- myFICO® Forums

- Types of Credit

- Credit Cards

- Citi, Cap1 questions

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Mute

- Printer Friendly Page

Citi, Cap1 questions

Is your credit card giving you the perks you want?

Browse credit cards from a variety of issuers to see if there's a better card for you.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Citi, Cap1 questions

So the DGF in interested in expanding her collection the citi cards offered to her all have a solid APR and it's the lowest citi offers on what ever card they are showing.

Cap1 is offering the Quicksilver, Venture, Savor and Savor one.

If I remember correctly the venture is a minimum 5k SL?

if / when she decides to pull the trigger what would give her the most juice for the squeeze?

total income for her is in the 60-70k range and all Fico 8's are 760+ range

she has store cards backed by both Cap1 and Citi if that helps

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi, Cap1 questions

If the primary concern is the highest possible SL, the Venture or Savor (not Savor One) would probably be your best bet. Citi can be a little more stingy and Cap1 tends to hand out its biggest limits with the Venture and Savor (the AF cards). Of course there are exceptions everywhere, but that seems to be the trend.

Good luck to her!!

Amex Cash Magnet: 24.4k

Fidelity Visa: 21.5k

Apple Card: 13k

CapOne Venture X: 10k

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi, Cap1 questions

Thank you pinkandgrey, and in true forum fashion I'll definitely update what she decides to do and gets!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi, Cap1 questions

Yes, both the Venture and Savor have a 5k minimum.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi, Cap1 questions

@addicted_to_credit wrote:So the DGF in interested in expanding her collection the citi cards offered to her all have a solid APR and it's the lowest citi offers on what ever card they are showing.

Cap1 is offering the Quicksilver, Venture, Savor and Savor one.

If I remember correctly the venture is a minimum 5k SL?

if / when she decides to pull the trigger what would give her the most juice for the squeeze?

total income for her is in the 60-70k range and all Fico 8's are 760+ range

she has store cards backed by both Cap1 and Citi if that helps

There really is no way to guess without more info on her profile such as number of cards, when they were opened, utilization on them, are they all store cards, any negatives, limits on her existing cards.

Cant squeeze the juice if you dont know where the fruit is

QS and Savor One, I've seen approvals as low as $1000.00.

Venture, I believe is $5000.00

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi, Cap1 questions

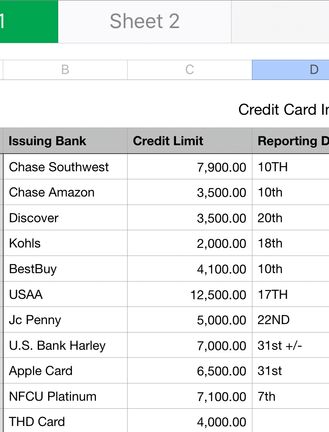

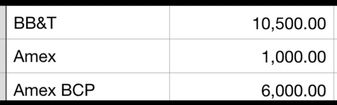

Highest limit is 12500 mostly every thing is paid off just waiting on updates to the CB's she owes a little over 1k on a 7.8k Card. She kinda shot herself in the foot when she transferred 3500 onto discover which has a 4K limit-- it's paid off now just hasn't reported yet

below is the cards she currently has

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi, Cap1 questions

Dang, you were prepared ![]()

As long as there aren't too many new accounts, she should be okay with both.

I wouldn't get Venture just because of guaranteed $5K.

It's not that much to begin with, and if she has no use for it later, it's kinda wasted app.

Does she travel or eats out?

Premier has a great SUB, there is $95 AF, and if she doesnt want to keep it, she could do a PC.

Has she tried for Disco CLI and everyone else who does SP CLIs?

Definitely wait till all three CRA update pay offs.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi, Cap1 questions

@Remedios wrote:Dang, you were prepared

As long as there aren't too many new accounts, she should be okay with both.

I wouldn't get Venture just because of guaranteed $5K.

It's not that much to begin with, and if she has no use for it later, it's kinda wasted app.

Does she travel or eats out?

Premier has a great SUB, there is $95 AF, and if she doesnt want to keep it, she could do a PC.

Has she tried for Disco CLI and everyone else who does SP CLIs?

Definitely wait till all three CRA update pay offs.

You should see the complete list 😬

we like to eat out and normally when she travels I just burn some airline miles and hotel points. Lately we've started up a mini ranch and have spent 1,000's on buildings and fences I wish a farmer card existed!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Re: Citi, Cap1 questions

@AllZero wrote:

Has DGF considered a 2nd Navy card? I'm sure she can squeeze a lot of SL juice.

We tried a cli on her platinum the other night and she didn't get it, I think she may have pulled that trigger a hair too soon, she is considering a second card but we shall see.