- myFICO® Forums

- Types of Credit

- Credit Cards

- Citi APR Decreases

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi APR Decreases

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi APR Decreases

@K-in-Boston wrote:Having only done a single Citi PC (with DW's Diamond Preferred to Double Cash in the past (which did stay at 14.49%)), I'm not too familiar with Citi's policies on PCs. With other lenders, usually an APR gets adjusted in a PC if they have differing APRs. Is that not the case? As an example, with NFCU if you did a PC from Go Rewards to Flagship Rewards and had an APR of 10.49% (lowest for Go) then it would be raised to 11.49% (lowest for Flagship). Another example would be BoA; if you had a BankAmericard with the lowest 13.49% APR and performed a PC, your APR would increase to 14.49% with a Cash Rewards or 16.49% on a Travel Rewards.

Let's just hope I can PC to the Prestige first.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi APR Decreases

Congrats on your APR reductions. Citi's never budged for me on my Double Cash that's almost 2.5 years old. Started at 18.99%, but with prime rate increases it's up to 20.49%. They did recently approve me for a TY Premier at the lowest advertised rate of 15.99%, though, so that's nice.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi APR Decreases

How often do APRs that start around 18% (from Citi, Barclaycard, Discover, others) actually lead to APRs that are under 8% or so? It doesn't seem to happen very often. There are so many reports of cards going from 18% to 13%, but they all seem to stop around there. I think most cases I've heard of cards having a 10% APR decrease (like 18% to 8%) have been of very old Amex cards.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi APR Decreases

@wasCB14 wrote:How often do APRs that start around 18% (from Citi, Barclaycard, Discover, others) actually lead to APRs that are under 8% or so? It doesn't seem to happen very often. There are so many reports of cards going from 18% to 13%, but they all seem to stop around there. I think most cases I've heard of cards having a 10% APR decrease (like 18% to 8%) have been of very old Amex cards.

A mod on Flyertalk has a Prestige with a 6% interest rate.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi APR Decreases

@wasCB14 wrote:How often do APRs that start around 18% (from Citi, Barclaycard, Discover, others) actually lead to APRs that are under 8% or so? It doesn't seem to happen very often. There are so many reports of cards going from 18% to 13%, but they all seem to stop around there. I think most cases I've heard of cards having a 10% APR decrease (like 18% to 8%) have been of very old Amex cards.

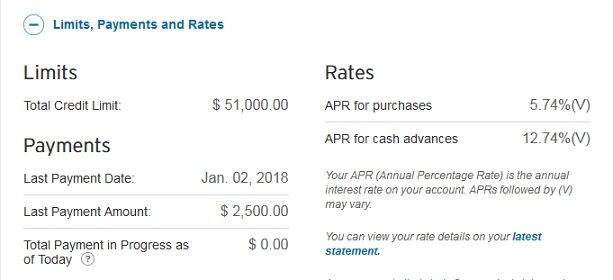

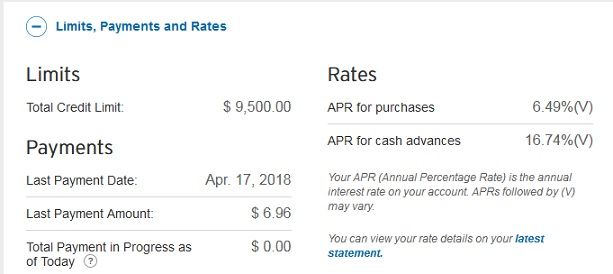

Most of my Citi CCs are roughly under 10% and about 4 of them are under 8%, such as AA Exec (5.74%) and ThankYou Premier (6.49%), for instance:

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi APR Decreases

Thanks for the thread. Just got 1.5% knocked off my Double Cash that I have had for less than 2 months. Although APRs are not really a concern of mine, it is nice to see them lower.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi APR Decreases

Good to know the APRs can improve further.

Business use: Amex Bus. Plat., BBP, Lowes Amex AU, CFU AU

Perks: Delta Plat., United Explorer, IHG49, Hyatt, "Old SPG"

Mostly SD: Freedom Flex, Freedom, Arrival

Upgrade/Downgrade games: ED, BCE

SUB chasing: AA Platinum Select

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi APR Decreases

@FinStar wrote:

@wasCB14 wrote:How often do APRs that start around 18% (from Citi, Barclaycard, Discover, others) actually lead to APRs that are under 8% or so? It doesn't seem to happen very often. There are so many reports of cards going from 18% to 13%, but they all seem to stop around there. I think most cases I've heard of cards having a 10% APR decrease (like 18% to 8%) have been of very old Amex cards.

Most of my Citi CCs are roughly under 10% and about 4 of them are under 8%, such as AA Exec (5.74%) and ThankYou Premier (6.49%), for instance:

I guess my question is, where did they start out? In the low 10's?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi APR Decreases

@Anonymous wrote:

@FinStar wrote:

@wasCB14 wrote:How often do APRs that start around 18% (from Citi, Barclaycard, Discover, others) actually lead to APRs that are under 8% or so? It doesn't seem to happen very often. There are so many reports of cards going from 18% to 13%, but they all seem to stop around there. I think most cases I've heard of cards having a 10% APR decrease (like 18% to 8%) have been of very old Amex cards.

Most of my Citi CCs are roughly under 10% and about 4 of them are under 8%, such as AA Exec (5.74%) and ThankYou Premier (6.49%), for instance:

I guess my question is, where did they start out? In the low 10's?

For most approvals, especially in the last several years, started at the lowest available APRs offered at that point in time (prior to Fed Rate hikes) and any subsequent basis points adjustments (or variable basis spreads) that Citi (or other lenders) made on their own to align with the market. So, the majority started anywhere around (or above) ~12.24% from what I recall.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi APR Decreases

I LOVE this thread!

I got my Citi a couple months ago. Was 24.something% APR. After reading this I got on chat a couple to few times a week and requested reductions. Got one every time.

Just hit 15.74% today.

Not that I even plan on keeping a balance, but it feels good to not be in the 20%s and I do not have any soft pull CLIs available now =/