- myFICO® Forums

- Types of Credit

- Credit Cards

- Capital One is Changing my Billing Cycle End Date,...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Capital One is Changing my Billing Cycle End Date, Ramifications for AZEO

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital One is Changing my Billing Cycle End Date, Ramifications for AZEO

I don't think I've seen this posted on this forum yet. Moderator, please move if there is already a thread for this topic.

I just received my Capital One statement for October 2020 and saw a message about them changing my billing cycle end date. My due date will remain the same, but the statement date will now be 25 days before the due date. This is something to be aware of for people trying to observe AZEO. Here is the exact quote:

----------

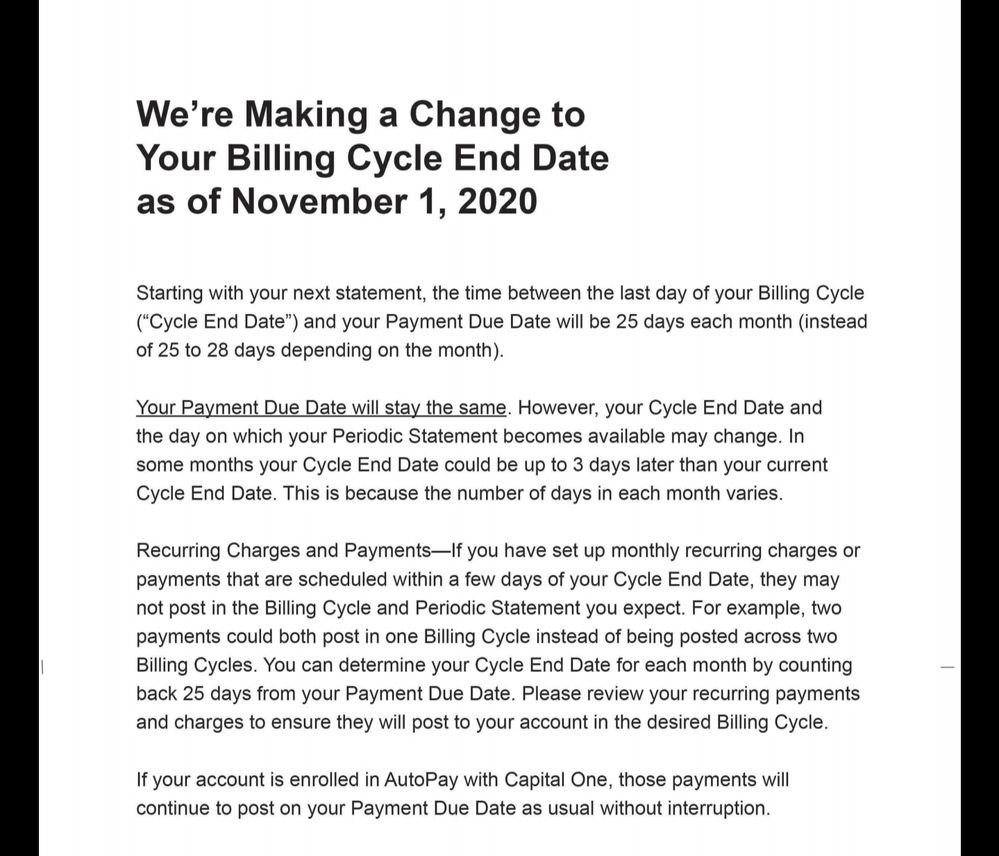

We're Making a Change to Your Billing Cycle End Date as of November 1, 2020

Starting with your next statement, the time between the last day of your Billing Cycle ("Cycle End Date") and your Payment Due Date will be 25 days each month (instead of 25 to 28 days depending on the month).

Your Payment Due Date will stay the same. However, your Cycle End Date and the day on which your Periodic Statement becomes available may change. In some months your Cycle End Date could be up to 3 days later than your current Cycle End Date. This is because the number of days in each month varies.

