- myFICO® Forums

- Types of Credit

- Credit Cards

- APR yikes!!! ... is something off?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

APR yikes!!! ... is something off?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

APR yikes!!! ... is something off?

I applied for a Huntington Voice card yesterday and was immediately approved online. I was finally able to get through today and get my starting CL and APR. HNB has two options for their Voice (no rewards advertising a lower APR between 9.99 to 20.99 and a 3X rewards option with a higher APR between 12.99 to 23.99). I opted for the 3X rewards.

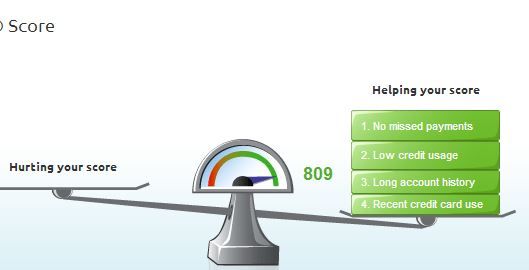

First, I'll say I never go into a CC app with a sense of entitlement. I'm happy about the opportunity of creating a relationship with a financial institution. That said, I've been gardening for a long time and have worked hard to get over 800 (it took years). I went into the app with the following:

809 EQ (what they pulled), AAoA 6 years, no derogs at all, income 47K, 1% util, 0 inquiries in the past year, DTI 17%. I have three other CC's reporting and a student loan and Chase auto loan.

I was expecting my first 5K limit with an APR closer to the low end of the range (12.99'ish). They gave me a starting CL of $2.1K and an APR of 20.99%

Does the APR seem high? I've never gone into a CC app with a decent score so my 24.99 CapOne cards is all I know. I think the CL is horrible and the APR seems really high. I mean, don't they say your APR is "based on credit worthiness"? Is that what an 800+ gets you? I'm seriously confused and honestly regret this app. I feel like the low CL and APR tells me they really didn't even want me as a customer and honestly, I'm considering just closing the card as soon as I get it.

Am I expecting too much? Any insight would be greatly appreciated.

** Here's what I think it is but not totally sure. I had an auto loan with them back a few years ago when my credit was not as good (630'ish). Could that be it? I was never late and even paid extra every month but I guess they could have an old report on file.

FICO SCORES: TU 769; EX 790; EQ 790 ***Gardening indefinitely***

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

The APR decision is made based on the info in the pull for the card, to me it is high for your profile but if you PIF who cares, use it and in 1 year request 12.99% Huntington Bank has just come back into the CC issuing business and they very well may be gun shy in giving out high limits with low APR. You can always call them and make noise too.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

@gdale6 wrote:The APR decision is made based on the info in the pull for the card, to me it is high for your profile but if you PIF who cares, use it and in 1 year request 12.99% Huntington Bank has just come back into the CC issuing business and they very well may be gun shy in giving out high limits with low APR. You can always call them and make noise too.

Thanks shock and gdale. How might one approach that? Ask them what it takes to get a 12.99? I'm interested to see "the price you pay for credit" when it comes.

FICO SCORES: TU 769; EX 790; EQ 790 ***Gardening indefinitely***

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

Like I mentioned, I'm curious to see their "price you pay for credit" and see what's listed as affecting their decision and pricing. When I got approved for AMEX, they sent me a mirror copy of what I purchased on myFico with the exact same score. I just wonder if the negative items affecting your score shows anything. It don't on here. Thanks for everyone's responses thus far.

FICO SCORES: TU 769; EX 790; EQ 790 ***Gardening indefinitely***

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

@axledobe wrote:Like I mentioned, I'm curious to see their "price you pay for credit" and see what's listed as affecting their decision and pricing. When I got approved for AMEX, they sent me a mirror copy of what I purchased on myFico with the exact same score. I just wonder if the negative items affecting your score shows anything. It don't on here. Thanks for everyone's responses thus far.

if you find out I would love to know it too. Chase accepted me with EQ Fico of 793 but with an internal score of 681 and got me 22,99% APR..their worst terms for the Freedom ...it's my first card from Chase![]() ...Does Huntinton also use internal scores?

...Does Huntinton also use internal scores?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

@lg8302ch wrote:

@axledobe wrote:Like I mentioned, I'm curious to see their "price you pay for credit" and see what's listed as affecting their decision and pricing. When I got approved for AMEX, they sent me a mirror copy of what I purchased on myFico with the exact same score. I just wonder if the negative items affecting your score shows anything. It don't on here. Thanks for everyone's responses thus far.

if you find out I would love to know it too. Chase accepted me with EQ Fico of 793 but with an internal score of 681 and got me 22,99% APR..their worst terms for the Freedom ...it's my first card from Chase

...Does Huntinton also use internal scores?

lg- Wow. With my lowest score (EX), Chase's prequal link offered me 18.99 on the Freedom but I opted out for other cards. For a 793, you would think you qualify for the best terms they offer. HNB must have some type of internal scoring system or they are holding an old report/score against me unannounced. Have you called Chase to ask about it?

