- myFICO® Forums

- Types of Credit

- Credit Cards

- Best CU CCs?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Best CU CCs?

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best CU CCs?

@CL-Addiq wrote:My new Alliant statement cut a few days ago. Cash out starts at $50 and is available on $1 increments. You can deposit to savings, checking, or a statement credit. Savings and checking require you to copy paste your account numbers into the cashback portal. (Just like with Affinity.)

The way cashback is calculated is deeply disappointing to me. I had read cashback is rounded to the nearest dollar, and I was hoping that meant the input, but it is indeed the output. My first statement I spent $25. At 2.5% cashback, that should be 62.5c and round up to $1 right? Wrong! Cashback is not calculated at 2.5% it is calculated as 1.5% and rounding to the nearest dollar and and then a second calculation at 1% that also rounds.

What does this mean for potential cash back rates?

.01-33.33 => 0% cashback!

33.34 => ~3% cashback

49.99 => ~2% cashback

50.00 => 4% cashback

99.99 => ~2% cashback

100.00 => 3% cashback

149.99 => ~2% cashback

150.00 => ~2.7% cashback

233.33 => ~2.1% cashback

233.34 => ~2.6% cashback

249.99 => ~2.4% cashback

250.00 => 2.8% cashback

These are for your total balance at the end of the month. There are cases when spending anything from 1c to $33.33 will net you $0. It's also theoretically possible to make a charge for 1c and get $1 meaning that transaction was worth 10,000% cashback, but that's just preposterous!

Given that I value TYP on my CDC at at least 1.08cpp, there are quite a few scenarios where I could come out behind. There are also cases where I could come out ahead, but I'm not much of a gambler. My plan is to use the card only for large transactions (>$250) and foreign transactions.

@CL-Addiq This is extremely interesting! Thank you so much for sharing these details.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best CU CCs?

@CL-Addiq wrote:

The way cashback is calculated is deeply disappointing to me. I had read cashback is rounded to the nearest dollar, and I was hoping that meant the input, but it is indeed the output. My first statement I spent $25. At 2.5% cashback, that should be 62.5c and round up to $1 right? Wrong! Cashback is not calculated at 2.5% it is calculated as 1.5% and rounding to the nearest dollar and and then a second calculation at 1% that also rounds.

What does this mean for potential cash back rates?

.01-33.33 => 0% cashback!

33.34 => ~3% cashback

49.99 => ~2% cashback

50.00 => 4% cashback

99.99 => ~2% cashback

100.00 => 3% cashback

149.99 => ~2% cashback

150.00 => ~2.7% cashback

233.33 => ~2.1% cashback

233.34 => ~2.6% cashback

249.99 => ~2.4% cashback

250.00 => 2.8% cashback

These are for your total balance at the end of the month. There are cases when spending anything from 1c to $33.33 will net you $0. It's also theoretically possible to make a charge for 1c and get $1 meaning that transaction was worth 10,000% cashback, but that's just preposterous!

Given that I value TYP on my CDC at at least 1.08cpp, there are quite a few scenarios where I could come out behind. There are also cases where I could come out ahead, but I'm not much of a gambler. My plan is to use the card only for large transactions (>$250) and foreign transactions.

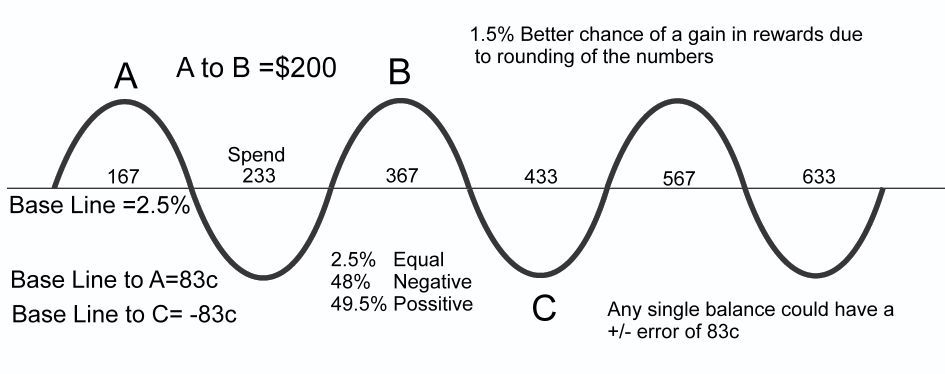

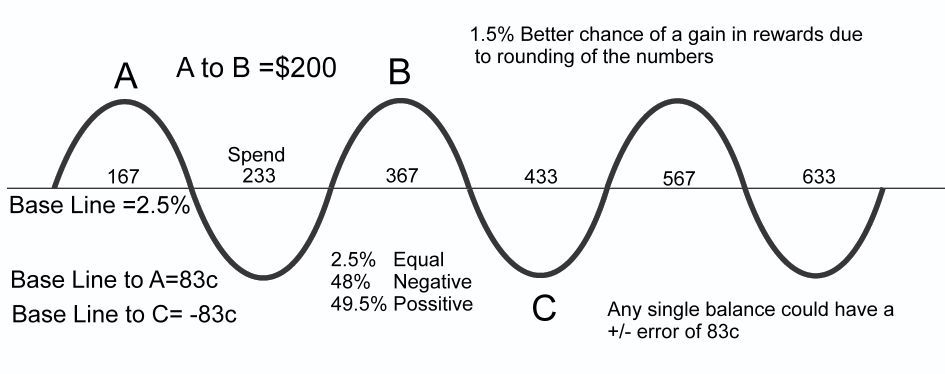

Looking at percentages is very misleading.

