- myFICO® Forums

- Types of Credit

- Credit Cards

- Amex Overpayment

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Amex Overpayment

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Overpayment

So weird you can't get major credit limit increases running so much through your cards.

Are you not able to show sufficient income?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Overpayment

@GatorGuy wrote:So weird you can't get major credit limit increases running so much through your cards.

Are you not able to show sufficient income?

Below is a snippet from a prior discussion, but I'm sure the OP can elaborate further on their profile.

https://ficoforums.myfico.com/t5/Credit-Cards/Best-credit-card-for-travel/m-p/6300062#M1773674

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Overpayment

@FinStar wrote:

@GatorGuy wrote:So weird you can't get major credit limit increases running so much through your cards.

Are you not able to show sufficient income?

Below is a snippet from a prior discussion, but I'm sure the OP can elaborate further on their profile.

https://ficoforums.myfico.com/t5/Credit-Cards/Best-credit-card-for-travel/m-p/6300062#M1773674

I read that whole thread. 😂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Overpayment

@GatorGuy wrote:

@FinStar wrote:

@GatorGuy wrote:So weird you can't get major credit limit increases running so much through your cards.

Are you not able to show sufficient income?

Below is a snippet from a prior discussion, but I'm sure the OP can elaborate further on their profile.

https://ficoforums.myfico.com/t5/Credit-Cards/Best-credit-card-for-travel/m-p/6300062#M1773674

I read that whole thread. 😂

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Overpayment

@FinStar wrote:

@GatorGuy wrote:So weird you can't get major credit limit increases running so much through your cards.

Are you not able to show sufficient income?

Below is a snippet from a prior discussion, but I'm sure the OP can elaborate further on their profile.

https://ficoforums.myfico.com/t5/Credit-Cards/Best-credit-card-for-travel/m-p/6300062#M1773674

Well it turns out I fell victim to the typical chase didn't check my credit profile and decided to check it more thoroughly two months in, OR I triggered a fraud alert when I used my Wisconsin DL to open an account in NJ where I had moved to not too long prior with a NJ address and they didn't like that, because I had all my accounts terminated with them not just my CC (they closed my checking and I was like **bleep**? Let me open another one online! And that triggered both accounts to be closed) now the reason for checking being closed was fraud they stated that, for the cc? Was it just a coincidence that it closed at the same time? Maybe? But they said it was due to high balances on chase account (I did a balance transfer because why wouldn't I? I got a BT promo offer) and high util overall and nr of inquiries (they knew that when I applied for the card... it was the only card I applied for at the time so nothing drastic changed on my profile and I can only assume it was negligence on their part for opening the account in the first place.

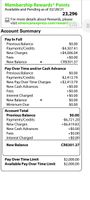

And just so you guys can see those are my citi and Amex statements to give you an idea of how much I put through the cards and my limits (amex is a 2k preset limit) citi got raised to 4k a few months ago from 2500. I'd be putting more through amex but sometimes I get fed up having to wait 20 minutes on the phone for them to call my bank to see if my previous payments went through (I eat out every night and sometimes it's 2-3 1.5k plus dinners in a row meaning I'd have to pay the card off every night then they freak out about my payments not clearing and block all charges until payment verification or balance check) end up just using my WF cc because at least being a transfer from my bank account they'll let me pay and spend the money right away (have wf checking)

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Overpayment

You have to decide what's important to you. If it's cars while you cannot increase your limits, that's your choice.

You can take advice, or you can continue doing same thing, without change in outcome.

You just have to decide what's important to you and stick with it.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Overpayment

@Remedios wrote:You have to decide what's important to you. If it's cars while you cannot increase your limits, that's your choice.

You can take advice, or you can continue doing same thing, without change in outcome.

You just have to decide what's important to you and stick with it.

Indeed, and I do appreciate the advice, and I'm sorry if I come out to be hard-headed I was just trying to see if I had any other options honestly... in any case I currently don't have a car so no matter what I'm going to have to purchase one, then I can focus on dropping my inquiries and "rebuild". I guess I always figured if most inquiries were over a year old it didn't really matter that much, but obviously that's not the case.

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Overpayment

On some profiles it doesn't really matter, but it doesn't seem like that's the case for you.

I don't think you're being hard headed, you are trying to combine what's good for your credit and what you think it's good for you.

Sometimes those two aren't in synch.

Since that isn't happening, do what you need to do then garden.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Overpayment

@Remedios wrote:On some profiles it doesn't really matter, but it doesn't seem like that's the case for you.

I don't think you're being hard headed, you are trying to combine what's good for your credit and what you think it's good for you.

Sometimes those two aren't in synch.

Since that isn't happening, do what you need to do then garden.

I guess the age of my profile isn't helping either...

Haha yeah I suppose you're absolutely right😅😅. I just want the best of both worlds and that just isn't possible right now...

Discover it cashback: $10900

Citi DC: $13000

WF Propel: closed 2k

Amex BCED: $3000

Amex Gold: $NPSL

Amex Plat: NPSL

Cap1 QS: $3200

Cap1 VX $50k

VS CC: $2900

Kohls: $3000

Synchrony car care: $3000

citi best buy visa: $8500

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Amex Overpayment

Well, we don't really need purchase protection or warranty with restaurants, so perhaps use debit for those bills for a while?

Was your Chase account closure of your only checking account? That might crimp the above, but another checking bank would set that up.

Did you indicate there is another IV coming up with AMEX? If you can get that verification completed, get the hard limit removed from the Gold card, that would be a big help to you. Then you aren't cycling so many payments and allow the NPSL to adjust to your spend patterns. Even if they don't initially approve, or it drags out in time, I'd suggest being patient, as the NPSL is intended for big spenders.

I'd also suggest doing an honest review of what caused Chase to close accounts. Look at it from Chase's perspective and try to see where they may see risk, how it might have looked like fraud. Even if you know all the facts, the banks do not, and are forced to make decisions on less than perfect data.

Oct 2014 $46k on $127k 36% util EQ 722 TU 727 EX 727

April 2018 $18k on $344k 5% util EQ 806 TU 810 EX 812

Jan 2019 $7.6k on $360k EQ 832 TU 839 EX 831

March 2021 $33k on $312k EQ 796 TU 798 EX 801

May 2021 Paid all Installments and Mortgages, one new Mortgage EQ 761 TY 774 EX 777

April 2022 EQ=811 TU=807 EX=805 - TU VS 3.0 765