FICO SCORES: TU 769; EX 790; EQ 790 ***Gardening indefinitely***

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

After a year I would talk with Huntington. They aren't a major major lender, so I assume they are more customer oriented and also more flexible when it comes to increases, APR reduction and things like that. Much like how a credit union is more flexible I guess. I hope I'm using that logic correctly.

If I were in your given situation, I would put lots of spend on it for 6 months. Then call them, go in branch or whatever it takes and just give them the low down. Nothing too fancy, but the real problem. "I appreciate the opportunity have enjoyed establishing a relationship with you. Although I have no problem with the card itself, I do feel that it doesn't fit my credit profile/doesn't suit my needs...etc etc"

The reason I say spend heavily is because they are more likely to help you if you are a profitable customer. Praise them and tell them they are good. Stroking a few ego's won't hurt. And then just take it from there.

If they require a hard pull for CLI, it's up to you. If they don't give you what you want, you can axe them if you choose to do so.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

@Shock wrote:After a year I would talk with Huntington. They aren't a major major lender, so I assume they are more customer oriented and also more flexible when it comes to increases, APR reduction and things like that. Much like how a credit union is more flexible I guess. I hope I'm using that logic correctly.

If I were in your given situation, I would put lots of spend on it for 6 months. Then call them, go in branch or whatever it takes and just give them the low down. Nothing too fancy, but the real problem. "I appreciate the opportunity have enjoyed establishing a relationship with you. Although I have no problem with the card itself, I do feel that it doesn't fit my credit profile/doesn't suit my needs...etc etc"

The reason I say spend heavily is because they are more likely to help you if you are a profitable customer. Praise them and tell them they are good. Stroking a few ego's won't hurt. And then just take it from there.

If they require a hard pull for CLI, it's up to you. If they don't give you what you want, you can axe them if you choose to do so.

I think this is great advice and I appreciate your response, shock. I have a small issue with large spend on the card, though. I have minimums to meet with both AMEX and Citi over the next three months, Citi AAdvantage being first. Unless I go on a shopping spree (which won't happen), the Voice likely going to see utility bill use only for a while. I may just give it some time. I don't know why but I feel like the APR is just a punch in the gut. Maybe I'm taking it too personal.... maybe not. I think there is a fine line between protecting yourself as a lender and insulting potential good customers. Being brand new to the prime world, I'll probably lay down and take it but I'd like to see what someone older than myself with an 800+ and much higher AAoA with long term experience with prime cards would say about that APR.

FICO SCORES: TU 769; EX 790; EQ 790 ***Gardening indefinitely***

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: APR yikes!!! ... is something off?

@axledobe wrote:I applied for a Huntington Voice card yesterday and was immediately approved online. I was finally able to get through today and get my starting CL and APR. HNB has two options for their Voice (no rewards advertising a lower APR between 9.99 to 20.99 and a 3X rewards option with a higher APR between 12.99 to 23.99). I opted for the 3X rewards.

First, I'll say I never go into a CC app with a sense of entitlement. I'm happy about the opportunity of creating a relationship with a financial institution. That said, I've been gardening for a long time and have worked hard to get over 800 (it took years). I went into the app with the following:

809 EQ (what they pulled), AAoA 6 years, no derogs at all, income 47K, 1% util, 0 inquiries in the past year, DTI 17%. I have three other CC's reporting and a student loan and Chase auto loan.

I was expecting my first 5K limit with an APR closer to the low end of the range (12.99'ish). They gave me a starting CL of $2.1K and an APR of 20.99%

Does the APR seem high? I've never gone into a CC app with a decent score so my 24.99 CapOne cards is all I know. I think the CL is horrible and the APR seems really high. I mean, don't they say your APR is "based on credit worthiness"? Is that what an 800+ gets you? I'm seriously confused and honestly regret this app. I feel like the low CL and APR tells me they really didn't even want me as a customer and honestly, I'm considering just closing the card as soon as I get it.

Am I expecting too much? Any insight would be greatly appreciated.

** Here's what I think it is but not totally sure. I had an auto loan with them back a few years ago when my credit was not as good (630'ish). Could that be it? I was never late and even paid extra every month but I guess they could have an old report on file.

IMO, it seems high for your profile. My Discover It card is at 22.99% and they won't budge, even with my 800 TU score, which is presumably what they pull. I PIF, so I don't care, but it is the "principle" of the matter...lol.