The money difference from the base line of 2.5% is what matters.

Maximum error is ~0.83, yes +/- 83 cents.

From you chart for the $50 with 4%

50*0.025 = 1.25

50*0.015 = 0.75 rounded = 1

50*0.01 = 0.50 rounded = 1

Yes $2 on $50 spend is 4%, it also is only 75c from the base line

2.00 rewards - real 2.5% of 1.25 = 75c error

Every month +/- a few cents, just as likely a gain as a loss.

Only real threshold is to spend more than the $33, that is where you hit the 83c loss.

It is not a card for the sock drawer.

Just spend 50 every month and make 75c on them

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best CU CCs?

I got interested in the CU rounding the rewards.

Never had a rewards system do this.

Wondered if some how it benefited them except with the even reward earnings.

It swings an even amount both positive and negative and has a cycle.

Other than the sock drawer issue it has no major advantage or disadvantage.

{Edit}

Calculating every value between 0 and $10,000 it gives a very small advantage to the customer.

A 0.75% (0.0075 as decimal) superior chance of coming out ahead of the base 2.5%

High / Low spend points

--------------------------------------------

Spend Gain/Loss

33 -0.825

167 0.825

233 -0.825

367 0.825

433 -0.825

567 0.825

633 -0.825

767 0.825

833 -0.825

967 0.825

1033 -0.825

1167 0.825

1233 -0.825

1367 0.825

" "

You can always win an extra 25c to 83c by:

Even 100 ending between 50-70 or 90-99

{ 460 or 494 }

Odd 100 ending between 0-10 or 67-90

{ 305, 370 }

** If one want's to play for a few extra cents. **

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best CU CCs?

@CL-Addiq wrote:This wasn't really my intention when creating this thread, but I went ahead and went on an App Spree for all five cards mentioned. I figured I'd share my experience for others. For each, my intention was to directly apply for the credit card, not apply for the credit union and then apply for the credit card at a later date.

Alliant - Incredibly simple, fully automated, single form process. Transperian pull. They paid the $5 deposit.

Langley - Initial application relatively simple. Equifax pull. Received a call a couple days later and needed to provide paystub via email and do docusign. Paid $5 deposit via ACH.

Affinity - Application pretty straight forward. Paid $5 deposit via ACH. Experian pull. Followed up the next day to get a second paystub which was noted as optional on app. Systems were confusing whether the credit card application was received. I've been told it's in, but haven't gotten a response yet. (Maybe a bad sign!)

Nusenda - More challenging application. Experian pull. Required a few calls and emails. Everyone I've spoken to have been extremely helpful, but there have been a couple delays. $5 deposit via ACH, but had to work directly with an agent to provide proof of $10 donation and do docusign.

Abound - Originally seemed simple with quick docusign the next day. However, no credit pull after a week. I called and found out the credit card application wasn't received. Refiled that. Transperian pull. Need to snail mail a check for $5 deposit and $10 donation.

All of them require a little extra patience in the application process. If they all get approved, I'll report back on ease of use of the cards themselves.

Were the pulls for membership, only for the credit card apps, or a mixture of both?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best CU CCs?

@Catbird_Seat wrote:Were the pulls for membership, only for the credit card apps, or a mixture of both?

Thanks!

My intention was to apply for the card at the same time as membership. I vaguely recall at least one stating they did a soft pull when applying to the CU. I can report that none did a double pull. I suspect that none did a hard pull just for membership, but I could be wrong.

Goals:

Goals:

Wishes:

Wishes:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best CU CCs?

Not sure if this was mentioned in this thread or not, but:

USAlliance has a pretty neat credit card right now.

3% on everything until the end of 2022. Starting 01/01/23, I believe this reverts to a 2% everything card.

6% on grocery stores until the end of 2023.

No Annual fee.

The signup process is a bit cumbersome but if a blind dolt like myself can figure it out you can, too.

Also now that I'm a member - they have a 3% savings account with no minimums, and....drumroll....

An 11 month "No penalty" CD at 4%. I've had several chats with their support staff. It is exactly what it sounds like it is.

Bonus: The staff is very friendly the 3 times I called. 2 of these 3 were because I didn't read something carefully.

