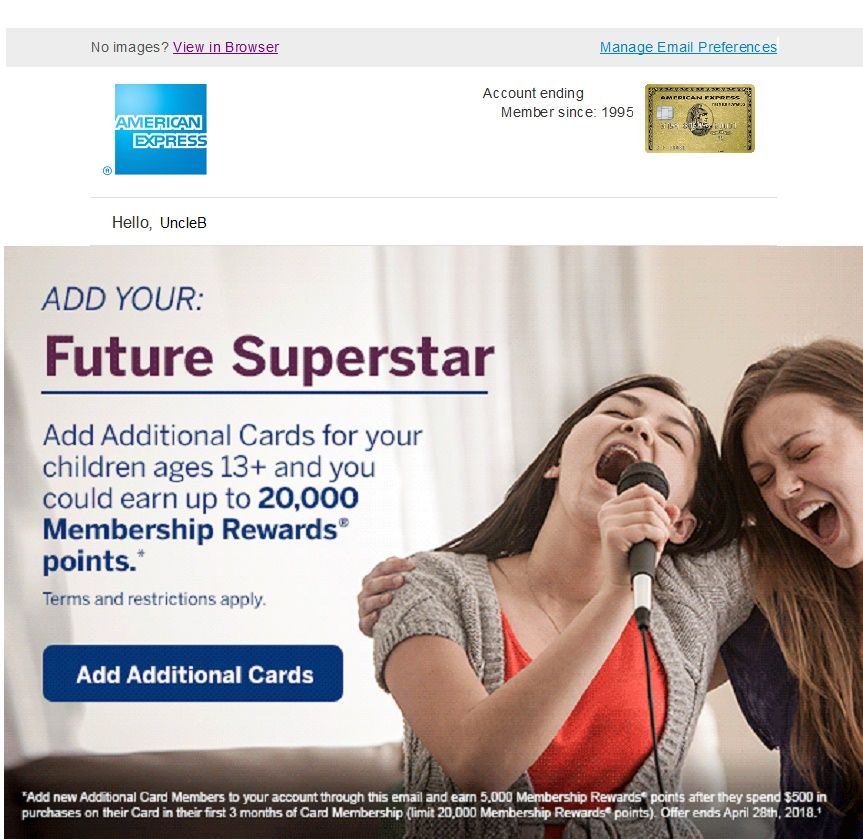

@UncleBwrote:Just FYI... the minimum age for Amex seems to have changed to 13.

They send me this message every month or so; this one is from yesterday:

Can I get SSNs for my 4 dogs? No doubt they could rack up some charges at Petsmart

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Authorized User Pending

@Anonymous or Omaha Steaks which seems to have an endless run with Amex Offers. ![]()

I have set my internal calendar reminder to add the kids when they turn 13. So happy that it's no longer 15! They may be added to DW's CFU and my oldest BoA at a slightly earlier age; will play that by ear with each one's maturity level. Chase and BoA are both lenders that have no minimum age, but as long as the practice of inheriting the entire account history continues, there's no rush. (Of course, Chase and BoA are also both lenders that do not issue different card numbers for AUs.) Even without the Amex backdating, that would give each child an AAoA of 21-22 years at age 18. ![]()

OP, happy that you were able to get this straightened out and kudos to you for helping your child or sibling build a great credit foundation!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Authorized User Pending

@Anonymouswrote:

@UncleBwrote:Just FYI... the minimum age for Amex seems to have changed to 13.

They send me this message every month or so; this one is from yesterday:

Can I get SSNs for my 4 dogs? No doubt they could rack up some charges at Petsmart

lol this reminded me of that one Married with Children episode when Buck the family dog was sent a credit card that the family used like crazy. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Authorized User Pending

@K-in-Bostonwrote:@Anonymous or Omaha Steaks which seems to have an endless run with Amex Offers.

I have set my internal calendar reminder to add the kids when they turn 13. So happy that it's no longer 15! They may be added to DW's CFU and my oldest BoA at a slightly earlier age; will play that by ear with each one's maturity level. Chase and BoA are both lenders that have no minimum age, but as long as the practice of inheriting the entire account history continues, there's no rush. (Of course, Chase and BoA are also both lenders that do not issue different card numbers for AUs.) Even without the Amex backdating, that would give each child an AAoA of 21-22 years at age 18.

OP, happy that you were able to get this straightened out and kudos to you for helping your child or sibling build a great credit foundation!

Shame AMEX is the only lender aside from a few CUs I think to allow complete control of AU limits. I know that was helpful til I trusted my two younger sisters to the point now I don't even think about setting one when I add them. Ah, the troubles we go for our family. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Authorized User Pending

This age change is a nice change.

I grew up with no credit knowledge, and what I accomplished was on my own. Happy to know that i can add my son to a card when he turns 13 (he's 9 now) to help him establish his credit and teach him all about the credit world ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Authorized User Pending

So just to update everyone, I got the email from Amex that the card is confirmed and I see it on my account now. Thank you to everyone here, you're all extremely kind and helpful.

I'm also extremely impressed with Amex's customer service. Makes me wish my parents had set us up with Amex cards a while ago ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Authorized User Pending

@DangerNoodlewrote:So just to update everyone, I got the email from Amex that the card is confirmed and I see it on my account now. Thank you to everyone here, you're all extremely kind and helpful.

I'm also extremely impressed with Amex's customer service. Makes me wish my parents had set us up with Amex cards a while ago

Their customer service is the best IMO.