Recurring Charges and Payments - If you have set up monthly recurring charges or payments that are scheduled within a few days of your Cycle End Date, they may not post in the Billing Cycle and Periodic Statement you expect. For example, two payments could both post in one Billing Cycle instead of being posted across two Billing Cycles. You can determine your Cycle End Date for each month by counting back 25 days from your Payment Due Date. Please review your recurring payments and charges to ensure they will post to your account in the desired Billing Cycle.

If your account is enrolled in AutoPay with Capital One, those payments will continue to post on your Payment Due Date as usual without interruption.

FICO8:

FICO9:

VantageScore3:

Inquiries (n/12, n/24):

AAoA: 11 yrs | AoORA: 37 yrs | AoYRA: less than 1 yr | New Accounts: 1/6, 2/12, 2/24 | Util: 1% | DTI: 1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One is Changing my Billing Cycle End Date, Ramifications for AZEO

I hope you are not practicing AZEO as your credit stats don't warrant the need for it at all. This should result in no issue for you at all.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One is Changing my Billing Cycle End Date, Ramifications for AZEO

No answer for you, but I'm wondering why they're doing this. Did you request it? Is it a new account? Did you move?

Was this only listed on your statement or did you also get an email?

I'm concerned that they'll randomly do this to me and screw up my util. I actually requested a closing/due date change once and they ended up not reporting to the bureaus for one month.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One is Changing my Billing Cycle End Date, Ramifications for AZEO

@NoHardLimits wrote:I don't think I've seen this posted on this forum yet. Moderator, please move if there is already a thread for this topic.

I just received my Capital One statement for October 2020 and saw a message about them changing my billing cycle end date. My due date will remain the same, but the statement date will now be 25 days before the due date. This is something to be aware of for people trying to observe AZEO. Here is the exact quote:

----------

We're Making a Change to Your Billing Cycle End Date as of November 1, 2020

Starting with your next statement, the time between the last day of your Billing Cycle ("Cycle End Date") and your Payment Due Date will be 25 days each month (instead of 25 to 28 days depending on the month).

Your Payment Due Date will stay the same. However, your Cycle End Date and the day on which your Periodic Statement becomes available may change. In some months your Cycle End Date could be up to 3 days later than your current Cycle End Date. This is because the number of days in each month varies.

Recurring Charges and Payments - If you have set up monthly recurring charges or payments that are scheduled within a few days of your Cycle End Date, they may not post in the Billing Cycle and Periodic Statement you expect. For example, two payments could both post in one Billing Cycle instead of being posted across two Billing Cycles. You can determine your Cycle End Date for each month by counting back 25 days from your Payment Due Date. Please review your recurring payments and charges to ensure they will post to your account in the desired Billing Cycle.

If your account is enrolled in AutoPay with Capital One, those payments will continue to post on your Payment Due Date as usual without interruption.

+1

I checked my emails and got nothing there, but just downloaded my most recent statment (for Oct) amd it is the very last page.

Looks like it is across the board.

Thanks or that would have messed up my AZEO and left me wondering why?!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One is Changing my Billing Cycle End Date, Ramifications for AZEO

@Anonymous wrote:

@NoHardLimits wrote:I don't think I've seen this posted on this forum yet. Moderator, please move if there is already a thread for this topic.

I just received my Capital One statement for October 2020 and saw a message about them changing my billing cycle end date. My due date will remain the same, but the statement date will now be 25 days before the due date. This is something to be aware of for people trying to observe AZEO. Here is the exact quote:

----------

We're Making a Change to Your Billing Cycle End Date as of November 1, 2020

Starting with your next statement, the time between the last day of your Billing Cycle ("Cycle End Date") and your Payment Due Date will be 25 days each month (instead of 25 to 28 days depending on the month).

Your Payment Due Date will stay the same. However, your Cycle End Date and the day on which your Periodic Statement becomes available may change. In some months your Cycle End Date could be up to 3 days later than your current Cycle End Date. This is because the number of days in each month varies.