Negatives: Their website appears to be going after the "1995 NASA" look. No Zelle. Only do cashback in $25 increments.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best CU CCs?

@Kforce wrote:

@CL-Addiq wrote:

The way cashback is calculated is deeply disappointing to me. I had read cashback is rounded to the nearest dollar, and I was hoping that meant the input, but it is indeed the output. My first statement I spent $25. At 2.5% cashback, that should be 62.5c and round up to $1 right? Wrong! Cashback is not calculated at 2.5% it is calculated as 1.5% and rounding to the nearest dollar and and then a second calculation at 1% that also rounds.

What does this mean for potential cash back rates?

.01-33.33 => 0% cashback!

33.34 => ~3% cashback

49.99 => ~2% cashback

50.00 => 4% cashback

99.99 => ~2% cashback

100.00 => 3% cashback

149.99 => ~2% cashback

150.00 => ~2.7% cashback

233.33 => ~2.1% cashback

233.34 => ~2.6% cashback

249.99 => ~2.4% cashback

250.00 => 2.8% cashback

These are for your total balance at the end of the month. There are cases when spending anything from 1c to $33.33 will net you $0. It's also theoretically possible to make a charge for 1c and get $1 meaning that transaction was worth 10,000% cashback, but that's just preposterous!

Given that I value TYP on my CDC at at least 1.08cpp, there are quite a few scenarios where I could come out behind. There are also cases where I could come out ahead, but I'm not much of a gambler. My plan is to use the card only for large transactions (>$250) and foreign transactions.

Looking at percentages is very misleading.

The money difference from the base line of 2.5% is what matters.

Maximum error is ~0.83, yes +/- 83 cents.

From you chart for the $50 with 4%

50*0.025 = 1.25

50*0.015 = 0.75 rounded = 1

50*0.01 = 0.50 rounded = 1

Yes $2 on $50 spend is 4%, it also is only 75c from the base line

2.00 rewards - real 2.5% of 1.25 = 75c error

Every month +/- a few cents, just as likely a gain as a loss.

Only real threshold is to spend more than the $33, that is where you hit the 83c loss.

It is not a card for the sock drawer.

Just spend 50 every month and make 75c on them

@CL-Addiq @Kforce I looked at your chart and am not clear on the issue. Can you confirm for me if $100 spend is $2.50? I was set to get this card, but I want to make sure I know it definitely gives 2.5% cash back. Also, you mentioned something about rounding to the nearest $1. What credit cards do this? I don't think I have any that function in this way. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best CU CCs?

@credit8502020 wrote:@CL-Addiq @Kforce I looked at your chart and am not clear on the issue. Can you confirm for me if $100 spend is $2.50? I was set to get this card, but I want to make sure I know it definitely gives 2.5% cash back. Also, you mentioned something about rounding to the nearest $1. What credit cards do this? I don't think I have any that function in this way. Thank you!

This is my version as a graph

Your rewards are based on the statement balance, and the math uses two rounding of numbers.

This means only 2.5% land on 2.5% rewards exactly.

Majority float both above and below the 2.5% calculation in a cycle of $200 spend

Because of the number 5 rounding up, there is a higher percentage of positive outcomes.

You would rarely see exact 2.5% but in the long run likely not be losing money.

Maximum error is 83 cents for any statement.

Gain and loss monthly an average of ~42c, with month to month probability to make a penney

If you want to see exactly 2.5%, NO, does it average 2.5% rewards? YES

Only real problem would be for those that want it as a sock drawer card.

You need more than $33 a month spend to get into the cycle of ~(even up/down spend)

It is always a loss <= $33 per month spend.

Because of the pattern one can calculate the spend needed if going for every $

Spend $167 every month and gain 83c

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Best CU CCs?

@Kforce wrote:

@credit8502020 wrote:@CL-Addiq @Kforce I looked at your chart and am not clear on the issue. Can you confirm for me if $100 spend is $2.50? I was set to get this card, but I want to make sure I know it definitely gives 2.5% cash back. Also, you mentioned something about rounding to the nearest $1. What credit cards do this? I don't think I have any that function in this way. Thank you!

This is my version as a graph

Your rewards are based on the statement balance, and the math uses two rounding of numbers.

This means only 2.5% land on 2.5% rewards exactly.

Majority float both above and below the 2.5% calculation in a cycle of $200 spend

Because of the number 5 rounding up, there is a higher percentage of positive outcomes.

You would rarely see exact 2.5% but in the long run likely not be losing money.

Maximum error is 83 cents for any statement.

Gain and loss monthly an average of ~42c, with month to month probability to make a penney

If you want to see exactly 2.5%, NO, does it average 2.5% rewards? YES

Only real problem would be for those that want it as a sock drawer card.

You need more than $33 a month spend to get into the cycle of ~(even up/down spend)

It is always a loss <= $33 per month spend.

Because of the pattern one can calculate the spend needed if going for every $

Spend $167 every month and gain 83c

@Kforce Ok. Thank you