- myFICO® Forums

- Types of Credit

- Credit Cards

- AMEX Plan It on Charge Cards

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

AMEX Plan It on Charge Cards

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Plan It on Charge Cards

@Remedios wrote:

@NRB525 wrote:

@Remedios wrote:While I dont meet the criteria for talking about Plan because I dont have a charge chard, that would be hella confusing (at least in the beginning ) for anyone who opted not to waste time on the credit card webz

Charge card or AMEX Revolver? Plan It is not yet available on the Charge cards. The example above is from a Hilton revolver. Current state.

Oh. Well

I havent tried it. I see it below the charges, but never really attempted to use it.

So I have a question, if you create a plan, when does the fee show up? After the statement? What happens if you change your mind and pay whole balance, do you still have to pay a fee if its assessed?

With the Plan, the first month the Plan is in effect you get the first Fee, at the time of the statement print. While there remains a Plan balance, then the Fee for that Plan is assessed each month. However, if you have a long term Plan, that goes say 18 to 24 months, and you pay off the Plan amount within a few months, the Fee stops once that Plan goes to zero.

That's what turns it into a nice short-term financing option: You have the flexibility to pay it off, and the Fee rate, on the original balance, usually is not too high for those months you have it. Plus, the Plan balance can stay on the card, and you still earn rewards on the other AMEX spend on that card, without being charged interest on the rest of your PIF card activity.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Plan It on Charge Cards

There seems to be some question from posters as to what kind of equivalent interest rate a Plan It program has. This varies from account to account based on AMEX's assessment of the risk. But it is easy to calculate the rate, just use an interest rate calculator:

https://www.calculator.net/interest-rate-calculator.html

Just put the dollar amount of the plan, the term and the monthly payment in and it will calculate the equivalent interest rate for the plan. You'll find it usually way lower than the normal APR if you carry a balance. It's a good way to carry a balance to smooth out the payback.

My Plan It rate right now is 5.4% compared to the normal revolving APR of 11.74%. A no brainer.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Plan It on Charge Cards

And, after calculating the Plan It rate, realize the rest of the spend going to the card is interest-free unless you decide to create another Plan.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Plan It on Charge Cards

Yesterday there was a small rain forest in my letter box fom Amex regarding BCE. There is some new way of computing minimum payments beginning at some date. I pay in full so really don't care. Goes without saying that my identifiers are on each page of that little rain forest so I stood by the shreader appreciating all the mailings from Amex.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Plan It on Charge Cards

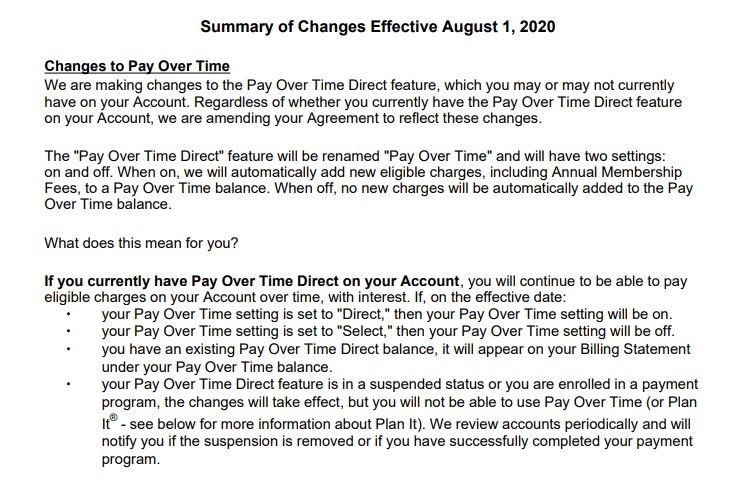

Checking my Gold statement today, and there is indeed a change to Pay Over Time being either "ON" or "OFF". If you are in POT Direct now, the switch will be to POT being On. If in POT Select ( as my charge cards are ) then POT will be set Off. So a specific request will be needed if POT is Off, to move items into POT. Which is usually quite crazy since the APR on POT is generally usurious.

Waiting to see now how the Plan It function is added, and the changes to the Autopay selectors to use Adjusted Balance.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Plan It on Charge Cards

My Green card statement cut a few days ago, so that card is switched over to have "Plan It" and "Pay It" available on the iPhone app.

Test-planning a $262 charge we did for two kayaking life jackets, the Plan It fees are:

3 months total fee $6.12 or 2.3% total

6 months total fee $12.12 or 4.6% total

12 months total fee $25.44 or 9.7% total.

So my Green card now has a LOC with a 10% APR. Technically it works out to a higher rate APR, because as the Plan It balance is paid down, the effective interest rate on the lower balances is higher, but it's much better than the 18.99% on the POT that went away.

Also, the Autopay options now include an "Adjusted Balance" option which pays in full the non-Plan It new charges, and the Plan It payment amounts for all active Plans.

AMEX rocks.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Plan It on Charge Cards

I've not seen this show up on my Gold card as yet, so I'm thinking this might be targeted. Probaly to people actually using their cards. lol

In fact I was just on their the other day checking my ED Plan It balance and to PIF, and just before that I thought i'd look at the Plan it breakdown they usually have at the top of the page. Unfortunately it had an error, the same error I've been seeing the last two weeks.

However, this last time I noticed that it automatically switched to the Gold Card which doesn't have a balance or Plan it terms. So I think there is some kind of glitch in the system for me where when I click on the plan it link it takes me back to my home card.

Tomorrow is the last day for free plan it and it almost pains me that I couldn't take advantage of it. lol

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Plan It on Charge Cards

@NRB525 wrote:I think Plan It is probably popular in the AMEX revolvers. POT is marketed using an APR in the 20% range, probably not popular.

Plan It uses a smaller number for the "monthly fee rate" which has better optics to customers. The "create a Plan" steps where the cardholder reviews the offer is much more transparent than the POT method.

POT APRs vary by profile. Mine are much lower, I think 14.74% with the last change in prime rate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: AMEX Plan It on Charge Cards

@jamesdwi wrote:Make you turn off the auto-transfer to pay-over time, The updates, make seems like everything over $100 is moved to Pay Over Time with a nice fee up to 1.3%, if you don't plan on using it, you could get killed on fees if you leave auto mode on.

I've had it enabled for 15 years. The "Select and Pay Later" which requires you to manually choose balances to pay over time is the only one that works that way. Automatic POT balances do not accrue interest or fees as long as the statement balance is paid.