- myFICO® Forums

- Types of Credit

- Credit Cards

- BofA Premium Rewards Incidental Credit

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

BofA Premium Rewards Incidental Credit

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BofA Premium Rewards Incidental Credit

@imaximous wrote:

@simplynoir wrote:

@imaximous wrote:These incidental credits in general can be very inconsistent from airline to airline, and sometimes even with the same airline. I've heard of many legitimate charges that don't trigger the credit, and people have to call customer service to get them manually applied. Then, others buy actual plane tickets for cheap and get the credit. BoA says seat or cabin upgrades don't qualify, and I've done it with United more than once (economy to premium). Same with award tickets.

IDK, I just use the card, cross my fingers and hope for the best. lol.

I'm pretty confident they have a bunch of people in a room throwing darts at a board to see what sticks for a particular day/week/month to trigger the credit

Ha! Pretty sure they use the same sophisticated technique to put a purchase within a bonus category.

We call that the AMEX special around these here parts ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BofA Premium Rewards Incidental Credit

@Anonymous wrote:

@wasCB14 wrote:@Anonymous

This is a response to your Private Message. I'm answering you publicly so that, should you decide to share more details, others can weigh in. I can't really answer your quantitative question without more data.

The general question is whether to focus on a BofA cash back system vs. a Chase trifecta. And, separately, comparing CSP to CSR.

If the AA $100 GC doesn't work, can you use the full BofA credit through another way?

What is your CSP CL? PCing to CSR requires at least $10k

When did you get your CSP? You might not be eligible for a CSR bonus anytime soon.

What airlines do you fly? How willing are you to book flights in uncommon ways, like over the phone or through alliance partners?

How do you use, or plan to use UR points? What point values do you get or anticipate? Maybe look at a few hypothetical bookings to get an idea.

What is your current BofA Preferred Reward tier? How soon do you expect to reach the Platinum Honors tier?

I won't post them here, but you may wish to repeat your travel and dining spend.

Other than the $300 travel credit, are there any CSR perks you might use like Priority Pass, trip delay coverage, or primary rental coverage?

At first glance, it's not obvious to me which system you should focus on. You also may be near the boundary of value between CSP and CSR. That being the case, you might also consider just accumulating a few no-AF cash back cards and occasionally getting a nice bonus, closing or downgrading as practical.

A few general thoughts...

1. BofA Premium can be a tougher card to get than Cash Rewards. A lot of people who have it have strong profiles and high income/assets.

2. I don't rely too heavily on projections of long-term spending and travel redemptions. Life changes and unexpected stuff can happen. I try to start each new account with a nice bonus. After a year or so, if I can't justify a card with back-of-the-envelope math in a minute or two, the card goes (via PC to no AF or an account closure).

I would be able to use the $100 credit on other expenses besides the AA gift card not a problem. I’m not loyal to any airline. Like I mentioned in my message, my thinking six months ago when I got the CSP was because I was interested in a travel card and it seemed that UR would provide me with the best value as I would be able to redeem them at a good value at Hyatt for example. I also mentioned that I was considering doing the trifecta to rack up UR quicker. The CSR was mentioned simply because before the recent fee hike most people recommended doing the CSR trifecta instead of the CSP because it was just a $55 difference, which is why I was possibly considering it. Now with the changes I dismissed the idea of getting it because I would not use Lyft or the DoorDash credit like I mentioned in my message. Now in six months that I’ve had the CSP I’ve spent $5,000 in travel and $1,465 in dinning so far. Now due to this, I’m wondering if the trifecta with the CSP would be more beneficial for me or if I should get the PR card.

In regards to actually getting the PR, I believe I have a good chance. I currently have an offer for it under my special offers and when I look at the terms I have a solid APR. In regards to question about the preferred rewards program I will be achieving platinum status this year. Following your general thought I will be considering after I hit the 1 year mark with my CSP if it is worth keeping and pursuing the trifecta or if it would be better for me to just do cash back with the PR.

I'd go for the BofA option, and maybe do a little bonus chasing now and then on the side.

When you reach Platinum ($50k) and eventually Platinum Honors ($100k) the PR/CR combo will really shine. You'll be getting clear value for your AF, and it doesn't really sound like you'd get that with Chase.

