- myFICO® Forums

- Types of Credit

- Credit Cards

- Chance of AA from chase

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Chance of AA from chase

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- « Previous

-

- 1

- 2

- Next »

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chance of AA from chase

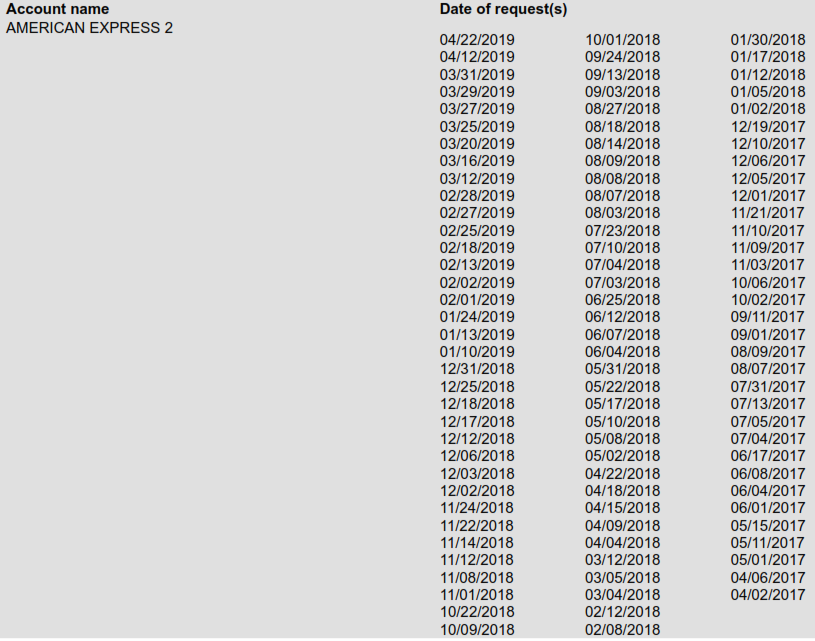

@Anonymous wrote:Everyone likes to peek at your reports. Some more than others.

![]()

![]()

![]()

They sure want that data!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chance of AA from chase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chance of AA from chase

@addicted_to_credit wrote:

It’s much harder than I thought to sit in the garden even though I have the cards I want. That soft pull approval with BB&T was too much to resist. I’m pretty sure I’ve tanked my AAoA and don’t want to think about it. Inquires aren’t terrible but definitely not the best now, 2 in the last year 7 in 2 years on EX, 1 in 2 years on EQ and 3 on TU - all recently. I’ve no need for anything else in the foreseeable future and need to keep telling myself that.

I would have still been in the garden but I wanted the PS4 Pro which prompted an app for B&H’s tax refund card and once I got that I was already out so I went for AMEX, Savor One, and Cash+. Struck out on the last but got the other three cards.

My AAoA is probably going under 2y on Experian. That 10 year account dropped me from 2y9m to 2y4m.

Oh well, I will just do my time in the garden. All of my reports are on ice which takes a bit of work to lift across the various sites so that’s usually a decent enough deterrent for me.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chance of AA from chase

I always think it's best not to worry about it mostly because there's really nothing you can do except keep a low profile, stop apping, keep the accounts in good standing, etc. The damage from the new accounts is done and there's nothing you can do about it.

I would stop letting it bother you and just use the cards, and not make any new applcations for at least several months. That's all you can do. If something happens you can address it at that time; it's a waste of energy to worry about it beforehand. If you truly do feel addicted to credit maybe pursue other hobbies.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chance of AA from chase

OP - I opened 6 new accounts, including a Chase card, in May, on top of 4 new accounts in the previous 6 months. It's been almost 6 weeks, and all cards work. From reading the stories here, it sounds like if Chase is going to close your accounts, it will happen in the first week or two after approval. Getting the card in the mail without notice of AA felt like a win. Hitting the month mark felt good. Seeing the new account hit my reports (after all the other new accounts) felt really strong. Seeing the SUB post felt great. I'm mostly over the fear.

I agree with everyone above. It wasn't wise, but it's done. Use the cards and don't apply for anything else for 12 months.

It's easy to get caught up in the approvals and the excitement for new cards here on MF, but as you come down from the high of your recent approvals (and the adrenaline from waiting to see if Chase responds), you'll move on to other things. I've spent the time analyzing spend, researching how to make the most of travel rewards, and planning my next apps, so that when the time comes, I don't make the same mistake.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chance of AA from chase

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Chance of AA from chase