Recurring Charges and Payments - If you have set up monthly recurring charges or payments that are scheduled within a few days of your Cycle End Date, they may not post in the Billing Cycle and Periodic Statement you expect. For example, two payments could both post in one Billing Cycle instead of being posted across two Billing Cycles. You can determine your Cycle End Date for each month by counting back 25 days from your Payment Due Date. Please review your recurring payments and charges to ensure they will post to your account in the desired Billing Cycle.

If your account is enrolled in AutoPay with Capital One, those payments will continue to post on your Payment Due Date as usual without interruption.

+1

I checked my emails and got nothing there, but just downloaded my most recent statment (for Oct) amd it is the very last page.

Looks like it is across the board.

Thanks or that would have messed up my AZEO and left me wondering why?!

My Oct statement hasn't cut for 1 of my cards. But, it's on my other 2 Oct statements. Thanks for the heads up and the reminder that I should check my actual statement and not just the charges in the portal.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One is Changing my Billing Cycle End Date, Ramifications for AZEO

There's no real benefit to AZEO unless you're going for a mortgage anyway but it's lame that they're cutting the grace period down.

My card statements won't come out until the 25th and it's not on my September statement. I don't see how they can get away with changing this without sufficient notice though. I would think this would constitute a change in terms and require 45 days notice under the CARD Act.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One is Changing my Billing Cycle End Date, Ramifications for AZEO

Thanks for posting this, OP.

I don't practice AZEO, so this won't have any tangible effect on me, but I do practice OCD and that part of me is a little sad about this change. I liked the reliability of my CapOne statement date always being on the same day of each month, no matter what. Goodbye to all that.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One is Changing my Billing Cycle End Date, Ramifications for AZEO

@Anonymous wrote:There's no real benefit to AZEO unless you're going for a mortgage anyway but it's lame that they're cutting the grace period down.

My card statements won't come out until the 25th and it's not on my September statement. I don't see how they can get away with changing this without sufficient notice though. I would think this would constitute a change in terms and require 45 days notice under the CARD Act.

What I don't like about it is the loss of the simplicity. I loved that the closing date stayed the same each month for each of my cards. Knew them by heart. Now, I'll have to break out an Excel sheet, which I've already created, by the way. lol

And, I hope it's not one of those cards that close in x days, unless it falls on [random condition]. I always love it when that happens with Synch and my payment doesn't make it on time before the statement cuts.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One is Changing my Billing Cycle End Date, Ramifications for AZEO

@Anonymous wrote:I hope you are not practicing AZEO as your credit stats don't warrant the need for it at all. This should result in no issue for you at all.

I actually don't practice AZEO. I mainly posted this information as a heads up for the general MyFico population. For me personally, I just try to have less than half of my open tradelines reporting a balance.

I did not do anything to initiate this date change. I just happened to notice the announcement when I downloaded my statement. As others have mentioned, it's just a bit of a nuisance as it used to be easy to remember the statement cut date.

FICO8:

FICO9:

VantageScore3:

Inquiries (n/12, n/24):

AAoA: 11 yrs | AoORA: 37 yrs | AoYRA: less than 1 yr | New Accounts: 1/6, 2/12, 2/24 | Util: 1% | DTI: 1%

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Capital One is Changing my Billing Cycle End Date, Ramifications for AZEO

@cr101 wrote:

@Anonymous wrote:There's no real benefit to AZEO unless you're going for a mortgage anyway but it's lame that they're cutting the grace period down.

My card statements won't come out until the 25th and it's not on my September statement. I don't see how they can get away with changing this without sufficient notice though. I would think this would constitute a change in terms and require 45 days notice under the CARD Act.

What I don't like about it is the loss of the simplicity. I loved that the closing date stayed the same each month for each of my cards. Knew them by heart. Now, I'll have to break out an Excel sheet, which I've already created, by the way. lol

And, I hope it's not one of those cards that close in x days, unless it falls on [random condition]. I always love it when that happens with Synch and my payment doesn't make it on time before the statement cuts.

My statement cut. I checked my statement and it applies to me as well, probably across the board. I too have closing dates memorized, but it's no big deal. I get notifications when my statement cuts.