You might also look at the $95 Hyatt card. If your first thought with URs is to transfer them to Hyatt, you can get a similar earn rate as CSP. You lose the primary rental coverage (which it sounds like you're not using) and don't have flexibility or the ability to merge points from a Freedom or CFU. You would, however, get a nice bonus and a free night certificate (at renewal, good for one year) useful at low to-mid-category properties. You could recover your AF money pretty easily. I have tended to use it for airport stays (LAX and CLT) before early flights. Not glamorous, but a good value for $95.

The $75 Hyatt card I have is, I believe, closed to new applications. I get the same certificate but a little less in rewards...though I don't spend much on the card in the first place.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BofA Premium Rewards Incidental Credit

@imaximous wrote:

@kudosalert wrote:

@imaximous wrote:

I’ve used my credit for bags, award ticket taxes and upgrades to premium economy.interesting. bags and in flight purchases seems to be the norm to trigger airline credits. good to know BOA lets you claim other expenses. thank you.

These incidental credits in general can be very inconsistent from airline to airline, and sometimes even with the same airline. I've heard of many legitimate charges that don't trigger the credit, and people have to call customer service to get them manually applied. Then, others buy actual plane tickets for cheap and get the credit. BoA says seat or cabin upgrades don't qualify, and I've done it with United more than once (economy to premium). Same with award tickets.

IDK, I just use the card, cross my fingers and hope for the best. lol.

Their card website states they DO cover seat upgrades. I think the fine print states it has to be a separate purchase, though.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BofA Premium Rewards Incidental Credit

@TSlop wrote:

@imaximous wrote:

@kudosalert wrote:

@imaximous wrote:

I’ve used my credit for bags, award ticket taxes and upgrades to premium economy.interesting. bags and in flight purchases seems to be the norm to trigger airline credits. good to know BOA lets you claim other expenses. thank you.

These incidental credits in general can be very inconsistent from airline to airline, and sometimes even with the same airline. I've heard of many legitimate charges that don't trigger the credit, and people have to call customer service to get them manually applied. Then, others buy actual plane tickets for cheap and get the credit. BoA says seat or cabin upgrades don't qualify, and I've done it with United more than once (economy to premium). Same with award tickets.

IDK, I just use the card, cross my fingers and hope for the best. lol.

Their card website states they DO cover seat upgrades. I think the fine print states it has to be a separate purchase, though.

Yup. You're right. I looked on the BofA site again and it does say that. I was most likely confused by all the different cards that offer these credits. ![]()

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BofA Premium Rewards Incidental Credit

@wasCB14 wrote:

@K-in-Boston wrote:

In my experience, the credit has posted when my statement closes. Not sure if anyone on FT made that correlation when it posted almost immediately for some and like a month later for others. I have used mine for upgrades to First each time.Not for me.

12/12 instant approval

12/17 statement closes

12/18 statement ebill available at Schwab

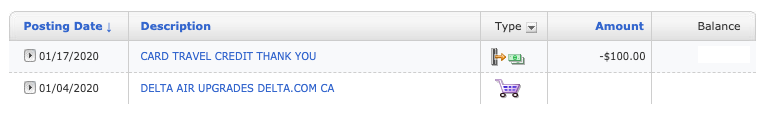

12/25 $100 AA GC purchase (I said 12/27 earlier in error)

12/27 AA GC transaction posted

1/2 $100 "Card travel credit thank you" posts (fwiw, this item gives 12/29 as a "transaction date")

1/10 statement balance paid (4 days before it was due)

1/17 next closing date

No other airport or airline-related activity on the card.

You may have been onto something with your later statement about a special batch being run for December credits. Once again, my experience is that non-December purchases resulted in the credit being issued at statement close. Interestingly, we have the same statement closing date on this card.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BofA Premium Rewards Incidental Credit

The AA $100 credits are rolling in at FT. I'll probably buy an AA egift card in case Schwab and Delta Platinums cover my other extras for 2020. Travel details still ambiguous.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: BofA Premium Rewards Incidental Credit

Last statement date: Jan 17

Next statement date: Feb 17

AA $100 eGC bought Jan 18

AA eGC posted Jan 20

$100 airfare extras credit posted Jan 28 with a "transaction date" of Jan 25.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select